Low-Income Credit Unions Feel The Pinch As Fee Income Falls

- Credit unions have a mandate and a mission to serve consumers of modest means, but serving low-income members comes at a cost. Those members tend to make many small-dollar transactions that can be costly to credit unions, while also having smaller overall relationships with their credit union (in dollar terms). That lowers assets per member and reduces the amount of earning assets available to dilute per-member operating costs.

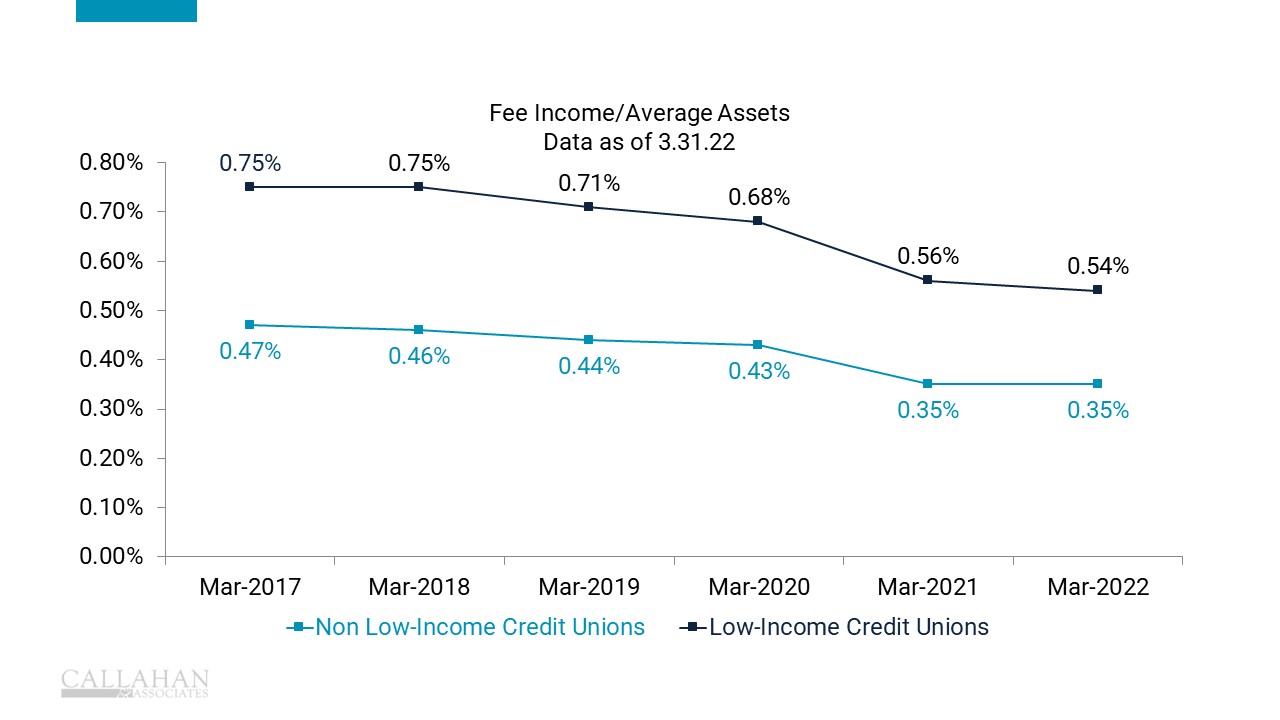

- The fee income per asset ratio is higher for credit unions with a low-income designation, giving the initial appearance that those institutions are overcharging their low-income members. However, these fees are what allow those credit unions to serve their members. In many cases, these fees are a cheaper or more palatable option than higher loan rates or restrictive services/underwriting practices. While no one loves fees, there are ways to structure fees constructively; and these charges help support a system of financial services that often does not exist at other institutions.

- Fee income per average asset at low-income credit unions has decreased more than at non-LICUs in recent years, as low-income institutions feel pressure to reduce fees (fees are also down overall at the national level). If these fee income streams continue to contract, low-income focused credit unions will need to look to creative earnings options in order to maintain operational revenue without sacrificing member service.