Growth in members, market share, and revenue highlight credit union performance in the first three months of 2018.

This week, Callahan hosted its Trendwatch webinar, a quarterly event that recaps the industry’s performance trends while highlighting credit union success stories and other areas of opportunity.

Here are three Trendwatch takeaways for the first quarter of 2018:

ContentMiddleAd

No. 1: Membership Growth Continues To Accelerate

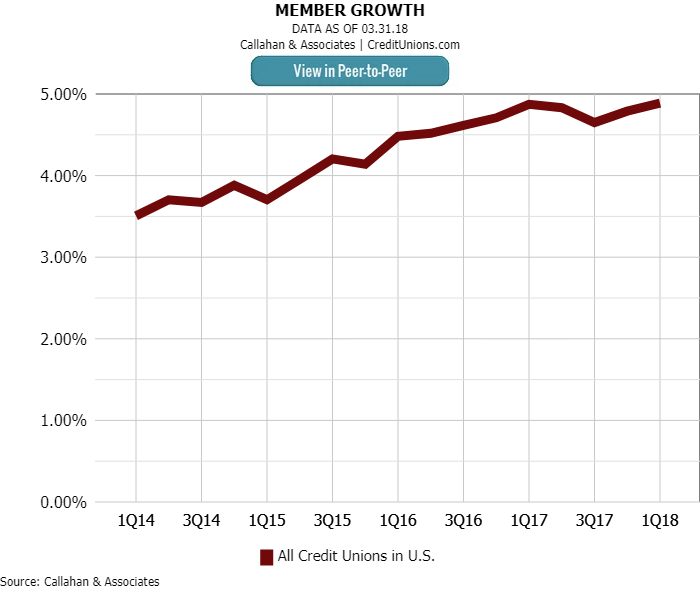

Member growth at first quarter hit 4.4%, bringing the industry’s total membership up to more than 114 million Americans. This growth represents the seventh consecutive quarter the industry posted a member growth rate of 4% or greater. This is a first for the movement.

At first quarter, credit unions added 1.5 million net new members, the highest total on record. This comes as the pace of indirect lending drops starting in fourth quarter 2017, the number of indirect loans added to credit union balance sheets decreased. This was after two years of rapid indirect loan growth.

First quarter 2018 represents the seventh consecutive quarter of 4% or higher member growth.

Catch Up On 1Q 2018 Trendwatch

This must-attend quarterly event for credit union leaders covers performance trends, industry success stories, and areas of opportunity. Attendees will find insight they won’t find anywhere else weeks before the official NCUA data release.

No. 2: Market Share Growth Across Several Product Types

Though the industry originated approximately $500 million less in first mortgages year-over-year, credit unions took a bigger piece of this smaller pie. The industry’s 8.9% first mortgage market share represents a 0.3 percentage point increase from first quarter 2017.

And the market share gains don’t stop there. At first quarter, a record 20.2% of consumers used a credit union to buy a car, up approximately 1.5 percentage points from first quarter 2017. Similarly, the industry posted its highest consumer loan market share since before the Great Recession, at 13.2%.

Product usage has also grown significantly. Compared to first quarter 2013, credit card penetration has jumped 2 percentage points, share drafts by 4.8 percentage points, and auto loans by 4.6 percentage points.

Taken in context with the industry’s record member growth and gains in market share, product usage rate growth suggests that not only have credit unions widened their net to capture new members, they’re deepening relationships, too. In fact, the industry’s average member relationship at first quarter 2018, $18,569, has grown $5,000 in just five years.

Gains in product usage rates suggest that not only have credit unions captured new members, they’re deepening relationships, too.

No. 3: Revenue Growth Hits 14.3% In First Quarter

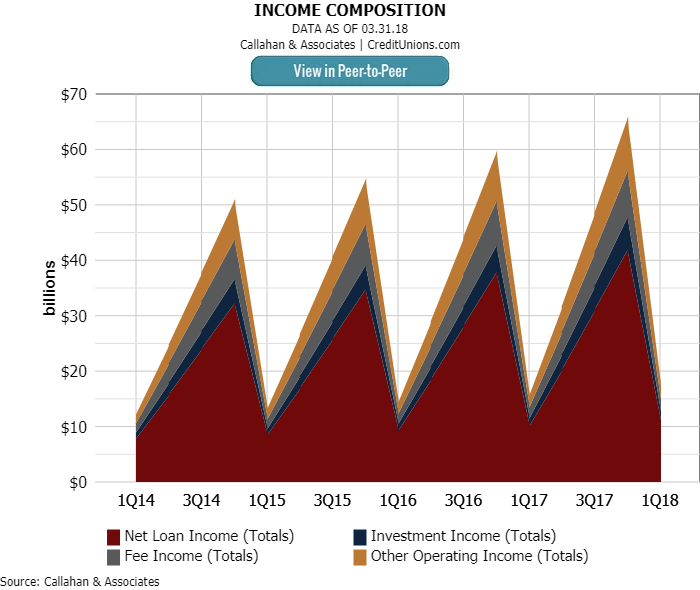

At first quarter, total revenue at credit unions totals approximately $17.7 billion, which represents a 14.3% increase year-over-year. Revenue comprises interest income, fee income, and other operating income.

By dollar amount, interest income grew the most year-over-year, by approximately $1.5 billion or 13%. By percent growth, however, other operating income (which includes interchange income and sales to the secondary market) experienced the largest year-over-year jump, 27%, to reach $2.8 billion.

Growth in interchange income likely relates to the uptick in credit card and share draft usage, and again points to the industry’s successful efforts to establish preferred financial institution status and deepen relationships. After accounting for expenses, gains in interest and non-interest income led the industry to post its highest ROA since third quarter 2005, at 0.89%, an 18-basis point increase from first quarter 2017.

By dollar amount, interest income grew the most year-over-year; by percent growth, however, other operating income (which includes interchange income and sales to the secondary market) experienced the largest year-over-year jump.