Speakers and attendees gathered this week at the Gaylord Texan Hotel outside Dallas for CU Direct’s annual lending conference, Drive ’18.

During a loan participation session, panelists discussed research findings and opportunities as well as a new tool in the participation space.

George Hoffheimer from Filene Research Institute and Brian Hamilton from CU Direct presented findings from a yearlong co-sponsored project that harnesses insights from 15 credit unions, 2 brokers, and 1 online provider. According to these two, credit unions participate loans for three primary reasons: to increase or decrease loan volume, to manage the balance sheet, or to earn alternative investment income. Research participants said the typical loan participation process was manual, onerous, and lengthy (requiring eight to 12 weeks). They also reported frustrations around inconsistent data and challenges in building trust and fostering relationships with the other party.

ContentMiddleAd

Hoffheimer and Hamilton offered six ways to ease the pains of loan participations:

- Create a marketplace that is more focused on credit unions.

- Offer simple, easy due diligence with which credit unions of any size can comply.

- Standardize all steps from identifying partners and conducting due diligence to analyzing data and distributing analysis.

- Introduce clearer pricing and profitability formulas.

- Ease the burden of performance reporting.

- Provide guidance on regulatory requirements, including for reporting and processes.

Joseph Heck from CUNA Mutual Group introduced a new loan participation network platform that includes an online marketplace, due diligence, standardized agreements, automated pool analysis, and streamlined reporting. CUNA Mutual has completed an initial beta session with 12 credit unions 6 buyers and 6 sellers and is currently in the second beta. In total, it has 30-35 credit unions on the platform. According to Heck, the biggest win in the first beta session came from standardizing non-disclosure agreements, which can be a significant pain point for credit unions.

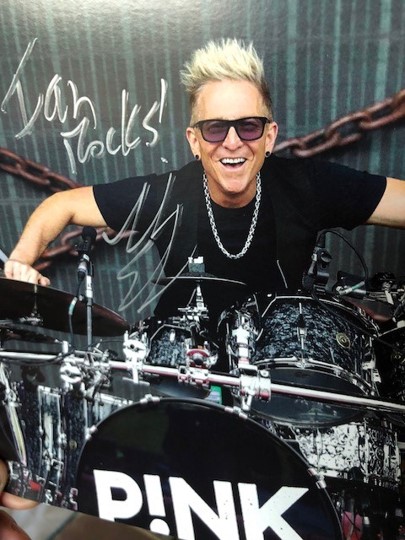

Drummer Mark Schulman has performed with the likes of Cher and Pink. In his Drive ’18 keynote, he addressed the importance of attitude.

During the keynote session Hacking the Rockstar Attitude, guest speaker Mark Schulman drew on his experiences as a drummer for singers like Pink and Cher to offer three core principles that support superior performance: attitude, behavior, and consequence.

According to Schulman, attitude drives behavior and behavior drives consequences. So, the rock star advised attendees to own their attitudes and provided an easy mental trick to becoming more grateful ditch a have to attitude for a get to one. For example, I get to go to work instead of I have to. That simple shift in verbiage encourages gratitude in attitude. This tip and more established a blueprint for how to incorporate rock and roll philosophy, techniques, and swagger into business for better performance and an energized environment.

Stay tuned to CreditUnions.com for more coverage of Drive ’18.

Read more coverage: Hacking The Rock Star Attitude For Credit Union Land; Disruption And Table Jumping At Drive ’18; How To Ace A Disruptive Future.