Read the full analysis or skip to the section you want to read by clicking on the links below.

- DEPOSITS

- MEMBERS

- MORTGAGES

- CREDIT CARDS

- LENDING

- BUSINESS LENDING

- AUTO LENDING

- EARNINGS

As of year-end, 3,477 credit unions in the United States, representing 61.1% of the industry, had active credit card portfolios. That’s a notable increase from year-end 2013, when 56.3% of credit unions offered credit cards.

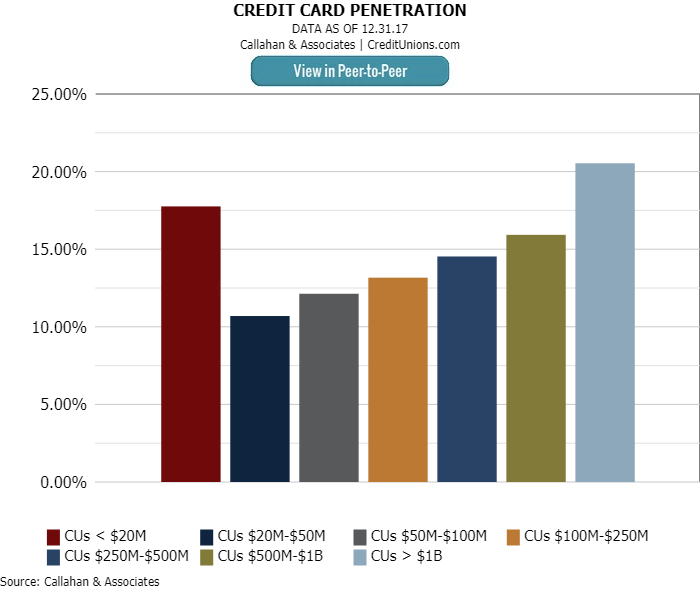

Credit card penetration has likewise increased over the past five years. The percentage of members taking out a credit union credit card has jumped from 15.3% five years ago to 17.5% as of fourth quarter 2017.

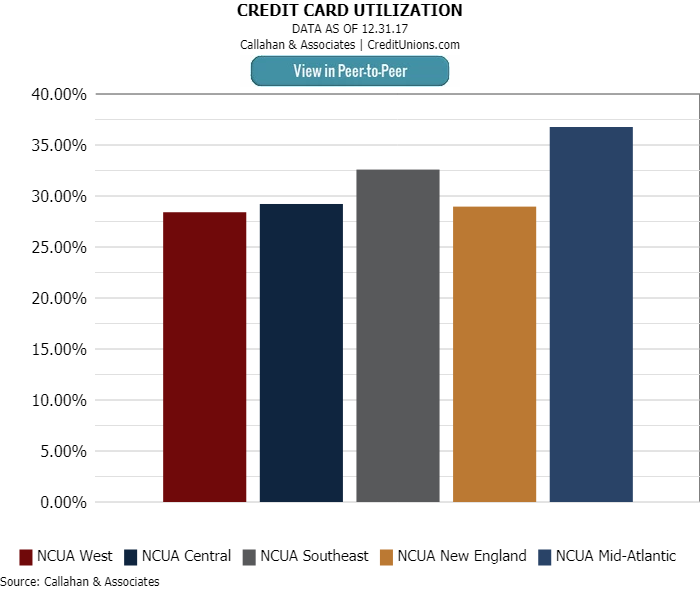

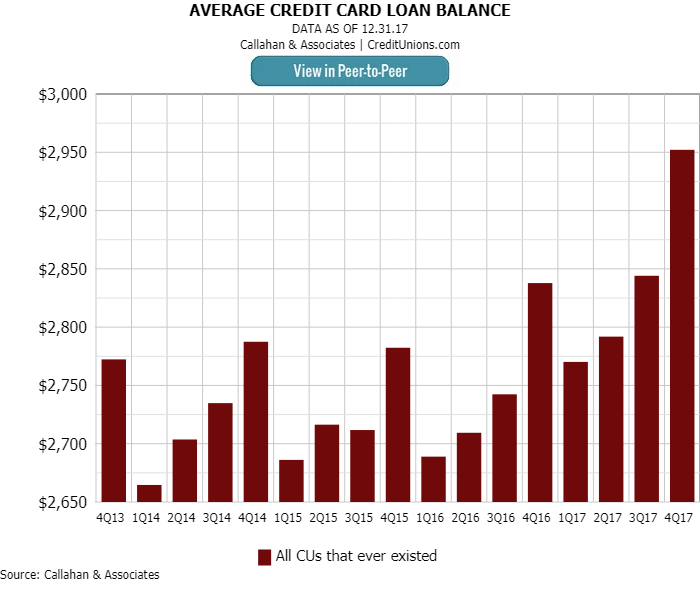

Both usage and balances increased in the fourth quarter. At year-end, the credit card utilization rate at credit unions was 32.1%, compared with 31.4% one quarter before. The average credit card balance was $2,952, compared with $2,844 three months earlier. Year-over-year, credit card balances increased 9.1% and surpassed $58.0 billion as of Dec. 31.

ContentMiddleAd

With increased activity, unfortunately, has come rising delinquency and net charge-offs. Credit card delinquency was 1.29% in the fourth quarter, up 15 basis points year-over-year. Credit card net charge-offs were 2.59%, up 35 basis points since last year. Although credit cards comprised only 6.0% of the industry’s total loan portfolio, credit unions should remain vigilant about asset quality in this product line.

Credit card penetration tended to increase with asset size. One notable exception: Credit unions with less than $20 million in assets. These institutions reported the second-highest penetration rate, at 17.8%.

The industry’s utilization rate was 32.1% at year-end. Strong usage in the Mid-Atlantic and Southeast regions boosted the industry’s average.

How do your 4Q17 numbers compare to your peers? Find out today.

Credit card delinquency reached 2.59% as of year-end 2017.

The average credit card balance rose 3.7% quarter-over-quarter.