Credit unions can increase loan growth 27% by doing one simple thing: increase system decisions on loan applications. In a recent study of credit union indirect application data from 2014, CU Direct was able to determine that auto-approved loan applications are 11% more likely to fund than applications approved manually. When one considers that about 27% of indirect applications were manually approved in 2014, increasing the number of those manually approved applications that are system-approved increases loan volume growth by over 3% of what it is today. Average credit union loan growth is currently 11%, so in doing the math, a 3-point increase from 11% equals a 27% bump in loans.

Now, 11% and 3% may seem like small numbers to a lot of people, but I recently met a credit union that told me that they had an aggressive loan growth goal of 13% for 2015. Again, average credit loan growth thus far in 2015 is 11%. The question then becomes, does it cost less to tweak a decision engine to auto-approve loans that are already being approved manually, or invest more in marketing and sales to generate that extra boost?

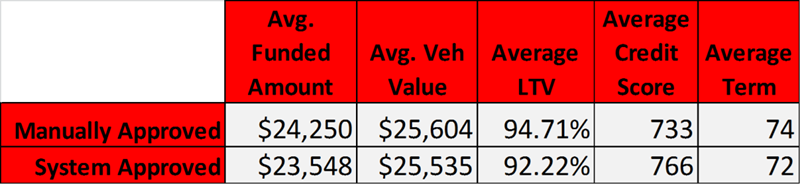

I’m assuming you get the rhetorical nature of the previous question. When speaking to credit union lenders about system approving loan applications, many are reluctant to allow a computer to make marginal credit decisions. In other words, many are OK with system-approving applications with a 750 credit score, 20% debt-to-income ratio, and 50% loan-to-value ratio. What is interesting, however, is that in this same study, we found that the applications that were manually approved were not that much different than the applications that were system approved.

2014 Key Application Attributes

So, in essence, we’re taking more time and spending more money doing manually what we’re already doing electronically. In other words, we’re not really getting anything more for our time and money.

Lenders must understand that consumers, and by extension dealers in indirect, want fast, accurate lending decisions. If we put ourselves in their shoes, we know that we would be offended if our preferred lender took two hours to do what another lender is able to do in two minutes. If we agree that manual decisions slow down the process, then we must determine how it is that we can increase the number of applications that can be handled by the decision engine. In order to do this, it’s important to dismiss some potential lending myths.

The first myth that we encounter with many credit unions is the belief that the credit score alone is sufficient to support most lending and pricing decisions. This is evidenced by the way many credit union pricing programs are set up by risk tier and term. A number of credit unions have a hard cut-off score for system approvals of 680 FICO or greater. But a larger number of the applications that are manually approved are below this cut-off. Is the credit score even a perfect indicator of risk? No. In fact, a borrower with a 680 credit score and a 5% payment-to-income ratio could actually be a lower risk than a borrower with a 720 score and a 20% payment-to-income ratio. In order to understand how these risk factors work together, credit unions must study portfolio performance based on these additional attributes.

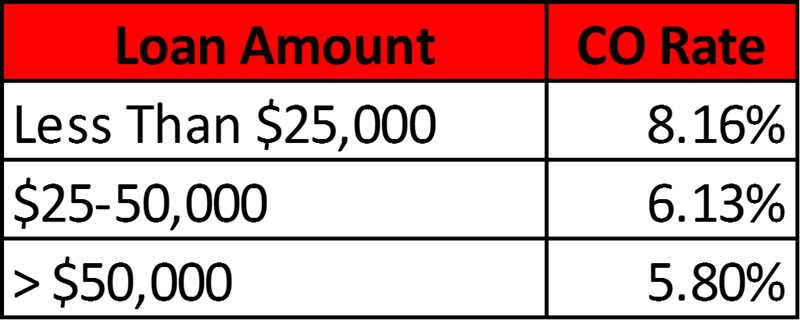

A number of the credit unions using CU Direct’s decision engine refer loans for manual underwriting because the loan amount exceeds a certain dollar amount. Many credit unions are just not comfortable with a computer making loan decisions on larger-balance loans. Truth be told, however, our study has found that larger balance loans actually have lower charge-off ratios or loss severities. This stands to reason, as mostly lower risk borrowers are approved on large-balance loans.

If the credit union is properly analyzing applicant risks, then one should feel more comfortable allowing the decision engine to make decisions on loans with higher balances.

Longer-term loans have historically been of concern to credit union lenders. The consensus has been that longer-term loans do not repay at a rate that the collateral value can keep pace with. In other words, borrowers who originate long-term auto loans spend more time under water on the loan. Therefore, in the case of default, the theory is that a larger portion of the balance will be charged off.

Again, actual performance data does not necessarily support this assumption. In fact, it has been found that auto loans with terms over 72 months actually have lower charge-off ratios than loans with shorter terms. Quite possibly, this is because the lower payments on these loans provide the borrower with more financial breathing room when they encounter financial challenges.

We also found that the average age of vehicles has increased by 2.4 years in the last 20 years, so vehicles hold their values longer. Finally, we discovered that the median actual term of an 84-month loan was only five months longer than a 60-month loan. In essence, these longer-term loans don’t actually stay on the books that much longer.

These are a few key examples where good analytics can help credit unions increase system decisions on loan applications, improving turn-around times, member satisfaction, and increasing loan volume. CU Direct’s Advisory Services can help your credit union review and examine these attributes and make recommendations on how you can optimize lending by better use of technology.