Virtual financial assistants (VFAs) are on the technology roadmap of the majority of credit unions, some more near-term than others. When considering what a VFA should do, it’s important to ask yourself what the goal of implementing this powerful new tool at your credit union really is.

Conversational artificial intelligence (AI) technology has leaped forward over the past five years or so, spawning VFAs that greatly outperform their rules-based ancestor, the chatbot. This improved experience, moving beyond simple commands into multi-turn conversations, has led to significant increases in usability and use cases. For evaluation purposes, it is helpful to put VFA capabilities into three categories.

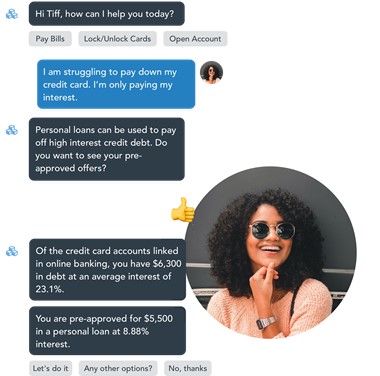

- Service: obtaining routing numbers, resetting passwords, getting basic account information, and conducting transactions.

- Marketing/Growth: refinancing offers, credit card comparisons, and account opening.

- Value: focusing on financial wellness, proactive insights, and personalization.

There are important decisions to be made regarding which features to include within each category, but let’s keep it simple to start. So, which of these should your VFA offer?

The service functionality should almost certainly be included in a credit union’s initial launch of a VFA. This generates cost reductions via AI resolution of lower-value service calls. But is that enough for a truly successful launch? Should marketing/growth and value functionality be included from day one?

One important aspect of these decisions is that complexity/length of implementation increases as you add capabilities to the VFA. For example, even within the service use cases, implementing a VFA that answers unauthenticated questions and guides members to the correct area of your website, is different from one that does this and also authenticates members for account information and money transfers. Obviously, added complexity and time of implementation often also means different pricing structure.

So, is it beneficial to start with more? To answer this question, first examine the goals of the project in the near-, medium- and long term. While reducing costs by resolving member issues within the VFA is almost always a near-term goal (the project needs to pay for itself, right?), what else should be considered for the near term? If you’re enjoying a large cost reduction from the VFA answering questions for members who are not authenticated, should you invest more on day one to get authenticated functionality?

Authenticated functionality is key to medium- and long-term return on investment (ROI) tied to personalization, even if long-term ROI for customer experience is harder to measure. Increasing the depth of the relationship with your members is the competitive advantage of most credit unions and these advanced phases of VFA functionality can help you do just that.

For most credit unions, a phased approach is the best bet. We recommend starting with an unauthenticated VFA for a quick launch (four weeks for implementation is very realistic), then rolling out additional features based on initial VFA adoption metrics and member behaviors.

An important factor in that strategy is choosing the right VFA provider. You need to ensure the provider has live implementations with customers at each of the stages, not just the promise to build it. In addition, never underestimate the complexity of moving from an unauthenticated VFA to an authenticated one and the importance of having a VFA provider with experience executing that.

Also consider the speed at which added functionality should be implemented. Credit unions can lose considerable momentum in adoption after starting quickly, by moving too slowly from basic service functionality to more robust value functions. This correlates to the point about provider experience. For example, when adding value functionality, you should not only consider if the provider has experience with delivering insights, but experience working with your specific provider of insights software. Even better, does the provider offer its own insights software, like Abe.ai does thanks to our parent company, Envestnet | Yodlee.

A quick start with an unauthenticated product is a great place to start, but with a close eye on adding functionality quickly where demand warrants it. This is the best way to compete with the large banks, like Bank of America and others, who have their VFAs at the forefront of their customer service technology strategies and are enjoying rapidly increasing adoption and usage.

Download The Next Generation of Conversational Banking to examine how financial institutions can leverage conversational artificial intelligence to go beyond simple reactive use cases and instead generate proactive interactions that engage members on meaningful money matters and support financial wellness.

Juan Romera is Product Evangelist at Abe.ai.