American consumers have been letting their fingers do the walking for a while now when it comes to banking online, and mobile banking makes those fingers more sticky.

According to a comScore report, 81% of Americans older than 13 have a smartphone. But thousands of American credit unions still don’t let their members bank on them. That’s a disconnect.

Economics show why mobile is a mandate for credit unions. Bain & Company reports that for every 100 mobile interactions there’s an average decline of 16 branch transactions. That same report finds that frequent mobile users are 40% less likely to switch banks.

Data in Peer-to-Peer software by Callahan & Associates underscores the message: Credit unions that have mobile banking are much more likely to be successful than those that don’t. And yet, many credit unions still don’t offer it.

As of mid-year 2017, only 2,797 or 52.9% of the 5,286 U.S. credit unions with less than $500 million in assets offered mobile banking. Nearly all of the larger credit unions do, and whereas they represent the bulk of the industry’s total membership, their smaller brethren under the half-billion line account for nearly 91% of the movement. ContentMiddleAd

Dialing For Data

The argument can be made that those 47.1% of credit unions under $500 million are surviving without mobile. But the data dictates that their future might not be as bright as those that do.

Just look at that most basic of measures: member growth. The 2,797 credit unions with less than $500 million that do offer mobile has shown positive member growth for the past four years. The 2,489 that don’t have lost members in the aggregate. At second quarter 2017, those figures were 1.66% year-over-year for those that do and -1.06% for those that don’t.

The mobile bankers had a slightly better efficiency ratio a measure of how much of a dollar it takes to make a dollar at 82.04% mid-year for the mobile bankers and 85.67% for the non-mobile group. They also had markedly lower delinquent loans, 1.30% to 0.86% at mid-year. Their aggregate ROA also reflects those differences: 0.48% in second quarter 2017 for the mobile bankers, 0.30% for the non-mobile group.

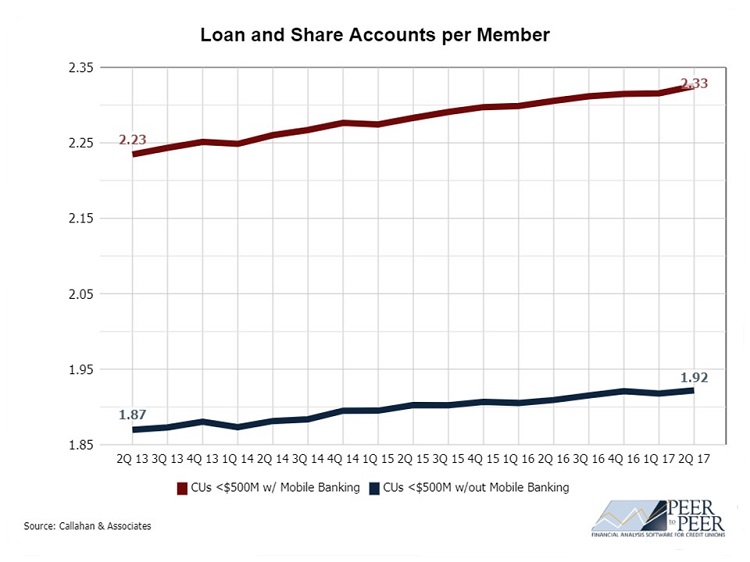

Also notable is the difference in a couple key measures of engagement. Mobile banking credit unions with less than $500 million in assets as of June 30, 2017, recorded 2.33 loan and share accounts per member, approximately 20% higher than the 1.92 for their non-mobile banking peers. Even more striking, the average member relationship for mobile banking credit unions in that asset-based peer group is nearly 35% higher than their counterparts at mid-year: $14,491 compared with $10,761.

As the charts below show, the difference between non-mobile and mobile banking credit unions in that asset class has held constant for the past four years, as mobile delivery of everything from banking to biscuits has become entrenched in daily commerce.

Every credit union has its own story to tell, and these numbers can be interpreted in various ways. However, the data doesn’t lie.

Click the tabs below to see a graphical analysis that compares credit unions with and without mobile banking.

12-MONTH MEMBERSHIP GROWTH

Sub-$500 million credit unions that offer mobile banking have been gaining members while those that don’t have been losing for the past four years.

Source: Callahan & Associates.

AVERAGE MEMBER RELATIONSHIP

Mobile banking credit unions hold a continuing substantial edge over their non-mobile counterparts in average member relationship.

Source: Callahan & Associates.

EFFICIENCY RATIO

As a group, credit unions under a half-billion dollars in assets tend to be more efficient if they offer mobile banking.

Source: Callahan & Associates.

LOAN AND SHARE ACCOUNTS PER MEMBER

In this measure of engagement, non-mobile banking credit unions average 1.92 loan and share accounts per member compared with 2.33 for those that do offer mobile banking, although both have grown slightly in the past four years.

Source: Callahan & Associates.

TOTAL DELINQUENCY

The 2,797 credit unions of less than $500 million in assets that offer mobile banking had a significantly lower delinquency ratio than their 3,018 counterparts in that asset class.

Source: Callahan & Associates.

RETURN ON ASSETS

Non-mobile banking credit unions in the sub-$500 million peer group have been reporting significantly lower ROA than the mobile banking group.

Source: Callahan & Associates.

Can You Hear Me Now?

Mobile banking is just one item on the menu, but clearly its presence is one key indicator that a credit union is successfully meeting member needs and expectations. Successful integration also is important, not just on the back end but more importantly to the member experience.

Credit unions that thrive are accomplishing that integration by driving digital adoption, which increasingly means mobile. They do that by having attractive, functional offerings that evolve with the technology, and by prompting members to do more of their routine transactions on the digital channels, including mobile.

The signal is clear: Credit unions that offer mobile tend to do better than those who don’t, on average.

A double bottom line here: As members adopt digital, agents can devote more time to supporting complex interactions and advising on higher-value products. That means deeper engagement and a stickier relationship. That’s easy to put your finger on.

This article appeared originally in the Credit Union Times in October 2017.

Ian Melhorn is an industry analyst at Callahan & Associates in Washington, DC. He can be reached at 202-223-3920 or imelhorn@callahan.com.