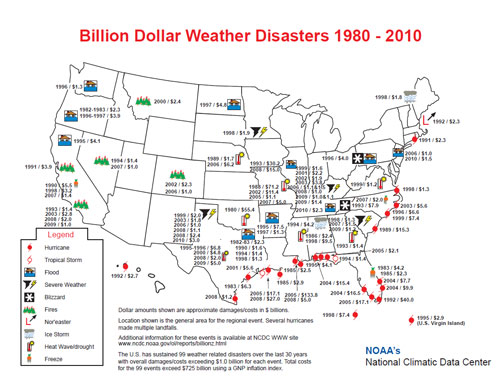

As depicted in this map from the NOAA’s National Climatic Data Center, most areas of the United States have been financially impacted by some type of severe weather to the tune of $1 billion or more over the past 20 years. The National Weather Service has also reported an increase in fatalities related to weather in recent years.

Click graph for larger view | Source: National Climatic Data Center

The table below recounts serious weather events, their costs and related deaths for the first half of 2011. Many of these events have already shattered records.

Click graph for larger view | Source: Ongoing Operations

How Can A Credit Union Prepare?

Here are a few considerations for your crisis management team as they review the credit union’s existing business continuity plan:

- Acknowledge the severe weather risk(s) in your area. Are any of your branches in flood zones? What types of natural disasters are most likely to occur in your region?

- Always place human health and safety first in your Business Continuity Plan. Do not forget about the most important aspect of your plan, taking care of your people

- Understand that disaster recovery does not equal business continuity. Disaster recovery is how your IT department may bring systems back up but it does not include many other essentials for the successful continuation of your business.

- Develop communication strategies BEFORE the event. Make sure you have the tools in place to communicate with both members and staff.

- Exercise your plan. Purposely look for gaps and ways you can improve it. Encourage staff members to poke holes.

Lessons Learned From Actual Disasters

When New Orleans Firemen’s Federal Credit Union presented on a recent Preparing for Severe Weather webinar for Ongoing Operations, it spoke from experience. The credit union found ways to continue serving its members despite Hurricane Katrina coming back online the following Tuesday with its online banking and email, relocating its call center operations to Texas, leveraging shared branching, and implementing or creating other backup plans. The credit union offered loan extensions to members in return for updated contact information as half its members were re-located over night and mail delivery halted. The credit union’s assets doubled over the three months after the hurricane, and that money has stayed. Prior to Katrina, the credit union was approximately $75 million in assets and now has more than $145 million. Among the key lessons learned: taking care of your staff and members is vital, tape backups might not be sufficient, and cash is king during a disaster. You can hear more of its story by viewing the entire archived webinar here.

Although hurricanes typically have a warning period that provides time to prepare, other severe weather events literally come out of nowhere. To prepare for multiple types of events, below are tips from Ongoing Operations’ team of Certified Business Continuity Professionals:

- Have a personal safety plan

- Keep at least one NOAA radio at each location

- Designate a weather watcher and educate them on the various resources available to track severe weather and events in your area

- Have multiple communication channels available to communicate with staff, members, the Board of Directors, and families

- Consider using alert technology for quick, consistent and timely dissemination of information

- Apply and test GETS cards

- Know where your alternate locations are ahead of time

- Don’t forget your shelter in place training

- Understand that you may be on your own for days/weeks after a serious disaster and plan accordingly

- Use the event to go Above and beyond for your community, staff and members if you can

- Protect all delivery channels not just the physical ones

- Cloud or outsource what you can

Contact Ongoing Operations at info@ongoingoperations.com or 877-552-7892 if you have questions or would like to learn more about our business continuity solutions. Our planners work closely with credit unions all over the country to develop, test and maintain their plans.

Additional Preparedness Resources

www.ready.gov/business/index.html

www.fema.gov/business/index.shtm

www.ncua.gov/newpublications/publications/pdf/brochures/lessonslearned/lessonslearned.pdf

About Ongoing Operations Ongoing Operations, LLC is a leading provider of Business Continuity & Technology Solutions to credit unions nationwide. Beyond just backing up credit unions’ key systems, Ongoing Operations takes a holistic approach to business continuity to ensure that all of your systems and member communication channels stay up and running no matter what. Learn more atwww.ongoingoperations.com.