The cost of education is on the rise. So, too, is the debt borrowers acquire to fund that education.

According to Forbes, the average cost of a four-year institution when adjusted for inflation has increased 2.6% every year since 1989. For the 2017-2018 school year, the average cost for a four-year college, not including in-state fees, was more than $28,000 per year, according to College Board.

Still, the price tag can prove to be worth it. According to the Bureau of Labor Statistics, the medial weekly salary of a college-educated employee is $1,137 67.7% higher than for employees with a high school degree only. This gap in salary, according to a 2015 study by Georgetown University, can amount to more than $1 million over the course of a lifetime.

In the first quarter of 2019, 713 of the nation’s 5,451 credit unions reported student loan balances on their books. This is down just two institutions year-over-year despite there being 194 fewer active credit unions in the country. As such, 13.1% of credit unions nationwide held student loans on their balance sheets compared to 12.7% 12 months ago.

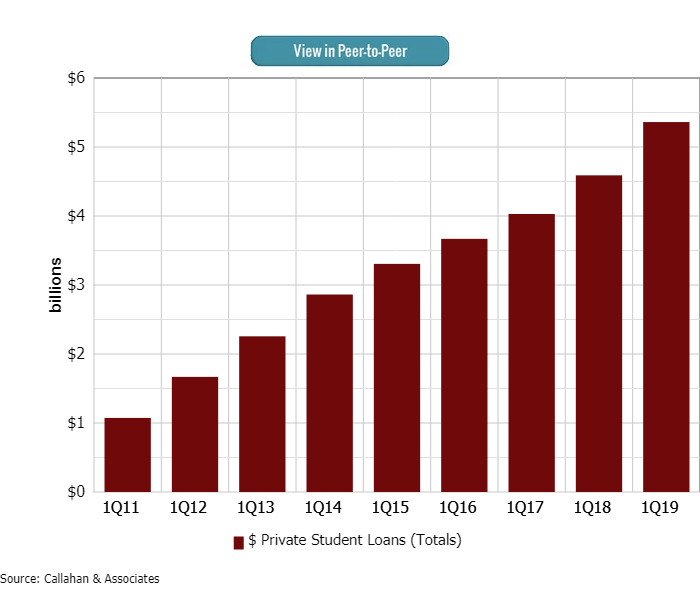

According to the St. Louis Federal Reserve, student loan borrowers in the United States owed $1.6 trillion in cumulative federal and private student loans as of March 31, 2019. That’s a 4.9% year-over-year increase. Broken out, private student loans made up 7.7%, or $123.1 billion, of all outstanding student loan balances. Of that, credit unions have financed $5.4 billion. By the end of the first quarter, the credit union industry accounted for 4.4% of all private student loans and 0.3% of total student loans outstanding.

Student loan balances at credit unions nationwide increased 16.8%, or $772.2 million, year-over-year. Cooperatives have now reported double-digit annual student loan growth for eight consecutive quarters. Since 2011, when credit unions began reporting student lending activity on the 5300 Call Report, total balances in the loan product have nearly quadrupled.

STUDENT LOAN BALANCES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

Student loan balances at U.S. credit unions have increased fourfold since cooperatives began reporting the product in 2011.

Since 2011, the proportion of the loan portfolio held by student loans also has steadily increased. In the first quarter of 2019, student loans made up 0.5% of the overall lending portfolio at credit unions nationwide. That’s up 4 basis points year-over-year.

Although student loans comprise a small portion of the overall portfolio, they are the largest non-housing debt incurred by the average U.S. consumer, according to the Federal Reserve Bank of New York. An increasing percentage of credit union members, particularly younger generations, are affected by student loans, and the product will continue to have an impact on their financial well-being for the foreseeable future.

Private student loans, particularly those financed through a credit union, have historically been subject to intensive underwriting practices. At 1.25%, adjusting for deferment, private student loan delinquency at cooperatives is below the national average of 1.57%, despite reporting delinquency after 60 days of nonpayment versus 90 days for bank lenders.

