Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: CUSOS

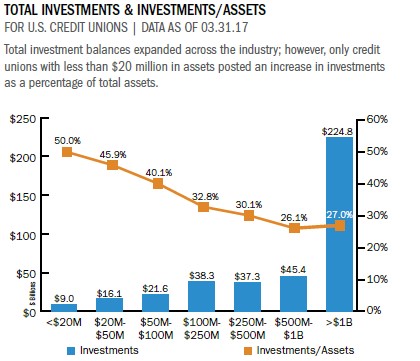

Investments generally increase from the end of one year into the first quarter of the next. The investment expansion of 8.1% from fourth quarter 2016 to first quarter 2017 was no different.

With rising Federal Reserve rates and increased consumer confidence, the credit union industry posted positive year-over-year investment growth in the first quarter for the first time since 2013. Year-over-year, credit unions reported an investment growth rate of 2.9% and investments topped $402.2 billion. Considering year-over-year investment growth has been negative for 10 of the past 16 quarters, the positive growth rate in the first quarter could indicate a slow recovery to this section of the balance sheet.

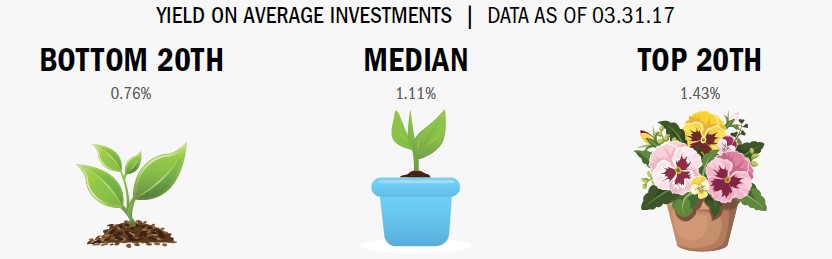

Along with increasing growth rates, investments yielded higher profits. As of March 31, 2017, the average yield on investment at credit unions was 1.44%. This was a 14-basis-point improvement over the 1.30% yield of first quarter 2016. Yields have slowly risen over the past four years, but this is the largest year-over-year improvement since 2006.

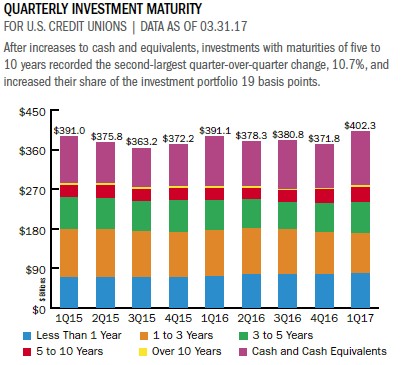

Investments in agency securities and cash at other financial institutions comprised 43.6% and 20.4%, respectively, at credit unions as of first quarter 2017. Although the investment composition has not changed much, investment maturities have slowly shifted. Investments maturing in five to 10 years grew 10.7% from Dec. 31, 2016, to reach $34.2 billion as of March 31, 2017. That maturity range posted the largest percentage growth, but the three largest investment segments in order were cash, investments maturing in one-to-three years, and investments maturing in less than one year.

Click the graphs below to enlarge and then continue reading to see how Ent Credit Union’s mortgage-backed security re-purchase strategy makes more of investments and funds member give-back programs.

Larger institutions underpinned the growth in average loan balances across the country. Whereas the median growth rate increased 2.8 percentage points, credit unions in the top 20th percentile posted gains of 9.6% per loan.

CASE STUDY

ENT CREDIT UNION

Ent Credit Union has been making a few hundred thousand dollars a year by serving up dollar rolls.

A dollar roll is a form of financing in which an investor in this case, Ent sells a mortgage-backed security (MBS) on one date and buys it back at a previously agreed upon lower price, in Ent’s case one month later.

The credit union gets the benefit of the lower price known as the drop when it buys the securities back. In the meantime, the broker gets to use the securities for its own purposes.

Along with the drop, the buyer invests proceeds from the monthly sale with either the Fed or into an investment repurchase transaction, typically called an investment repo. Ent CFO MJ Coon says she expects a 1% yield on the Fed investment but addsEnt could earn a few more basis points by investing those proceeds in an investment repo.

Coon says her credit union averages around $75 million in outstanding bonds in this strategy at any given moment and has made approximately $1.5 million since it began using dollars rolls in May 2014.

Dollar rolls involve the effective use of MBS investments many credit unions already hold in portfolio or purchases for this purpose.

Laying out carefully established stipulations in counter-party agreements ensure you do not end up taking delivery of securities that might not be as attractive as the bond you sold, Coon says.

Dollar rolls pose no interest rate risk. The credit union commits to both the sell price and the repurchase price before entering the transaction as well as how much it will earn on the proceeds from the sale over the 30-day period. If it doesn’tmake sense this month, Ent sits on the sidelines and foregoes the transaction.

The heavy lifting is getting started and making sure everyone has a full understanding of the entire process, Coon says. Once the complex accounting requirements of this strategy are understood, then it becomes routine.

Read The Whole Story

The data in this article was pulled using Callahan’s Peer-to-Peer software. Learn more about Peer-to-Peer.

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 1Q 2017