CU QUICK FACTS

Rogue Credit Union

Data as of 06.30.18

HQ: Medford, OR

ASSETS: $1.5B

MEMBERS: 128,702

BRANCHES: 20

12-MO SHARE GROWTH: 10.1%

12-MO LOAN GROWTH: 14.1%

ROA: 1.36%

Nestled in a scenic valley renowned for its orchards and recreational pursuits, Rogue Credit Union ($1.5B, Medford, OR) is reaping the fruits of a decade-long strategy with the simple goal of having the most loyal members in the nation.

Gene Pelham had been at Rogue for five years as the credit union’s president/CEO for one year when the cooperative’s first-ever experience in the red prompted Pelham and his board to double down on the business by focusing on the members rather than the numbers.

In March 2008, our leadership team gathered around a table, Pelham says. ‘I slid a pile of poker chips across the table and asked, Who’s all in for loyalty?’ We all were, and we’ve been all in since that day.’

ContentMiddleAd

That was before the impact of the recession really became evident, before the challenges became even more real, but the die was cast and the Rogue team was not about to reverse course on building a solid foundation.

‘We’re not going to be the most efficient credit union out there,’ Pelham says. ‘We’re not going to be the most profitable. But if we create member loyalty, we can create financial sustainability for our members and our credit union.’

BEST PRACTICE: PRICING FOR THE PEOPLE

Rogue Credit Union prices its lending and saving products to be competitive but sustainable. Members buy in because they know they’re being treated fairly.

The linchpin to Rogue’s loyalty strategy is the Loyalty Filter, which calls on every employee to consider whether each decision (1) creates and keeps members who will tell others about their credit union, called a ‘promoter’ at Rogue; (2) drives enough profit based on fair rates to sustain the credit union; and (3) expects and rewards participation from the member.

‘If all else fails, take care of the member,’ Pelham says. ‘We do that and everything else will take care of itself.

It’s a simple strategy that is difficult to execute. And execute Rogue has.

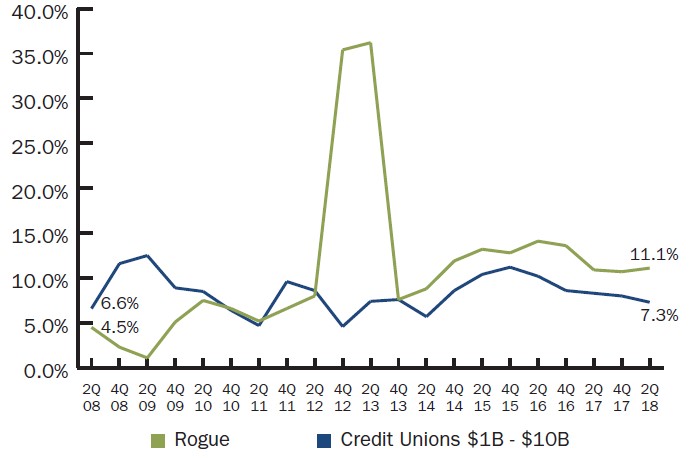

Membership at the credit union increased 11.13% year-over- year in the second quarter of 2018. By comparison, annual membership growth for credit unions with $1 billion to $10 billion in assets and for all U.S. credit unions was 6.19% and 4.87%, respectively, according to data from Callahan Associates. This marked the latest installment of a four-year string of organic double-digit member growth every quarter.

‘We don’t buy members,’ says chief operations officer Jeanne Pickens. ‘We do very little traditional advertising or marketing. It’s almost all word-of-mouth.’

According to Pickens, Rogue hasn’t rolled out a promotion focused solely on growing membership in the 18 years she’s been there. That’s the promoters in action.

As for rewarding participation, Rogue offers the Ownership Account, a non-transactional savings account that currently pays 3.00% for Rogue Rewards, money deposited from participation in the credit union’s rewards programs.

