Workplace incentives foster employee loyalty and satisfaction as well contribute to the organization achieving its financial goals. Credit unions can adjust many incentive levers including what gets incentivized, who gets incentivized, and how to strike a balance between sales and service.

Here, Greater Nevada Credit Union, Schools Financial Credit Union, and Ventura County Credit Union share strategies and tips that have helped take their own employee incentive programs to the next level.

Contributions On The Credit Union’s Terms, Rewards On Employees’ Terms

The now $550 million Greater Nevada Credit Union(Carson City, NV) uses traditional incentives for its front-line staff, particularly when it needs to build productand service awareness or support a management goal.

CU QUICK FACTS

Greater Nevada CREDIT UNION

Data as of 03.31.15

- HQ: Carson City, NV

- ASSETS: $541.1M

- MEMBERS: 48,307

- 12-MO SHARE GROWTH: 14.42%

- 12-MO LOAN GROWTH: 20.39%

- ROA: 1.07%

Our loan consultants derive the majority of their income from production and sales, says Marcus Wertz, Greater Nevada’s vice president of consumer lending. They get a small base, but there is no cap on their incentive income.

The credit union couldn’t extend this style of incented engagement into areas such as support staff, processors, and underwriters, but that didn’t stop it from soliciting and rewarding contributions from these employees in other ways. Today,all employees can partake in Greater Nevada’s RecRoom program, an intranet-based portal where employees earn points and exchange them for rewards such as merchandise and trips.

Referrals are a primary way non-sales employees earn points, but there are other options as well. Some require virtually no member interaction. For example, participants in the credit union’s Strategic Thinker program earn RecRoom points for submittingideas that support the credit union’s main business goals. They earn bonus points for ideas the credit union implements.

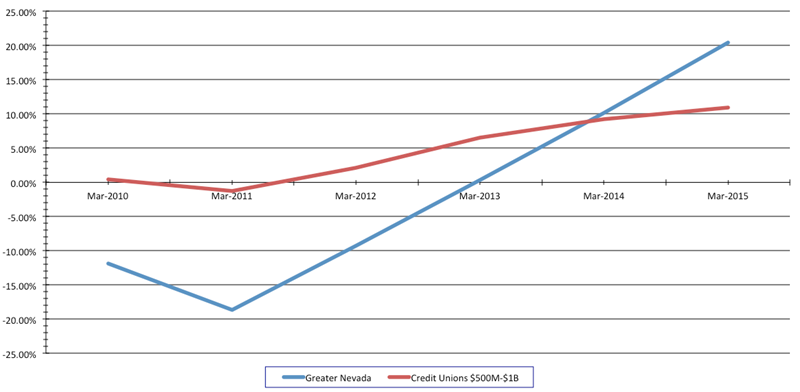

The ability of employees to take multiple paths to offer the credit union direct and indirect support helped the credit union’s annual loan growth reach 20.4% as of first quarter 2015 versus a comparable peer average of 10.9% over the same period,according to Callahan data.

LOAN GROWTH

For all U.S. credit unions $500M-$1B | Data as of 03.31

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Bringing Balance To The (Sales) Force

Schools Financial Credit Union($1.6B, Sacramento, CA) plans to boost its loan-to-share ratio in the coming months, says Steve Langley, chief retail officer andvice president of member services. To do so, it has revised its sales production standard for employees.

CU QUICK FACTS

Schools Financial CREDIT UNION

Data as of 03.31.15

- HQ: Sacramento, CA

- ASSETS: $1.6B

- MEMBERS: 120,478

- 12-MO SHARE GROWTH: 4.91%

- 12-MO LOAN GROWTH: 17.34%

- ROA: 0.68%

Prior to January 1, 2015, the credit union had a mixed bag of results when it came to its production-based rewards for employees. Several different types of products and services paid a reward, but that reward was the same for everything.

‘Sell the right product’ was sometimes heard as Sell the product you’re comfortable with,’ Langley says.

And because all products moved the needle on an employee’s production goals equally, the temptation was there to focus on the easiest-to-sell options rather than the member’s best options.

By comparison, today’s revised plan provides a tiered point system for products and services in accordance with their value to the member and the credit union. Loans which are all weighted equally at 1.50 points have the highestpoint in the spectrum while enrolling a member in bill pay, for example, earns the employee 0.75 points. This structure encourages employees to find the best option for the situation, not the one that looks best on paper.

Slightly less than two-thirds of Schools Financial’s roughly 280 employees operate under this new standard. And the credit union expects these employees to hit monthly production levels ranging between 21 to 35 points each depending on their role.

