Choosing with whom to partner for a core system is one of the biggest decisions a credit union can make. And switching to a new provider when an existing one is no longer a good fit cannot be taken lightly.

When a credit union is looking for a new core processor, what’s the best way to organize all its options? How does it narrow the playing field so it considers only the right provider for its needs? How does it identify a core that helps similar credit unions thrive?

By taking the advice below, which makes a daunting task doable.

Tip 1: Build A List Of Core Providers

To identify core processors that might be particularly suited to serve the needs of the credit union, start by finding providers that serve similar institutions. This will help the credit union narrow its list of potential partners to only those core processors that have experience serving a certain kind of business model, field of membership, asset size, and more.

How does a credit union do that?

First, look for conversion announcements in industry publications and websites, and make a list of the credit unions that have recently switched core providers.

Then, use the CreditUnions.com Search & Analyze tool to determine assets and other key information, such as number of branches or location.

Finally, note which core processors those credit unions use. That information is readily available via Search & Analyze for clients of Callahan & Associates. But that information will also be available in the announcements used to craft the initial listof potential core providers.

Tip 2: Analyze Credit Union Performance

The 5300 Call Report is an invaluable resource for evaluating the performance of the credit unions that use a particular core provider. The individual call reports for all federally insured credit unions are available from the NCUA. Search one by oneand prepare an Excel file of your findings.

But Callahan’s Peer-to-Peer analytical tool makes this tedious comparison shopping a snap.

For example, a $500 million credit union in Virginia that is considering several core providers for a conversion can easily see how other credit unions that use those cores are performing.

First, it finds similar credit unions by filtering based on criteria such as asset range, membership size, and branch footprint. This last one helps the credit union find institutions with comparable operating expenses.

With its initial Peer-built list of similar credit unions in hand, the credit union goes into the vendor tab in Peer-to-Peer and filters by core provider. This creates a peer group of all the credit unions within its established financial guidelines thatuse the selected core.

The Virginia credit union then repeats the process again for all the core providers it is analyzing so it can compare the performance of different credit union groups using a single graph.

Now, the credit union is ready to examine key ratios. This credit union is interested in learning which credit union group is operating most efficiently. It also wants to know which group is posting strong loan and member growth. These are important considerations.

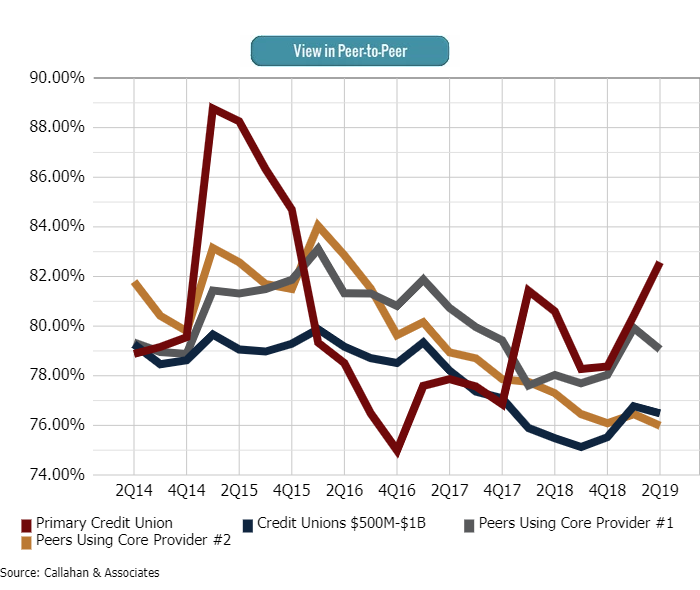

EFFICIENCY RATIO

DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

In this case, credit unions using Core Provider #1 are reporting less efficient operations, on average, and credit unions using Core Provider #2 are reporting more efficient operations (remember, a lower ratio is better when it comes to efficiency because it indicates a credit union is spending less money to earn $1).

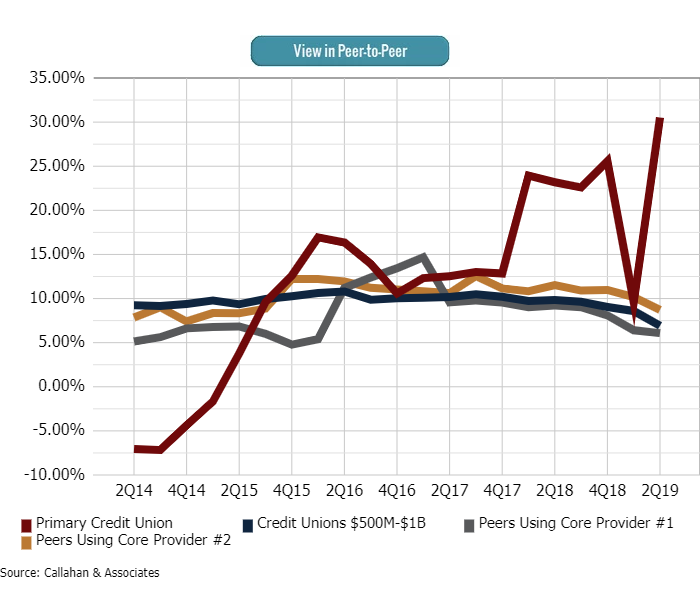

Additionally, credit unions using Core Provider #2 are also posting stronger loan growth.

LOAN GROWTH

DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

After reviewing the data, it appears Core Provider #2 might be a good fit for this Virginia credit union.

Now, the credit union is ready to more seriously look at Core Provider #2.

Tip 3: Gather Feedback

Having the right performance data helps a credit union narrow its search to a handful of core processors, but qualitative data is also important when making a final decision.

So, after identifying the core processors that appear to best support similar credit unions, make a list of executive contacts for credit unions that use those providers.

Then, ask those contacts about their conversion experience. How was the conversion? What do they wish they knew about the core processor going into the conversion? Are they happy with their selection? Do they have any advice to share?

Try to find at least one or two credit unions that have been with the core provider for several years to get a better understanding of what a long-term relationship will look like.

A core provider can look perfect on paper and in peer groups but personal feedback will add context to the numbers and can make all the difference.

The 2020 Core Report

Callahan’s Supplier Market Share Guide: Credit Union Core Processors helps leaders fully understand the performance and strengths of core processors in the credit union space. This guide offers:

- Expert opinion and advice.

- Changes in market share.

- Client performance comparisons.

- Aggregate assets for credit union clients.

- Newly acquired clients and integration information for select platforms.

earn how to get access.

Switching core providers can be a tedious, time-consuming process, but there are resources available to lighten the load. Lean on the data, whether through Peer-to-Peer or via the NCUA, as well as peer feedback to find the perfect fit.