In a 2015 Gallup Poll, parents of children younger than 18 years old cited paying for college as their top money concern.In fact, more than seven in 10 parents indicated they were very or moderately worried about the issue. Simply stated, this means that parents worry more about having enough money to pay for their children’s collegeeducation than other Americans worry about any other common financial concern, even more than retirement or medical costs.

This fear is certainly not unfounded. In the 2019-20 academic year, the average annual cost of tuition,fees, and room and board at a public four-year college was nearly $22,000 for an in-state student, and more than $38,000 for an out-of-state student. That number jumps to just under $50,000 for a private four-year college.

In spite of the cost, and the ensuing student loan debt that many students and families are forced to take on, study after study continues to show that college is a good investment for most people. In a recent study from the New York Fed, research shows that the average college graduate with just a bachelor’s degree earned about $78,000, compared to $45,000 for the average worker with only a high school diploma. Thismeans a typical college graduate earns a premium of well over $30,000, or nearly 75 percent. The same study also reported that while the average rate of return for a bachelor’s degree has edged down slightly in recent years due to risingcosts, it remains high at approximately 14%, easily surpassing the threshold for a good investment.

Young adults and families must walk a fine line in balancing cost versus return to ensure they are making a good investment when planning for college. Every day, credit unions help members walk this line when buying a house or saving for retirement. Isthere an opportunity for credit unions to play the same role here?

Poor Transparency=Poor Outcomes

Most Americans would never buy a house or car without knowing the cost. Unfortunately, the same cannot be said for college. Why is it so hard? Confusing lingo, a dizzying array of costs, limited unbiased advice, and strong emotions make for a very challengingbuying process.

- Sticker Price vs Actual Price: While the college costs noted above would be considered sticker price, the reality is that relatively few families will pay this amount. Unfortunately, because every college is differentand may include significant behind the curtain institutional discounting, it’s very difficult to know exactly what you’ll pay before you apply.

- Financial Aid Confusion: Financial aid is also notoriously hard to understand and predict. One study found that financial aid summaries from colleges are incredibly confusing. In the study, one-third of financial aid award letters reviewed did not even include any cost information for parents, while at the same time using hundreds of differentterms for loans.

- Higher Ed Outcomes: As college costs have risen, more and more students are paying close attention to the ROI of college certainly a step in the right direction. Getting a good job continues to be one of the main goals forstudents pursuing higher education. While that sentiment is great, most students and families don’t know how to access information about college outcomes (graduation rates, job placement, future salary expectations) or how to interpret thenumbers they may come across.

A Role For Credit Unions

Over the past 12 years, hundreds of credit unions have stepped into the student loan fray by offering private student loans to students and consolidation loans to graduates, resulting in well over $4 billion in outstanding private student loans withinthe credit union space. While providing a fair-value private student lending option to members is critically important, it’s only part of the equation.

Decisions around college and student loan debt will have long-term implications. Assisting members in a proactive manner that helps them make good decisions around college, leading to positive job outcomes and limited debt, can be one of the most financiallyempowering initiatives available to a credit union.

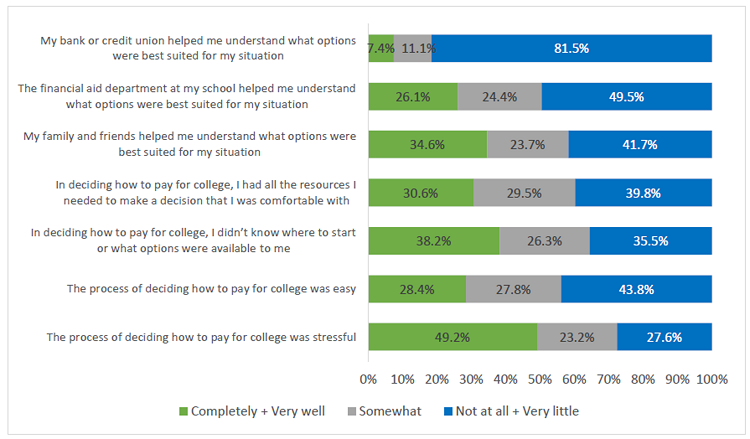

Today, the vast majority of credit unions play no role in the incredibly important decision-making process around college planning and funding. New research from the Filene Institute supports this assertion. In a survey of more than 1,500 credit unionmembers, 81.5% indicated that their bank or credit union offered little to no help in understanding options around funding college. Even more startling is the fact that nearly 50% said the financial aid department at their school offered little tono help. Many turned to friends and family. While this may have proved helpful, the overwhelming majority (72.4%) said that process was very or somewhat stressful.

A New Approach

To address this critically important area, Credit Union Student Choice is taking the next step in education finance by forging a multi-yearpartnership with Edmit, an emerging college advisory company. Founded by former university leaders, Edmit’s innovative and intuitive platform provides tools and resources to help families makesmart decisions about what college will be right for them financially and academically.

The unique platform provides personalized financial aid and scholarship estimates for thousands of colleges, as well as salary information by major and recommendations on how best to pay for college. By providing basic information related to householdincome, grades, and test scores, students and families receive expert advice and personalized recommendations on the colleges that best meet their needs, both financially and academically.

Users can view side-by-side, customized college comparisons and view recommendations to help them make logical, data-driven decisions, as opposed to relying strictly on emotion. Edmit’s learning center also contains a wealth of information and anonline course about how to pay for college with more aid and less debt. Users can even revisit Edmit after applying to colleges in order to upload their award letters and other info to keep the advice current.

Available free of charge to Student Choice partner credit unions and their members, the Edmit platform is also available via an annual license fee to all credit unions.

Bringing forth this new capability into the credit union space, focused specifically on college planning, selection, and funding gives credit unions a powerful new tool to support their members’ long-term financial wellness. Visit www.studentchoice.org/empowering for more information.