Staff at Rogue Credit Union use the principles of the Loyalty Filter to evaluate member interactions and make decisions without consulting policy manuals or getting permission. What follows are creative decisions that empower members’ financial lives and make them lifelong advocates for Rogue.

Building Trust And Branches

Other than the high-paying specialty account, Rogue’s rates are competitive but not cutthroat.

‘Our strategy on pricing is to be better than most,’ says executive vice president Matt Stephenson. ‘Our strategy on service is to be the best. Folks get into trouble when they try to have the best price and the best service at the same time. That’s a losing recipe.’

According to Stephenson, as long as consumers know they’re being treated fairly, they don’t care if a product or service is the cheapest.

‘Trust is our most important currency,’ the EVP says.

Rogue, meanwhile, has spent a lot of currency on its branching operations. The credit union places a premium on real estate that helps it build presence and visibility. And, yes, sometimes that means slipping in before Walgreens or another major retailer can snatch up a prime spot.

‘We rarely lease,’ Pelham says. ‘We own most of our buildings, which allows us to control some of the premier locations in our marketplace. We’re willing to pay to have those places because we know a branch is better than any billboard we can buy.’

A 3-Pronged Strategy

Rogue goes all in on member loyalty by continually asking three questions:

- How do our decisions create and keep promoters?

- How do we create good profits that members value? That keep the credit union operational?

- How do we expect and reward member participation?

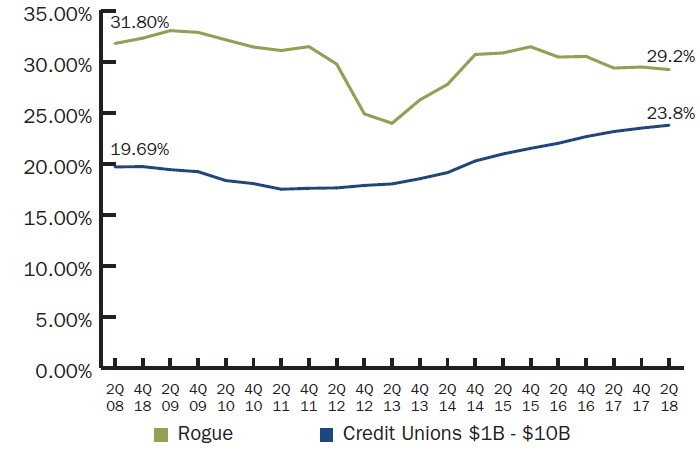

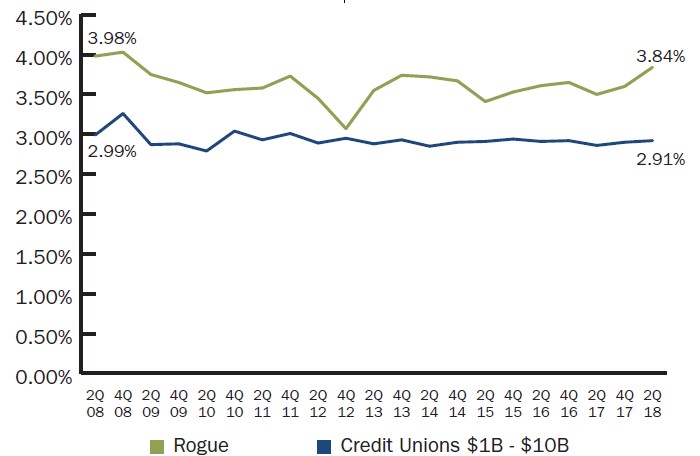

That commitment has required a significant investment. Rogue’s second quarter ratio of operating expenses to average assets was 3.84%, 93 basis points more than its peer group of billion-dollar credit unions and 74 basis points more than the average for all U.S. credit unions regardless of size.

