The second quarter of 2020 more fully revealed the effects of the COVID-19 pandemic. The virus forced many businesses to quickly adapt to an online and remote workforce. Others had to close down either temporarily or permanently whichforced the layoffs of millions of employees across the country. The economic effects of the novel coronavirus cannot be understated and have put financial institutions in a unique position to support Americans in need, even if that meant taking ahit on their earnings statement. The paycheck protection program (PPP), a part of the CARES Act, launched on March 27 to help small businesses continue to employ their workforces. As of July 6, nearly 4.9 million loans had been approved by more than5,000 lenders.

Key Points

- 833 credit unions granted PPP loans in the second quarter. As of June 30, 2020, credit union PPP balances surpassed $8.3 billion as the industry offered paycheck support to more than170,000 business.

- The average PPP loan balance at U.S. credit unions was $48,931. For all lenders nationwide, the average exceeded $100,000.

- The average loan-to-share ratio fell 7.1 percentage points annually to 76.2% as of June 30. Relief packages, increased unemployment payments, and loan deferments fed increased share balances nationwide.

- A surge in first mortgage production, which was up 94.0%, coupled with a 37.0% increase in business loan originations supported by PPP lending underpinned the 26.6% year-over- year increase in loan originations.

- Total delinquency decreased 5 basis points over the past year to 0.58% as credit unions implemented widespread loan forgiveness programs.

NET LIQUIDITY CHANGE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Credit unions added $142.2 billion in liquidity over the past 12 months, more than any year on record.

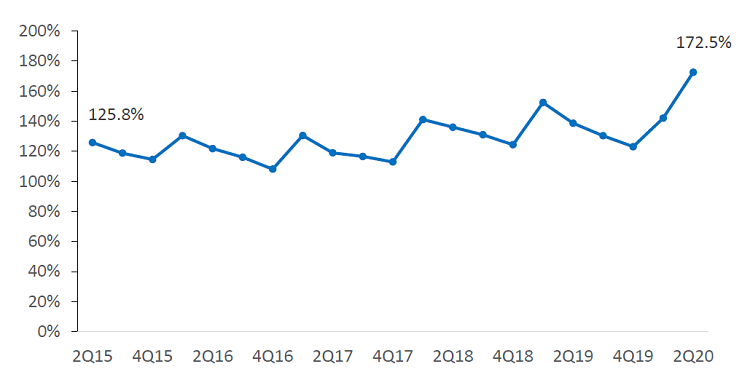

COVERAGE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Credit unions continue to hold a high coverage ration in anticipation of a spike in loan defaults.

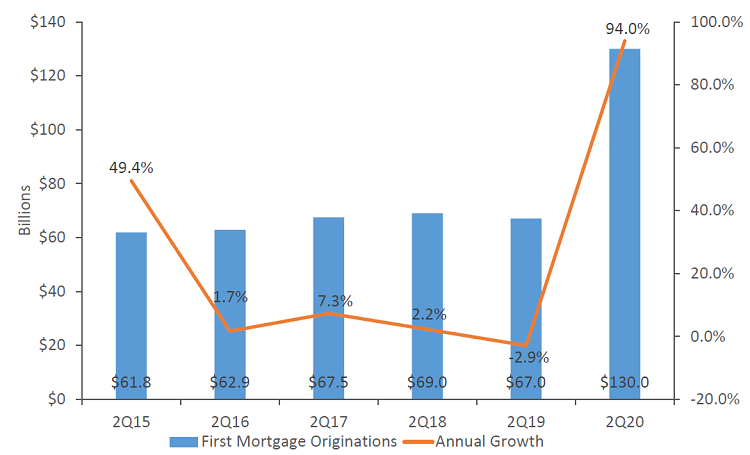

FIRST MORTGAGE ORIGINATIONS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

First mortgage lending made up most of the industry’s loan production through the second quarter. Up 94.0% year-over-year, first mortgage originations reached $130.0 billion in the first six months of 2020.

The Bottom Line

Despite economic uncertainty and low interest rates, credit unions assisted struggling members. Deposit balances surged, and mortgage loan production led by refinancing reached record growth levels. Credit unions used the PPP loan programto support their communities and small businesses and help keep members and non-members alike employed.

How Do You Compare?

It only takes a few minutes to benchmark your credit union’s 2Q20 data and performance in Peer-to-Peer. Compare against credit unions in your state, asset range, or by business model. Let us show you how easy it is with a customdemo.

This article appeared originally in Credit Union Strategy & Performance.