We spend a lot of time at Callahan Associates thinking about who owns analytics at credit unions. Coming from an analytics and reporting background, I was ready to enjoy the challenge of learning exactly what business intelligence means that’s my job here at Callahan Associates, as director of business intelligence within the cooperative movement, but I was surprised by the lack of cohesive narrative on the topic within the industry.

That is by no means to say that business intelligence is not on the rise in a major way among credit unions far from it. Rather, I ran into a highly stratified landscape of different approaches to and readiness to deploy what we know as Big Data.

A single credit union is, in principle, meant to do the best it can for its members. As such, my first question was, how do credit unions look after and make the most of their own data the activities that form the core of business intelligence. And second, what activities and players within the credit union industry help credit unions leverage their own data and analysis within the spirit of the cooperative movement?

My colleague Chris Howard kicked off 2016 by challenging us to think about the role of disruptive collaboration in the industry in this and years to come. Business intelligence-driven advanced data analytics will offer value when it allows credit unions and, notably, CUSOs to deepen the impact of financial cooperatives in the lives of the Americans.

Read more about Chris Howard’s view of disruptive collaboration in, Disruptive Collaboration Is A Big Idea For 2016

This brings me back to my initial question. What are individual credit unions doing with business intelligence and where does the potential lie for them in future?

Big Money, Big Data

The credit union industry is home to many institutions that are taking cutting-edge approaches to business intelligence. Although these are not limited to the $1 billion-plus players, there is certainly a correlation between asset size and the ability of a credit union to devote time and resources to the life of its data. Even the NCUA is on the Big Data/business intelligence train: the regulator is now seeking credit union input on how the regulator can best upgrade its own systems to optimize exam efficiency and information gathering.

Naveen Jain at First Tech Federal Credit Union ($8.7B, Mountain View, CA), not coincidentally located in the heart of Silicon Valley, has been singular in developing a comprehensive and elegant design for First Tech’s entire business intelligence process.

How do credit unions look after and make the most of their own data – the activities that form the core of business intelligence. What activities and players within the credit union industry help credit unions leverage their own data and analysis within the spirit of the cooperative movement?

What does this look like? At the core of effective business intelligence is a credit union’s data, and the institution must determine how to make it accurate, how to store it, and how to use it in iteration.

Credit unions like First Tech make use of sophisticated systems that bring together their data on everything from core banking and credit cards to branch performance and call centers. From there, they manage and warehouse data, making it available for deployment by different business teams, from marketing to accounting. The operational complexity of this requires state-of-the-art technology and people who are experts in everything from SQL, data analysis, and database administration to data visualization and automated marketing.

But What About Everyone Else?

A lot of these systems are slick, which got me thinking about what this sophisticated technology with all its demands on financial and human resources means to smaller credit unions? What value does Big Data, or any data, bring to them and their members?

Over the past decade, there has been a slow rise of BI across the entire industry, beginning with making better use of data shared with providers. Some of this has been frustratingly piecemeal for example, a credit union could look at a report on credit card use trends at the end of a month and draw analytical conclusions or compare two reports covering different pieces of a member’s use of their credit union resources. But how could an institution bring them together? How do credit unions use multiple data sets together to inform decision-making in a way that benefits members?

Want more business intelligence and Big Data? Check out, A Strategy To Build Business Intelligence Across A Credit Union and Analytics And Marketing In The Era Of Big Data.

At Charlotte Metro ($374.2M, Charlotte, NC), Paul Leavell has been forwarding the idea that the first step toward effective business intelligence is to understand that even little data can be incredibly impactful without sacrificing the requisite thoroughness and accuracy that is core to the concept of Big Data.

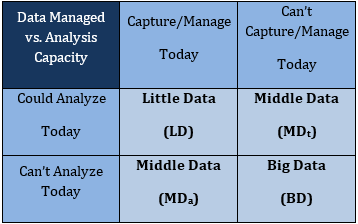

He and colleague David Cooper put together the Cooper-Leavell Matrix, which has allowed them to guide creative and tactical marketing through the segmentation of data into three size buckets. Positive ROI and member response came out of their approach, which acknowledges that not every credit union can readily capture and analyze Big Data. As such, they find ways to make use of data they can handle with the resources and requirements they have.

The Cooper-Leavell Matrix is a way to categorize data in terms

of its accessibility and utility.

Scalability is at the heart of Charlotte Metro’s matrix approach. In the process of making strides in its facility with small data and working to push its use of middle data, it made improvements to its data warehousing and reporting processes. It also was able to parse out information such as who made charges at a baby store and might be a good marketing target for an auto loan (a new minivan, perhaps?) or mortgage.

Where Do CUSOs Fit In?

