With more than 85% of the industry reporting in Callahan Associates FirstLook Program, early data trends point towards another quarter of double-digit loan growth. Fourth quarter 2015 will mark theseventh consecutive quarter with loan growth topping 10%.

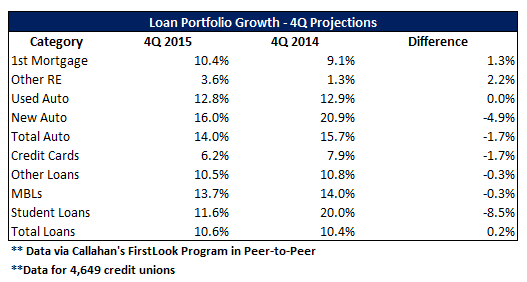

Year-over-year loan growth for is projected to have increased 10.6% at the end of the calendar year 2015. While total loan growth is up 23 basis points from the same time last year, some categories are starting to slow. Year-over-year growth of total auto loans, credit cards, and student loans decreased 1.7, 1.7, and 8.5 percentage points, respectively, from December 2014 to December 2015.

The major lending categories, first mortgage and auto, both topped 10% year-over-year growth at 10.4% and 14.0%, respectively. Once again, new auto led all categories with 16.0% year-over-year growth.

Other key areas of focus asset, share, and member growth were also strong at the end of the year, at 7.5%, 7.0%, and 3.7%, respectively, all growing faster than as of year-end 2014.

Callahan Associates will continue to add to our FirstLook data cycle through the office data release from the NCUA. For more data trends, register to attend our Trendwatch webinar on Wednesday, Feb. 17 at 2:00 p.m. ETor Thursday,Feb. 18, at 11:30 a.m. ET.