On a macroeconomic scale, the percentage of overall student loan balances that are more than 90 days delinquent was 11.4% in the fourth quarter of 2018, according to The New York Federal Reserve. However, this statistic includes poorly underwritten and serviced loans, which severely impacts overall delinquency. According the Brookings Institution, the so-called student loan crisis in the U.S. is largely concentrated among non-traditional borrowers attending for-profit schools and other non-selective institutions, who have relatively weak educational outcomes and difficulty finding jobs after starting to repay their loans.

Effective loan underwriting practices employed at credit unions include but are not limited to:

- Using risk-based pricing.

- Encouraging well-qualified co-borrowers with a strong history of debt repayment.

- Verifying school enrollment.

- Disbursing funds directly to the schools.

- Limiting school eligibility to those with historically strong graduation rates and student loan repayment rates such as traditional four-year not-for-profit schools.

- Employing focused, direct lending outreach to families and students who are within the credit union’s core membership versus relying on indirect channels of loan promotion and acquisition.

Additionally, many credit unions partner with a vendor to help them take advantage of best practice underwriting and servicing strategies that lead to long-term student lending success.

STUDENT LOAN DELINQUENCY (NET LOANS IN DEFERMENT)

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

Student loan delinquency at U.S. credit unions has generally trended down over the past five years as cooperatives fine-tune their underwriting policies.

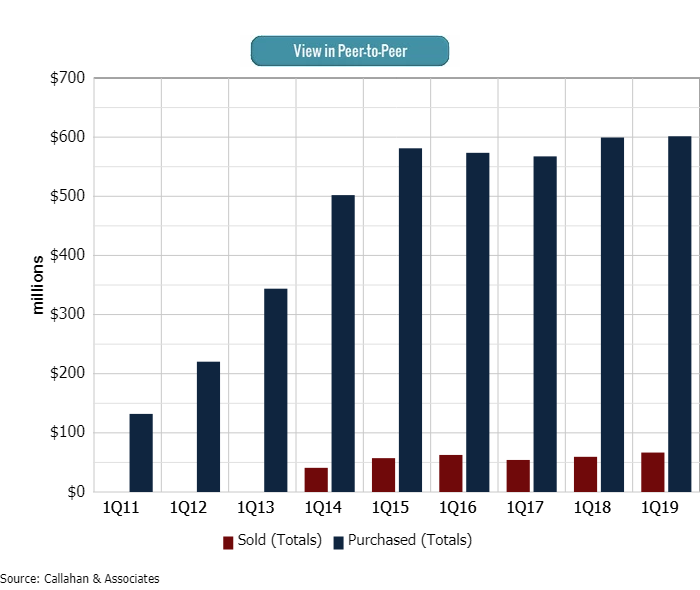

In the first quarter of 2019, credit unions reported purchasing $601.5 million in student loan participations. By comparison, they sold $66.7 million in student loans. In total, 223 credit unions reported a purchased student loan on their portfolio. Student loan participation purchases at credit unions totaled $449.1 million from 2011 to 2015 and $20.3 million from 2015 and 2019. Although student loan participations have slowed for the broader industry, 65 credit unions reported a higher purchase balance this past quarter than they did 12 months ago.

STUDENT LOAN PARTICIPATIONS OUTSTANDING

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.19

Callahan & Associates | CreditUnions.com

Credit unions reported more than $600 million in purchased student loans as of March 31, 2019.

For credit unions that make student loans, effectively servicing those loans is integral in ensuring the financial well-being of members. Cooperatives nationwide have financed loans that were originated both from within and outside the institution. Of past, credit unions have outperformed the market in underwriting and overall service, which has helped ease the repayment burden for members.

Callahan & Associates, the owner of CreditUnions.com, also is a part-owner of Credit Union Student Choice, a CUSO that provides private student lending solutions to member-owned financial cooperatives.

-G5J5.png)