On Aug. 11, 2021, Callahan hosted its quarterly Trendwatch webinar, outlining significant industrywide trends through the second quarter of 2021. As some state and local economies have sustained their reopen status for months, credit unions nationwide have begun to reverse some of the effects experienced during the pandemic and subsequent lockdowns. The Trendwatch call outlined how credit unions are financially positioned after the first six months of the year, as leaders at these cooperatives draw insights from credit union leaders and advocates to help navigate performance challenges and opportunities.

Here are three takeaways from Wednesday’s webinar:

1. Liquidity decreases for the first time since the onset of COVID-19.

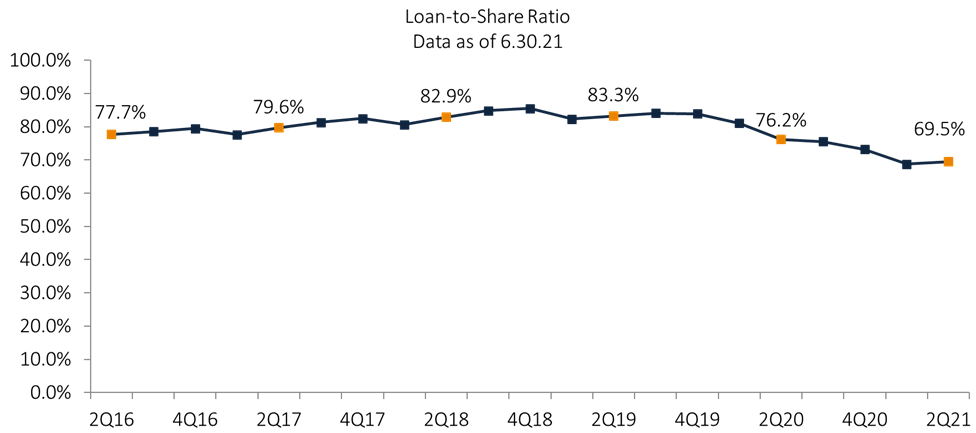

The loan-to-share ratio at credit unions increased quarter-over-quarter for the first time since 2019. At 69.5%, the ratio expanded 77 basis points over the past three months but is down 6.7 percentage points annually. Through the COVID-19 pandemic, the industry consistently reported deposits growing at a faster pace than loans as cash flowed into accounts through federal relief checks, increased unemployment benefits, and decreased spending amid lockdowns. Additionally, members opted to save and were reluctant to take on debt. Over the past quarter, however, loan balances grew 2.5% while deposits increased 1.4%, signaling a potential return of consumer confidence. Still, on an annual basis, deposit balances grew 15.2%, far outpacing the 5.1% growth in loan balances.

Loan-To-Share Ratio

For All U.S. Credit Unions | Data As Of 06.30.21

The loan-to-share ratio increased over the past three months for the first time since 2019 as members began to take on more debt in lieu of security through savings.

Source: Callahan & Associates.

2. Credit union lending regains strength across various segments over the past quarter.

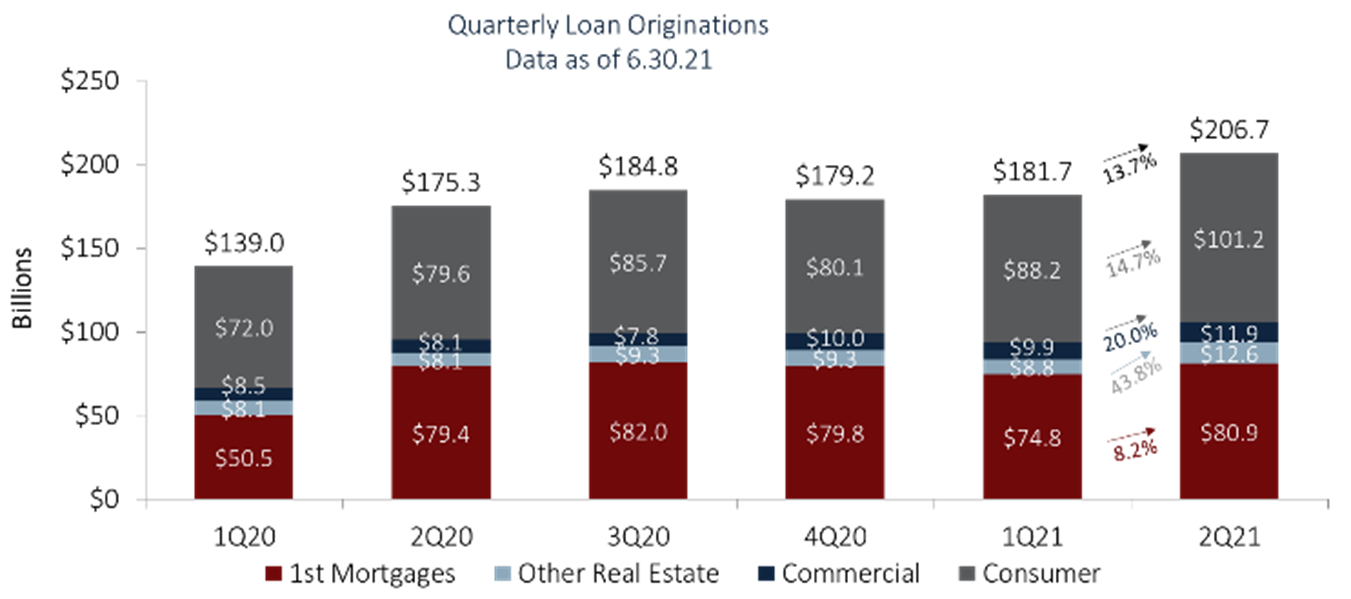

Credit unions nationwide reported strong loan production in the second quarter. At $206.7 billion, second quarter originations outpaced the first quarter by 13.7%. Year-to-date loan originations increased 23.6% year over year as of the second quarter. First mortgages, which fueled loan growth through much of the year, expanded 19.9% annually to $155.8 billion through June 2021. Consumer loan originations grew 24.8% annually, to $189.5 billion. Between the first and second quarter, consumer originations expanded 14.7% as economies reopened and members grew more comfortable taking on debt to fund consumer purchases.

