Whena memberis setting aside money in a savings account, it’s easy to ask them if they’re saving up for a boat or an African safari. But if someone’s getting ready to put money in a health savings account,there are a whole other set of questions that aren’t so easy to ask — or answer.

- Do you plan on starting a family?

- Any major procedures in the near future?

- Do you have ongoing prescription medication costs?

The decision to get into the health savings account business represents a philosophical shift in the way that your members need to think about this money and the way your employees have to help them think about this money. A credit union’ssuccess in moving fromwealth management to health management is balanced on the ability to be knowledgeable source of information on this new (and sometimes confusing) insurance product.

At the online event, Reaching Your Members with HSAs: Partnerships, Products & Participation, LeighAnne Terry, Human Resources Manager at Callahan & Associates spoke about the importance of HSA programs to the credit union industry in providing member value: hear a clip.

Marketing your credit union as a trusted resource for HSA information and advice was the theme of the second episode in our four-part series, HSAs: The Most Important Opportunity to Enhance Member Value and Lifelong Relationships in the 21st Century. Part two, Reaching Your Members with HSAs: Partnerships, Products & Participation, is available as a recording. Part three, Everything You Need to Know About Operating, Reporting, and Maintaining an HSA Program at Your Credit Union, is scheduled for Thursday, July 12, 2007. For more information, contact Leigh Anne Terry at 1-800-446-7453 x 128.

When Mission Federal Credit Union ($1.9 billion in San Diego, CA), learned that North San Diego County was rated the fifth most desirable place in the USA to retire, it set a goal to be known as the area’s premiere retirement account administrator.

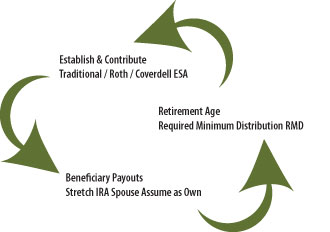

The credit union identified three goals:

1) Increase member participation in retirement related accounts such as traditional IRAs, Roth IRAs and Coverdell ESAs;

2) Educate members and staff about the regulations around age and distribution;

3) Develop a plan to work with spouses and beneficiaries through the payout process.

By matching goals to components of the retirement cycle, Mission hoped to meet the needs of members as they aged as well as retain the assets through each cycle.

In order to meet its goals and take advantage of the asset acquisition opportunity the credit union needed to transform its retirement program. Mission started by adding a Retirement Center to the website. Dedicating an entire area to thislife cycle increased awareness of the credit union’s services and gave members a specific area to access their information. It also served as a training tool for employees. Previously Mission offered employee training on retirement service oncea year, now their online Retirement Center provides a list of Frequently

Asked Questions (FAQs) that educate employees and members alike year-round.

Although the shift to online education may seem counter-intuitivegiven the association between retirees and older persons, website tracking found that members were using this information. In fact, 60% of the activity was performed outside regular business hours, some even at 2:00 am. Not only were they conductingresearch, members actually prepared their own documents before they came in to the branches using the newly automated forms available on the Retirement Center site. This saved time that could be redirected towards education and relationship building.As a result in one month alone, April 2006, the Retirement Center produced forms totaling more than $272,000 in contributions for the credit union.

Read more innovations from credit unions in the CUSP Community.