A branching strategy with a twist has helped one New York-based credit union deepen engagement with members and establish new relationships with college-aged students in its market.

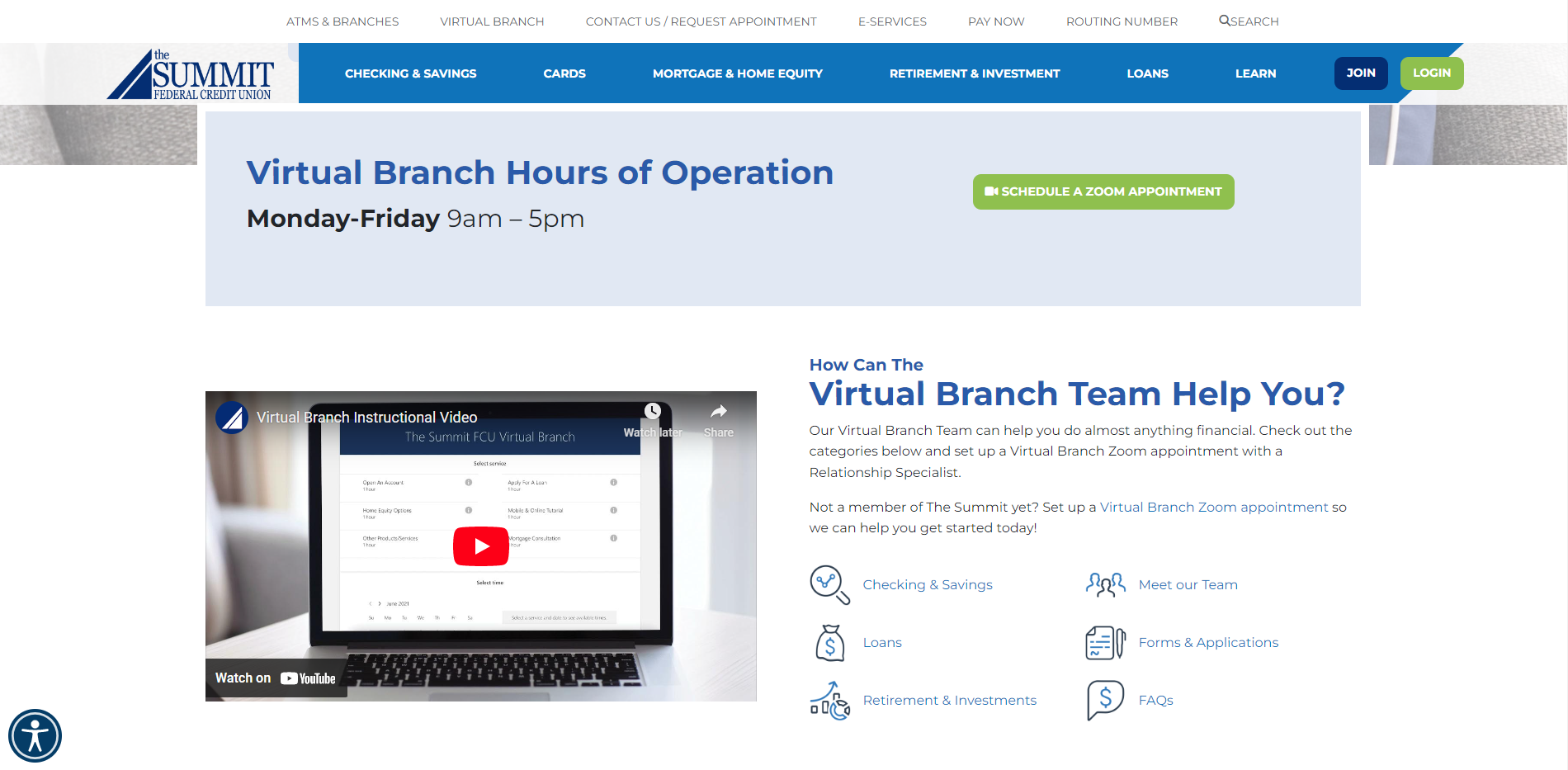

Rather than a traditional brick-and-mortar facility, The Summit Federal Credit Union ($1.3B, Rochester, NY), launched a virtual branch in July 2021 as part of a multi-level strategy to increase operational resilience while continuing to provide high levels of member service.

“Our virtual branch was created as a response to the pandemic to provide an alternate, safer service delivery channel,” says Alessandra Sunderlin, The Summit’s vice president of member relations. “As we emerged from the pandemic, the virtual branch continued to grow in popularity. It was an innovation created out of necessity.”

All Digital, Nothing Else

The virtual branch is completely digital, unlike other hybrid branches that place self-service interactive teller machines (ITMs) within a lightly staffed facility. The Summit’s version provides high-touch member support with four full-time employees — some working remotely from home — who use Zoom conferencing technology to emulate the experience of a face-to-face visit to a traditional branch.

The virtual branch supports most popular transaction types, including balance inquiries, account transfers, and applications for home, auto, and credit card loans. Cash transactions, gift cards, and money orders require a visit to a regular branch. Members can also book a Zoom appointment with one of the credit union’s retirement and investment advisors, and in many instances, members can secure a meeting within 15 minutes of making the reservation.

“The beauty of our virtual branch is a member can be anywhere in the world and still meet with our relationship specialists,” Sunderlin says. “We were very fortunate to use existing and experienced talent to staff the branch. Members don’t have to drive anywhere to meet with us. We’ve had members use the branch from their child’s soccer games and even while vacationing in Australia.”

Although the virtual branch came about amid branch closures brought on by the pandemic, it also has been beneficial when The Summit — with its Western New York base near the shores of Lake Ontario — has had to close for weather. On top of that, the virtual branch has made accessing the credit union easier for all kinds of members, including snowbirds who head south for the winter and younger consumers — particularly those of college age — who are a key demographic for growth.

Modest Investment, Better Member Experience

Setting up the virtual branch required minimal investment once the credit union added technology resources to bolster its processing and connectivity capabilities and build in redundancy to ensure the virtual branch was always operational.

CU QUICK FACTS

THE SUMMIT FCU

DATA AS OF 12.31.22

HQ: Rochester, NY

Assets: $1.3B

Members: 90,858

Branches: 15

Net Worth: 9.7%

ROA: 0.9%

Severe weather conditions, mostly due to heavy snowfall and freezing rain, can bedevil even the most robust companies in the area. The credit union regards its virtual branch as a key element of its business continuity planning when the roads are unpassable for members and employees to reach a physical branch. Staff, also, can easily assist physical branches when normal operations are compromised.

A pre-launch marketing and awareness campaign around the virtual branch included social media emails, website promotion, and in-branch materials. The Summit even created a digital banking guide webpage that walks members through what services are available and how to access them.

“Now we offer the convenience and choice for our members to conduct their business both in branch, or through the virtual channel,” Sunderlin says. “They can get the same great service that we are known for, but in the way that works best for them.

The credit union’s virtual branch usage numbers bear that out, with transactions in the first few months of 2023 that show 20% more Zoom appointments than the same period in 2022.

The virtual branch appeals to the credit union’s younger demographic, particularly the students at the local colleges and universities in the region The Summit serves.

“We sponsor the athletic department at Monroe Community College here in Rochester and we’ve built relationships with Syracuse University and others,” says Dawn Kellogg, The Summit’s public relations and community engagement specialist. “We visit the campuses and make sure incoming students know about our virtual branch so that even when they are on breaks, they can still reach us.”