We’ve seen among small- and mid-sized credit unions that dedication to incremental improvements to their data warehousing and analysis efforts deliver cumulative results. This is often achieved through partnerships with CUSOs.

What more potential is awaiting credit unions as data and analysis become a part of the knowledge sharing and cooperative business model?

Next week in Minneapolis, the Analytics and Financial Innovation (AXFI) Conference will bring CUSO and credit union leaders together to talk about how the movement must make analytics and innovation core to business strategy and must do so now.

The AXFI Conference is an example of vendors and credit unions focusing on analytics beyond simply focusing on the sales cycle. This type of partnership is true to the cooperative spirit and also essential to meeting the challenges posed by the rapid pace of analytical innovation across the financial services space.

CUSOs have been key strategic partners for credit unions in the rise of effective business intelligence. Many organizations are working at great speed to deliver the next-generation systems that credit unions need or will soon need to match the pace of innovation set by competitors. OnApproach, one of the primary sponsors of the conference, offers a range of solutions that fit with different credit union needs. It also partners with other data analytics CUSOs, including Denali Alaskan Federal Credit Union’s Deep Future Analytics as well as the Knowlton Group.

The collaborative model is the best – and perhaps only – way credit unions can compete in the critical realm of business intelligence and the Big Data is requires. Read more about this advantage in, Of CUSOs And Big Data

This kind of cooperative innovation enables credit unions of more varied sizes access to higher-level analytical tools than they would be able to develop in-house. Such services, of course, are aligned with the purpose of CUSOs, but I am struck by the teaming up of minds and systems in which these groups are enthusiastically engaging.

Although the pace and the look of business intelligence at credit unions varies considerably, the benefits are consistent and the need for continued focus on all things data is paramount. As the industry advances, the opportunities presented by nimble, data-driven pricing or predictive modeling are immense.

What more potential is awaiting credit unions as data and analysis become a part of the knowledge sharing and cooperative business model?

Although credit unions can talk about data incessantly, the real focus remains upon the member. Data and the analysis of it aids in the understanding of what members are doing and what they want from their credit unions. And it is data that enables credit unions to deliver that in ever more personalized ways.

You Might Also Enjoy

- How A Governance Committee Helps Langley FCU Tackle Business Intelligence

- A Way To Predict Member Behavior

- How Analytics Can Drive Efficiency And Innovation

- KEMBA Financial Knocks Down Silos With Shared Data Ownership

What Does Business Intelligence Mean For Credit Unions?

We spend a lot of time at Callahan Associates thinking about who owns analytics at credit unions. Coming from an analytics and reporting background, I was ready to enjoy the challenge of learning exactly what business intelligence means that’s my job here at Callahan Associates, as director of business intelligence within the cooperative movement, but I was surprised by the lack of cohesive narrative on the topic within the industry.

That is by no means to say that business intelligence is not on the rise in a major way among credit unions far from it. Rather, I ran into a highly stratified landscape of different approaches to and readiness to deploy what we know as Big Data.

A single credit union is, in principle, meant to do the best it can for its members. As such, my first question was, how do credit unions look after and make the most of their own data the activities that form the core of business intelligence. And second, what activities and players within the credit union industry help credit unions leverage their own data and analysis within the spirit of the cooperative movement?

My colleague Chris Howard kicked off 2016 by challenging us to think about the role of disruptive collaboration in the industry in this and years to come. Business intelligence-driven advanced data analytics will offer value when it allows credit unions and, notably, CUSOs to deepen the impact of financial cooperatives in the lives of the Americans.

Read more about Chris Howard’s view of disruptive collaboration in, Disruptive Collaboration Is A Big Idea For 2016

This brings me back to my initial question. What are individual credit unions doing with business intelligence and where does the potential lie for them in future?

Big Money, Big Data

The credit union industry is home to many institutions that are taking cutting-edge approaches to business intelligence. Although these are not limited to the $1 billion-plus players, there is certainly a correlation between asset size and the ability of a credit union to devote time and resources to the life of its data. Even the NCUA is on the Big Data/business intelligence train: the regulator is now seeking credit union input on how the regulator can best upgrade its own systems to optimize exam efficiency and information gathering.

Naveen Jain at First Tech Federal Credit Union ($8.7B, Mountain View, CA), not coincidentally located in the heart of Silicon Valley, has been singular in developing a comprehensive and elegant design for First Tech’s entire business intelligence process.

How do credit unions look after and make the most of their own data – the activities that form the core of business intelligence. What activities and players within the credit union industry help credit unions leverage their own data and analysis within the spirit of the cooperative movement?

What does this look like? At the core of effective business intelligence is a credit union’s data, and the institution must determine how to make it accurate, how to store it, and how to use it in iteration.

