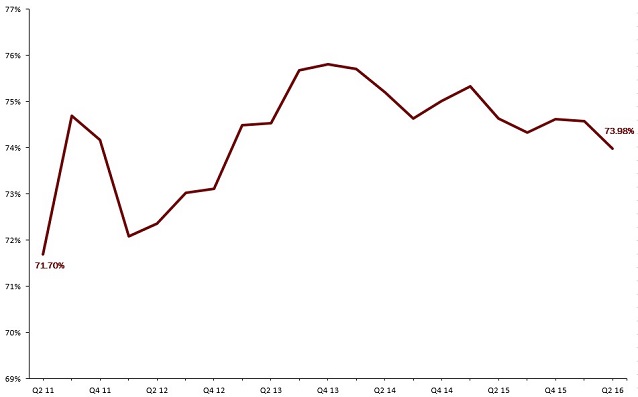

With 5,959 credit unions reporting second quarter data, the projected efficiency ratio for U.S. credit unions is 73.98%. This figure is 59 basis points lower than the 74.57% posted in first quarter. The declining efficiency ratio is good news for the industry because just like golf the lower the number, the better.

CREDIT UNION EFFICIENCY RATIO

For U.S. credit unions* | Data as of 06.30.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

*For 5,959 credit unions

The efficiency ratio divides a credit union’s operating expenses by interest income and non-interest income. A low efficiency ratio means operating expenses are a smaller percentage of income, and the credit union is operating efficiently. A high or rising efficiency ratio means the credit union is dedicating a larger share of its income to overhead expenses.

A credit union’s efficiency ratio can fluctuate over time, influenced in part by external factors such as the interest rate environment. Nevertheless, credit union executives strive to regulate the aspects of the efficiency ratio that are under their purview.

Just ask PGA pro Jim Furyk, bringing down a golf score isn’t easy. Similarly, credit unions struggle to simultaneously lower operating expenses and boost income in order to lower their efficiency ratios. Lowering an efficiency ratio takes a smart long game and a tight short game.

Long-term expenses, such as office space rental costs and loan servicing fees, can negatively impact the efficiency ratio. Short-term expenses, such as travel and conference expenses and miscellaneous operating expenses, can also throw off an efficiency ratio. Positive long-term drivers that lower the efficiency ratio include interest from loans and smart long-term non-interest income strategies.

Although it’s never good to bogey, there can be good reasons why a credit union’s efficiency ratio is temporarily high. For example, the efficiency ratio of a credit union that hires more employees with the hopes of becoming more efficient might go over par before it starts to see boosts in income.

Overall, the industry trending down for the efficiency ratio is a positive sign that means credit unions are managing funds appropriately. So, this summer hit the links (both the hyperlinks and the golf course) to learn strategies for keeping both an efficiency ratio and a golf score low.

BE SMART. ATTEND TRENDWATCH.

This must-attend quarterly event for credit union leaders covers performance trends, industry success stories, and areas of opportunity. Attendees will find insight they won’;t find anywhere else weeks before the official NCUA data release.