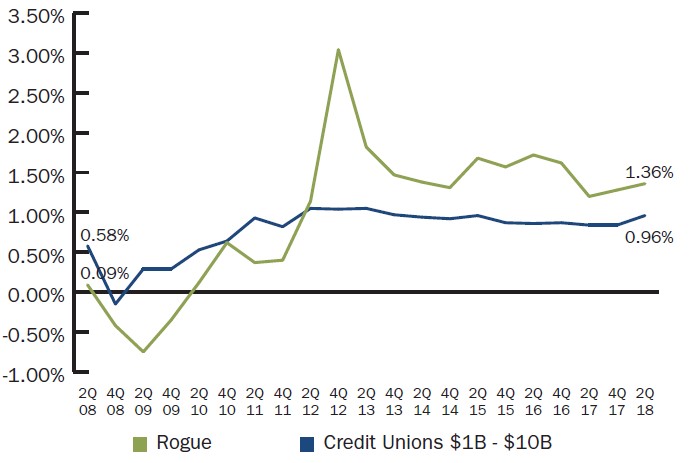

Profits remain steady with a higher-than-average return on assets. Income rose sharply last year. Net income per member is higher than average, and members continue to grow in profitability.

Market share also is strong. As of June 30, 2018, Rogue had the highest deposit share 23.8% of any credit union in its primary market of Jackson County, according to the credit union. The highest among banks was 15.73% for Umpqua Bank, followed by JPMorgan Chase, U.S. Bank, and Wells Fargo.

Rogue’s deposit market share might be strong, but its auto lending share is much higher. Oregon Department of Motor Vehicles data shows Rogue makes 40% of all new and used consumer loans in its home market, says COO Pickens.

BEST PRACTICE: LOCATION, LOCATION, LOCATION

Rogue Credit Union owns its branch locations. It invests in prime real estate based on its belief that a branch beats a billboard every time.

Rogue has not had a quarter of year-over-year auto loan growth of less than 10% for the past five years. According to the credit union, its ratio of indirect to direct auto loans is 65.8%, but it has a strategy to engage these members.

The outbound contact team reaches out to new members through phone calls, emails, and direct mails. According to marketing manager Kelsey Esqueda, when Rogue reaches a member by phone, 47.55% of the calls result in an additional product or service, including loans, checking accounts, and electronic services.

‘We approach these not as sales calls but as an introduction to the credit union,’ Pickens says. The credit union’s reputation helps, she says, as years of building trust in the community paves the way for deeper engagement with new members and old.

Click the tabs below to view graphs.

MEMBER GROWTH

MEMBER GROWTH

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

Rogue Credit Union has not had a quarter with less than 10% year-over-year member growth in the past four years. Merging in the former Chetco FCU in late 2012 created the growth spike shown there and in early 2013.

Source: Callahan ‘ Associates.

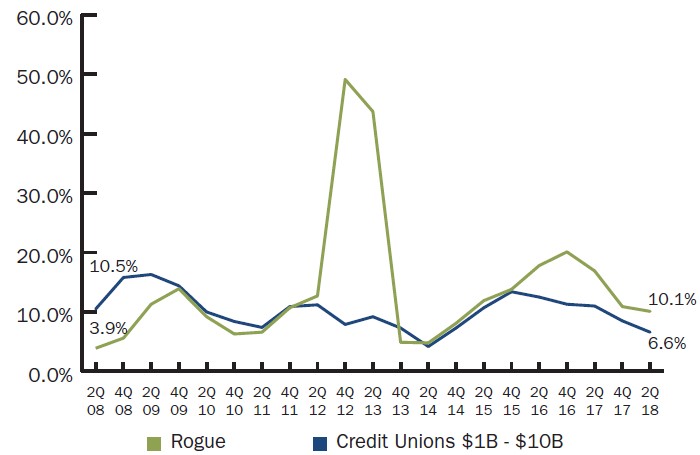

SHARE GROWTH

SHARE GROWTH

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

Deepening engagement with its members has helped drive share growth at Rogue, including a jump of 10.09% year-over-year in the second quarter of 2018. The credit union launched its Ownership Account in early 2016, adding those deposits to the mix.

Source: Callahan ‘ Associates.

