A 2019 study by Market Force Information found one-third of respondents consider their primary financial institution to be either a credit union or community bank. Overall, confidence in the economy remains strong, and consumers feel comfortable enough to take on additional loans. American consumer credit balances excluding mortgages reached $4.1 trillion in September, a 4.8% increase over last year. Consumer loans are predominantly driven by relationships, and traditional financial institutions are accommodating the increased demand.

Key Points

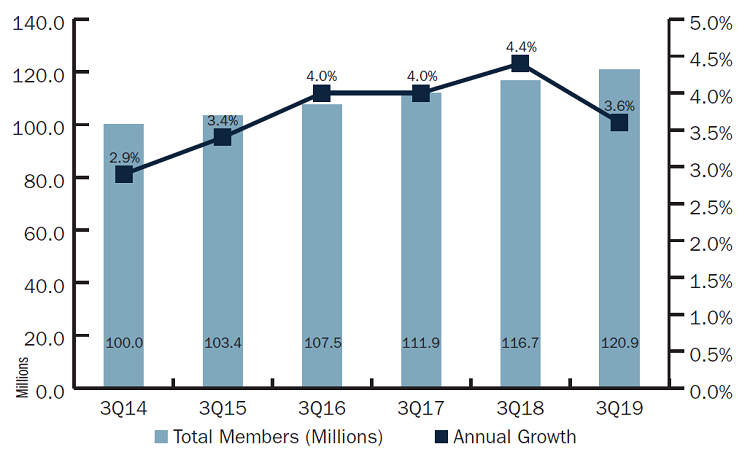

- With 120.9 million members nationwide, credit unions have never had a more widespread impact. The third quarter’s member growth of 3.6% is slower than recent periods but still higher than the general population growth of 1%.

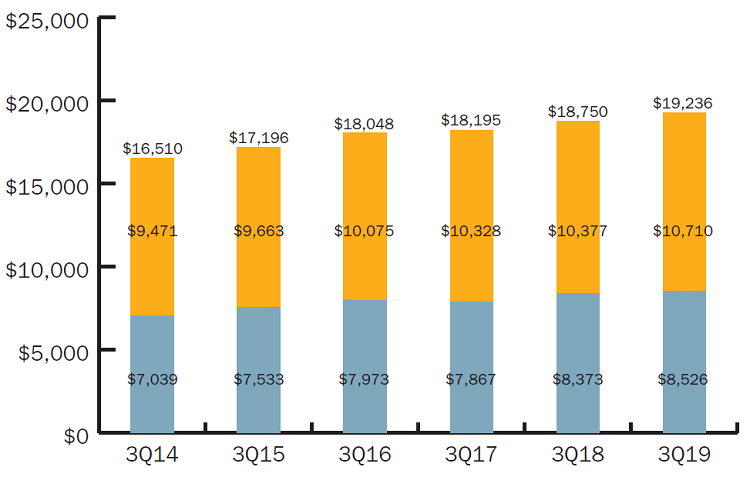

- The average member relationship increased 2.6% year-over-year.

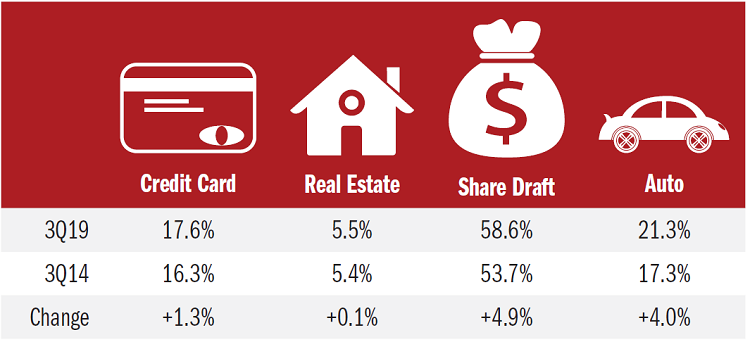

- Credit unions have increased their reach across many major products. Notably, share draft penetration a fundamental metric for overall member engagement has grown by 4.9 percentage points since 2014.

- Revolving consumer loan balances grew 7.0% to $64.4 billion as of Sept. 30, 2019. Credit union market share in this category has also expanded, from 5.3% in 2014 to 6.2% in 2019.

Click the tabs below to view graphs.

MEMBER GROWTH

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Total membership in the third quarter was up 4.2 million year-over-year. Member growth exceeded population growth but has slowed from recent years.

AVERAGE MEMBER RELATIONSHIP

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

As of September 2019, the average member relationship surpassed $19,200, driven by a 3.2% increase in average share balances.

PENETRATION RATES

PENETRATION RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Credit unions have engaged their members with strong product offerings, and penetration is consequently at all-time highs in most major categories.

The Bottom Line

Third quarter performance indicates the feverish member growth of the past few years is set to slow down, but credit unions are still in a healthy position to realize future gains. Membership continues to rise, as does average member relationship. Share draft penetration reached an all-time high of 58.6% and helped drive an increase in lendable assets. Lending penetration rates flourished as a result. Auto loan penetration also hit an all-time high of 21.3%, and the 17.6% penetration rate for credit cards was the highest since March 2002. However, slowing growth in indirect lending and increased credit card delinquency shows cooperatives still have plenty of opportunity to help members. Introducing alternative products and services are two such strategies.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.