On the balance sheet, first mortgage loans continue to expand at the fastest annual pace of all loan products, up 8.5% over the past 12 months and 2.9% over the past quarter. Used auto loans, in comparison, grew 6.6% annually and 3.1% over the quarter. Additionally, credit card balances, which are down 1.7% year-over-year, grew 2.1% over the quarter, a turnaround from first quarter trends. Total loan balances at credit unions nationwide increased 5.1% year-over-year to $1.2 trillion, the highest balance on record.

Quarterly Loan Originations

For All U.S. Credit Unions | Data As Of 06.30.21

Loan production at credit unions nationwide increased 13.7% between the first and second quarters of 2021.

Source: Callahan & Associates.

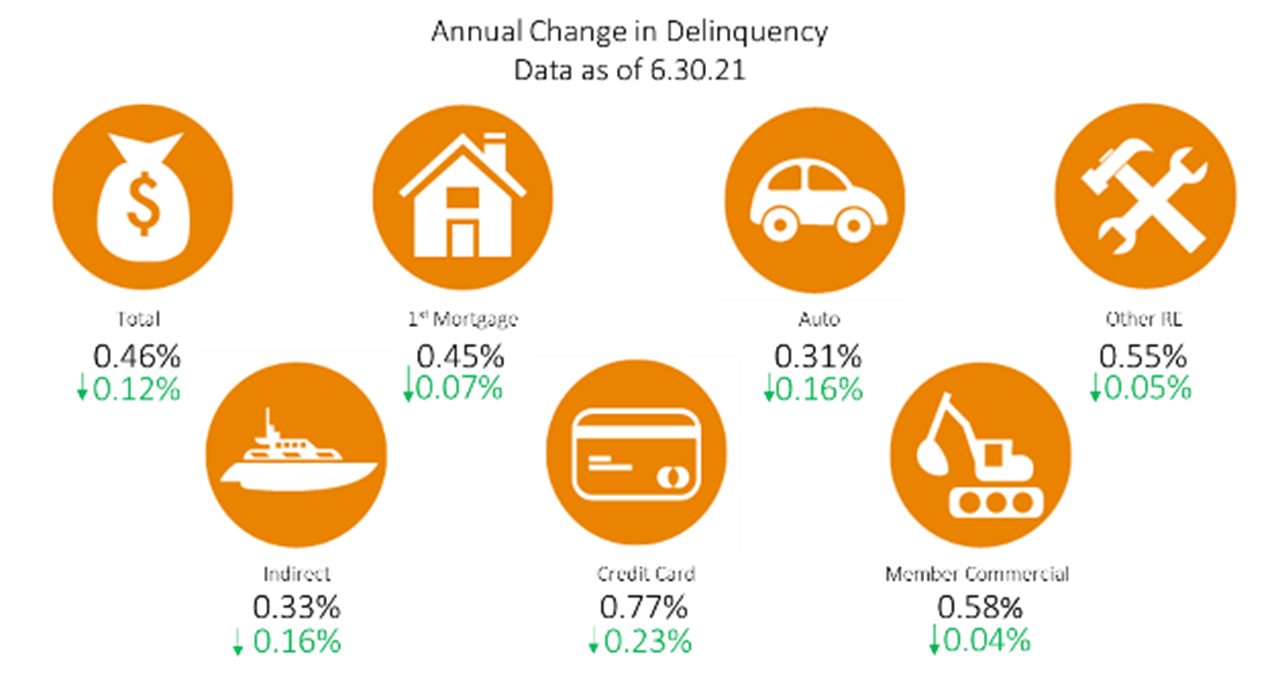

3. Asset quality remains strong through the pandemic.

Asset quality at credit unions nationwide have stayed strong throughout the pandemic. Total loan delinquency was 0.46% as of the second quarter, the lowest delinquency rate on record. New auto delinquency decreased 10 basis points annually, to 0.23%, the lowest of any product. Credit card delinquency was down 23 basis points over the past 12 months, the largest decrease of any loan segment.

At the onset of the pandemic, credit unions added to their provision for loan losses accounts to protect against potential spikes in default rates. This trend failed to materialize and credit unions around the country began to slow allocation into provisions. For the first time ever, credit unions drew down provision allocations in a second quarter, as 53.4% of all credit unions nationwide reported zero or negative provision allocations over the past three months, and the industry pulled out $51.0 million in total. This had a significant impact on the bottom line. The return on assets at credit unions nationwide was 1.11% as of the second quarter, up 54 basis points year-over-year, 51 basis points of which is associated with cuts in provision expense.

Annual Change In Delinquency

For All U.S. Credit Unions | Data As Of 06.30.21

Total delinquency decreased 12 basis points year-over-year to 0.46%, the lowest rate on record.

Source: Callahan & Associates.

Customize A Data Scorecard With 2Q21 Data

2Q21 industry data is here and we want to send you a custom scorecard. Pick 10 ratios most important to your credit union and we’ll compare you to relative credit union and banking peers.

Learn More