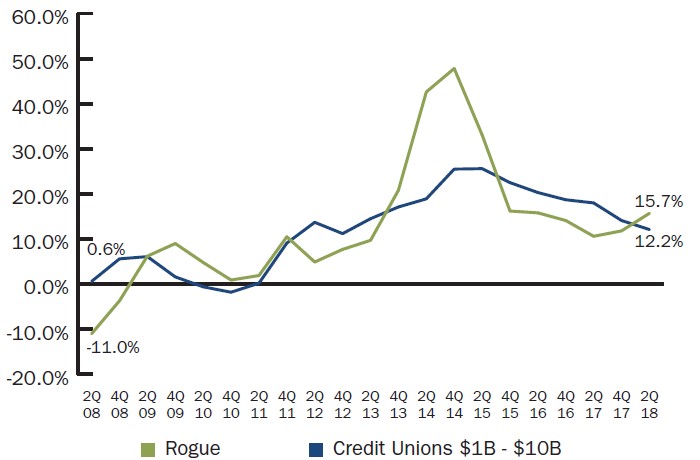

AUTO GROWTH

AUTO GROWTH

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

Rogue has not had a quarter of year-over-year auto loan growth of less than 10% for the past five years.

Source: Callahan ‘ Associates.

AUTO LOAN PENETRATION

AUTO LOAN PENETRATION

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

State DMV records show Rogue landing 40% of new and used car loans in its core market area. That lending success shows in the credit union’s auto loan penetration among its membership.

Source: Callahan ‘ Associates.

RETURN ON ASSETS

RETURN ON ASSETS

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

Rogue’s strategy of member loyalty with a focus on profits has helped produce a return on assets that has been consistently higher than the average billion-dollar credit union since it merged in the former Chetco FCU in late 2012.

Source: Callahan ‘ Associates.

<h3

OPERATING EXPENSE/ AVERAGE ASSETS

OPERATING EXPENSE/ AVERAGE ASSETS

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

A heavy investment in an expanding branch network and the people who provide the service shows in Rogue’s ratio of operating expenses to average assets since it began its loyalty strategy a decade ago.

Source: Callahan ‘ Associates.

Scoring With Net Promoters

These traditional performance numbers are good, but the metric that matters most to the Rogue executive team is the Net Promoter Score. Rogue’s initial score on that widely used metric shocked Pelham, he says, but it has steadily been on the rise, from 69.98 in 2013 to 80.00 this year. Rogue monitors that progress through 1,300 monthly relationship surveys.

BEST PRACTICE: INCENT ENGAGEMENT

Traditional growth metrics aren’t on the board when it comes to incentives for Rogue senior managers. The Net Promoter Score is because it’s considered the most direct measurement of success in building member engagement.

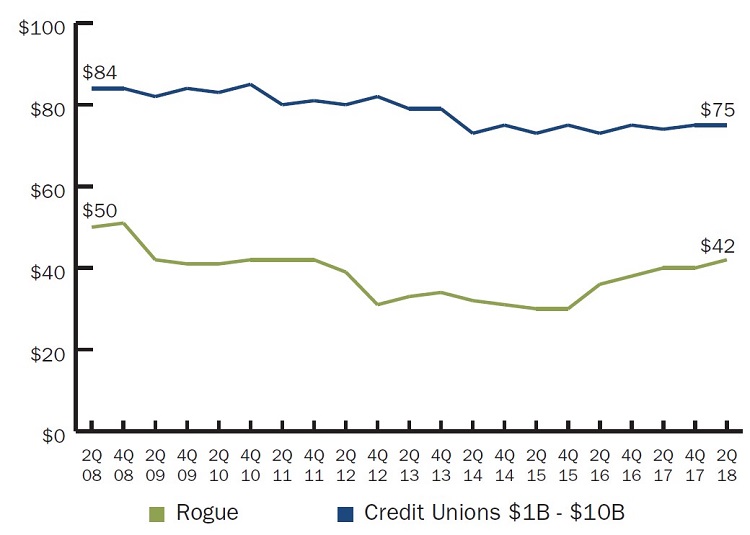

Those first surveys in 2008 were a call to action for Pelham and his team. For example, members thought the rewards program in place back then was unrewarding at best. So, Rogue eliminated it along with $150,000 in fee income. That’s a sizeable chunk of change for a $300 million credit union that was losing money for the first time in its history.

Fast-forward 10 years and Rogue Credit Union has among the lowest fee income per member ratios in the movement. It was $42 in the second quarter of 2018, compared with $75 for credit unions between $1 billion and $10 billion in assets and $74 for all U.S. credit unions.

FEE INCOME PER MEMBER

FOR CREDIT UNIONS $1B | DATA AS OF 06.30.18

Rogue Credit Union’s fee income per member has been well below average since it began its loyalty strategy in 2008.

Source: Callahan ‘ Associates.

That doesn’t mean the credit union isn’t making money. It is. Net income per member in the second quarter was $77, compared with $66 for its asset class and $55 for all U.S. credit unions.

‘We know how to maximize income and minimize expenses,’ Pelham says. ‘And we do it with member impact in mind. That might mean not making an extra 110% on something when we only need to make 75% or not pushing a deal when we know it means walking away from money.’

BEST PRACTICE: SPREAD THE LOVE

Rogue allocates more community sponsorship dollars to new markets where it is building a reputation. Branch management helps decide where resources go, which ensures staff buy-in.

Who? What? Where? When? Why?

Who?

Jackson County, OR, was named for President Andrew Jackson when it was created in 1852. Medford, OR, was named after Medford, MA, when it was platted in 1883. The state incorporated Medford as a town in 1884 and as a city in 1905.

What?

Medford is the Jackson County seat. The most recent U.S. Census estimate for the city’s population was 81,780. Timber and agriculture dominate an economy that now includes global fruit basket and direct mailers Harry ‘ David as well as major health care networks.

Where?

Jackson County is on the California border in southern Oregon. Via Interstate 5, Medford is 275 miles south of Portland, OR, and 365 miles north of San Francisco. The Pacific Ocean is approximately 100 miles to the west.

When?

A great time to visit Medford is during the Pear Blossom Festival. The spring event began in 1954 to celebrate that major crop still widely grown in the area. In nearby Ashland, the Oregon Shakespeare Festival that runs from March through October has attracted more than 20 million visitors since it began in 1935.

Why?

Attracted by salmon runs, people have lived along the Rogue River for thousands of years and it remains a legendary destination for sportsmen. Outdoors lovers of all kinds enjoy trails, camping, fishing, paddling, and the magnificent scenery of the great Northwest.

To show promoters how serious it is about earning their loyalty, Rogue even renamed its collections team. Now, they are known as Member Solutions.

‘We make sure our staff understands that just because someone is not paying their bills doesn’t mean they’re a bad person,’ Pelham says. ‘We all get caught in bad situations sometimes. We work to see these situations as an opportunity to help.’

A Community Helper

Another way Rogue catches the attention of promoters is through community involvement, including its sponsorship of the 65-year-old Pear Blossom Festival and Parade in Medford and similar efforts in other communities in the Rogue Valley.

‘We don’t just write checks,’ Pickens says. ‘We make sure we work side-by-side as volunteers, too.’

Another part of Rogue’s loyalty strategy is a living local theme that permeates the credit union’s branding and messaging.

‘We’re at the other end of the state from Portland and the state capital in this rural area on the California border,’ Pelham says. ‘There can be this simmering angst that no one cares about us and we have to take care of ourselves. We’ve taken up that mantle.’

Accepting responsibility for an entire region has helped build the trust that has become the credit union’s currency, Pelham says.

‘We had no idea our living local strategy would resonate so strongly, but it has,’ the veteran CEO says. ‘When in trouble, who do you go to? Your friends and family. That’s who we are. We’re here for good times and bad.’

This article appeared originally in Credit Union Strategy ‘ Performance. Read More Today.