Step Up Your Mortgage Lending Game

Prior to the COVID-19 pandemic, credit unions had been anticipating a slowdown in mortgage lending. But with the Federal Reserve dropping interest rates to historic lows, credit unions are currently experiencing a surge in mortgage activity particularly with refinance loans.

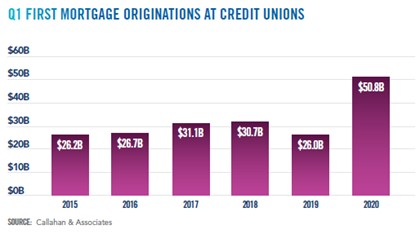

According to data from Callahan Associates, the first quarter of 2020 saw mortgage production nearly double from levels reported a year ago. And in the second quarter, credit unions funded $314 billion in loans, a 26% increase versus the first half of 2019 that was driven by a 94% jump in first mortgage originations.

Now is a great time for credit unions to focus on stepping up their mortgage lending game and it looks like this trend will continue on for quite some time post-pandemic. Projections released in early September 2020 indicate the Fed will hold rates near zero for at least three more years. All 17 officials who participated [in a policy meeting] said they expect to keep rates near zero at least through the next year and projected rates would stay there through 2023, according to a September article in The Wall Street Journal.

As credit unions prepare for more mortgage requests, it’s important to keep the member in mind. Buying a home is overwhelming in the most ideal of times let alone in the middle of or just after a pandemic. That’s why members will be looking to their credit unions for guidance through this process.

According to the Jack Henry Modern Consumer Survey, members are specifically looking for digital experiences (which account for 81% of interactions) that are useful, relevant, seamless, and appropriately simple. For the 19% of in-person interactions, members expect experiences to be personalized, empathetic, authentic, and focused on their needs and circumstances.

Credit unions can help by hosting a webinar on the real cost of home ownership and what to expect when you’re a first-time homebuyer; and by offering a digitized mortgage process. As more members continue to favor an omnichannel approach, borrowers might feel more comfortable working with loan officers over the phone and online.

Stay On Top Of Remote Payments

Before the pandemic, the remote payments category was growing at a 14% rate, according to the Federal Reserve. During the pandemic, remote payments have been averaging 40% growth showing how critical it is for credit unions to keep their cards top-of-app.

An RTi Research study conducted in March 2020 shows 30% of consumers have used touchless payment methods like mobile for the first time during the pandemic; and as the adoption of mobile wallets for payments tied to food delivery services (e.g., DoorDash, Uber Eats) continues to rise, it’s become commonplace to link a card to a digital wallet to place an order. For credit unions that successfully educate their Modern Members while communicating their unique benefits, this could turn into recurring transactions that will pay off long into the future.

Next Steps

Mortgages and remote payments are certainly bright spots in an otherwise dreary economic climate. Credit unions should capitalize on the chance to further educate members on the products and services they really need. Whether they’re applying for their first home loan or figuring out how to deposit a check on their phone, members don’t want to feel frustrated. To ensure they feel valued and heard, focus on the member experience:

- Let the desired member experience drive your strategy.

- Build (or buy) systems that will serve your defined target market. Consumer lending processes have benefited from some automation though typically in stages, causing credit unions to use two or three systems to originate consumer loans.

- Don’t stop with your members. Offer the same systems support for your employees. Think about specific interactions your employees have with your members and consider whether your technology supports or threatens the success of those interactions.

Like this article? Check out this ebook, Delivering a Compelling Modern MemberSM Experience in the Age of a Pandemic, or visit our site for additional resources about delivering Modern Membership.

About Symitar

From leading core, digital, lending, and payments capabilities to a truly open approach of working with credit unions, Symitar is your human-centered, tech-forward partner. We offer a comprehensive, integrated platform to help you achieve your goals. Together we serve the Modern MemberSM and advance the value and importance of credit union membership.

Twitter: https://twitter.com/symitar

Facebook: https://www.facebook.com/Symitar

LinkedIn: https://www.linkedin.com/company/symitar

Email: modernmember@symitar.com