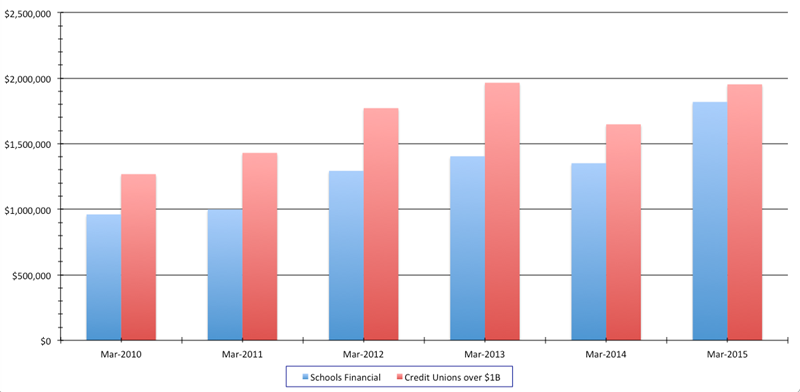

Although still early in deployment, the strategy is showing early signs of success. In first quarter 2015, Schools Financial’s annual loan origination per employee was nearly $468,000 higher than the year prior, brining it much closer to the medianfor its comparable peer group.

ORIGINATIONS PER EMPLOYEE (ANNUALIZED)

For all U.S. credit unions $1B+ | Data as of 03.31

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

An Engagement Plan For The Sales Averse

It was a transformative moment when the leadership team at Ventura County Credit Union ($725.5M, Ventura, CA) realized making sales appealed only to a certain segment of employees. Investing in employees and rewarding them for good member service and employee support, however, was something all 180 staffers could get behind, says chief operating officer Gavin Bradley.

CU QUICK FACTS

VENTURA COUNTY CREDIT UNION

Data as of 03.31.15

- HQ: Ventura, CA

- ASSETS: $725.5M

- MEMBERS: 71,259

- 12-MO SHARE GROWTH: 5.07%%

- 12-MO LOAN GROWTH: 46.47%

- ROA: 0.45%

As part of a larger cultural shift heralded by CEO Joseph Schroeder, the team has applied a fresh approach to incentives over the past six months.

We needed front-line employees to understand not providing information about a product or service a member needs is like financial malpractice, Bradley says. It’s the same in our support departments, except assisting our front-lineemployees who are assisting members is the focus for those employees.

The credit union used ServiStar training from Michael Neill and Associates to de-emphasize specific product sales production goals in favor of meeting the needs of the members. It also provided coaching to help all departments provide the best serviceto members and one another. Ventura County Credit Union now uses sales to gauge how well an employee is living out the credit union’s mission of delivering high-quality services to improve the financial well-being of its members and community.

Not providing information about a product or service a member needs is like financial malpractice.

Crucial in this transition was the introduction of an internal service survey that allowed employees to rate one another as well as provide praise, constructive feedback, and ideas. This increased ownership over problems, as employees began to offer moreimmediate assistance to their front-line counterparts instead of redirecting them to different departments.

Although the credit union has retained some individual incentives for new or value-added offerings, focusing on shared benefits for all employees shows we care about the people working for us more than their positions, Bradley explains.

To show the credit union cares about its people, Ventura County Credit Union offers family healthcare coverage (for which it pays for half), reimburses employees up to $3,000 for education, and allows employees to work up to 40 hours per year at a non-profitof their choice on the credit union’s dime.

According to Bradley, anything extra the credit union has given its employees is returned 10 fold in terms of loyalty, productiveness, and community awareness.

Two years ago, we would have struggled to get 80 monthly referrals to our financial advisors from branch staff, Bradley says. With our new approach, referrals average between 100 and 160 per month.

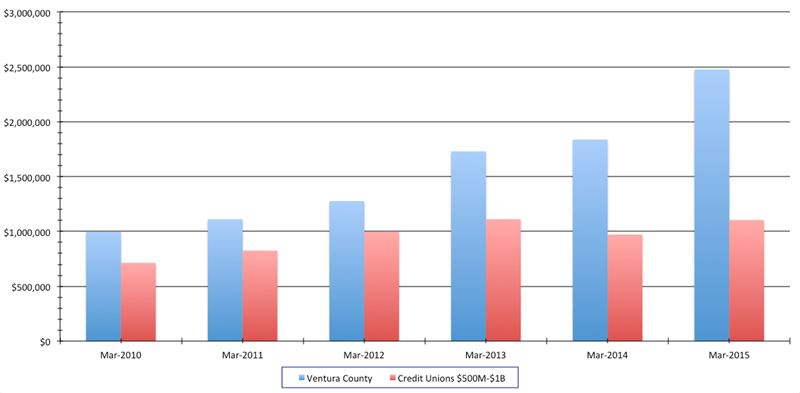

As of first quarter 2015, staff at Ventura County Credit Union generated $1.4 million more in annualized loan originations per employee and served 82 more members per employee than at similarly sized peers.

LOAN ORIGINATIONS PER EMPLOYEE (ANNUALIZED)

For all U.S. credit unions $500M-$1B | Data as of 03.31

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Marc Rapport contributed to this article.