Credit unions like First Tech make use of sophisticated systems that bring together their data on everything from core banking and credit cards to branch performance and call centers. From there, they manage and warehouse data, making it available for deployment by different business teams, from marketing to accounting. The operational complexity of this requires state-of-the-art technology and people who are experts in everything from SQL, data analysis, and database administration to data visualization and automated marketing.

But What About Everyone Else?

A lot of these systems are slick, which got me thinking about what this sophisticated technology with all its demands on financial and human resources means to smaller credit unions? What value does Big Data, or any data, bring to them and their members?

Over the past decade, there has been a slow rise of BI across the entire industry, beginning with making better use of data shared with providers. Some of this has been frustratingly piecemeal for example, a credit union could look at a report on credit card use trends at the end of a month and draw analytical conclusions or compare two reports covering different pieces of a member’s use of their credit union resources. But how could an institution bring them together? How do credit unions use multiple data sets together to inform decision-making in a way that benefits members?

Want more business intelligence and Big Data? Check out, A Strategy To Build Business Intelligence Across A Credit Union and Analytics And Marketing In The Era Of Big Data.

At Charlotte Metro ($374.2M, Charlotte, NC), Paul Leavell has been forwarding the idea that the first step toward effective business intelligence is to understand that even little data can be incredibly impactful without sacrificing the requisite thoroughness and accuracy that is core to the concept of Big Data.

He and colleague David Cooper put together the Cooper-Leavell Matrix, which has allowed them to guide creative and tactical marketing through the segmentation of data into three size buckets. Positive ROI and member response came out of their approach, which acknowledges that not every credit union can readily capture and analyze Big Data. As such, they find ways to make use of data they can handle with the resources and requirements they have.

The Cooper-Leavell Matrix is a way to categorize data in terms

of its accessibility and utility.

Scalability is at the heart of Charlotte Metro’s matrix approach. In the process of making strides in its facility with small data and working to push its use of middle data, it made improvements to its data warehousing and reporting processes. It also was able to parse out information such as who made charges at a baby store and might be a good marketing target for an auto loan (a new minivan, perhaps?) or mortgage.

Where Do CUSOs Fit In?

We’ve seen among small- and mid-sized credit unions that dedication to incremental improvements to their data warehousing and analysis efforts deliver cumulative results. This is often achieved through partnerships with CUSOs.

What more potential is awaiting credit unions as data and analysis become a part of the knowledge sharing and cooperative business model?

Next week in Minneapolis, the Analytics and Financial Innovation (AXFI) Conference will bring CUSO and credit union leaders together to talk about how the movement must make analytics and innovation core to business strategy and must do so now.

The AXFI Conference is an example of vendors and credit unions focusing on analytics beyond simply focusing on the sales cycle. This type of partnership is true to the cooperative spirit and also essential to meeting the challenges posed by the rapid pace of analytical innovation across the financial services space.

CUSOs have been key strategic partners for credit unions in the rise of effective business intelligence. Many organizations are working at great speed to deliver the next-generation systems that credit unions need or will soon need to match the pace of innovation set by competitors. OnApproach, one of the primary sponsors of the conference, offers a range of solutions that fit with different credit union needs. It also partners with other data analytics CUSOs, including Denali Alaskan Federal Credit Union’s Deep Future Analytics as well as the Knowlton Group.

The collaborative model is the best – and perhaps only – way credit unions can compete in the critical realm of business intelligence and the Big Data is requires. Read more about this advantage in, Of CUSOs And Big Data

This kind of cooperative innovation enables credit unions of more varied sizes access to higher-level analytical tools than they would be able to develop in-house. Such services, of course, are aligned with the purpose of CUSOs, but I am struck by the teaming up of minds and systems in which these groups are enthusiastically engaging.

Although the pace and the look of business intelligence at credit unions varies considerably, the benefits are consistent and the need for continued focus on all things data is paramount. As the industry advances, the opportunities presented by nimble, data-driven pricing or predictive modeling are immense.

What more potential is awaiting credit unions as data and analysis become a part of the knowledge sharing and cooperative business model?

Although credit unions can talk about data incessantly, the real focus remains upon the member. Data and the analysis of it aids in the understanding of what members are doing and what they want from their credit unions. And it is data that enables credit unions to deliver that in ever more personalized ways.

You Might Also Enjoy

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Takeaways From Day 1 Of GAC

Credit Union Storytelling With A Mission Focus

How Lake Trust Turns Member Experiences Into Brand Strategy

Keep Reading

Related Posts

Markets React To Consequential Announcements

Financial Nihilism Is Real, But How Can Credit Unions Respond?

2026 Begins With Market Sentiment Similar To 2025

Takeaways From Day 1 Of GAC

Aaron PassmanCredit Union Storytelling With A Mission Focus

Marc RapportHow Lake Trust Turns Member Experiences Into Brand Strategy

Savana MorieView all posts in:

More on: