Read the full analysis or skip to the section you want to read by clicking on the links below.

- DEPOSITS

- MEMBERS

- MORTGAGES

- CREDIT CARDS

- LENDING

- BUSINESS LENDING

- AUTO LENDING

- EARNINGS

Credit union loan originations in 2017 reached an all-time high of $485.5 billion. This despite annual loan origination growth slowing from 12.3% in 2016 to 5.2% as of fourth quarter 2017.

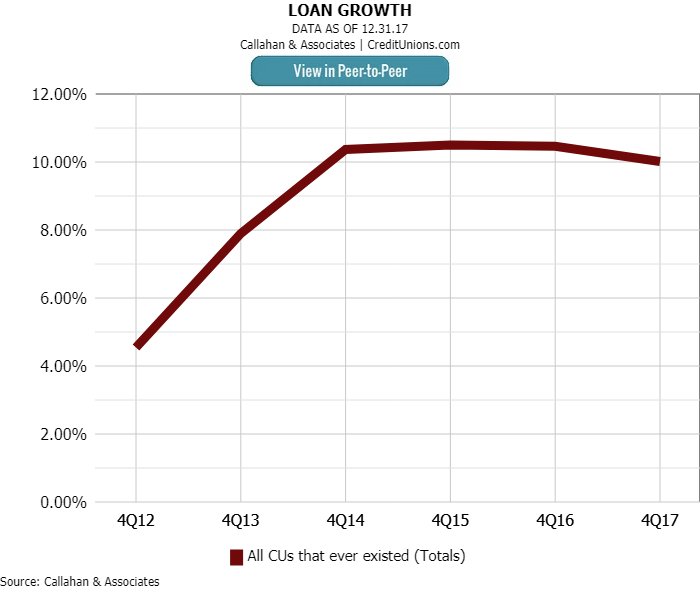

Annual outstanding loan growth slowed slightly from 10.5% to 10.0% year-over-year.

First mortgage, other real estate, and credit card loan balances accelerated faster in 2017 than in 2016. New and used auto loan balances expanded at the fastest rate in the loan portfolio 13.2% and 10.2%, respectively although that double-digit growth did not reach the highs achieved in 2016.

ContentMiddleAd

First mortgages comprised the largest share, 40.8%, of the credit union loan portfolio. Whereas this is unchanged from last year, auto loans and student loans increased their share of the lending pie.

First mortgage loans remained the largest share of the credit union loan portfolio at year-end 2017.

Total loan delinquency for the industry fell 2 basis points to 0.81% at year-end 2017. When broken up regionally, credit unions in the Western Region reported the lowest total loan delinquency. The region’s 0.50% delinquency was 31 basis points lower than the industry average and 61 basis points lower than the New England region, which reported the highest delinquency.

Although the New England region reported the highest delinquency, it also posted the largest decrease 11 basis points year-over-year.

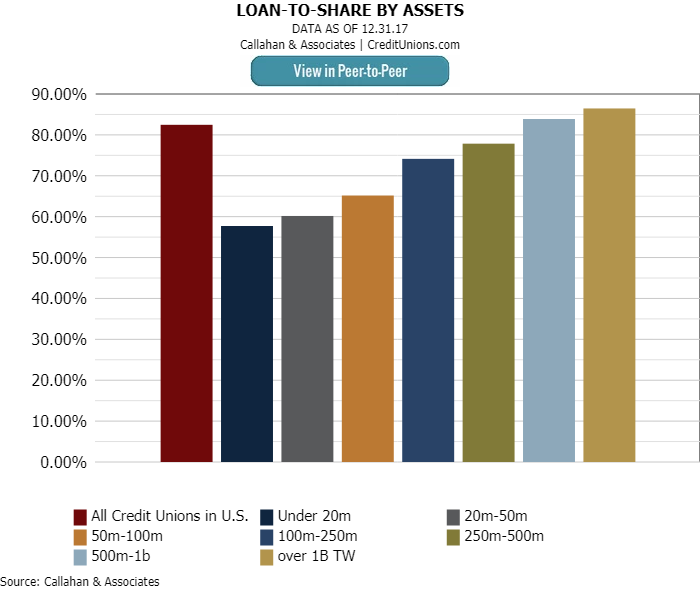

The industry’s loan-to-share ratio hit a near-record high of 82.5% at year-end. This ratio peaked at 83.7% in the third quarter of 2008 and dropped substantially during the Great Recession dipping all the way to 65.9% in the third quarter of 2013 before gradually rebounding.

While there is variability within each asset band, there is a strong correlation between credit union asset size and average loan-to-share ratio.

As a credit union grows in assets, it’s loan-to-share ratio likewise grows. The spread between credit unions with less than $20 million in assets (57.7%) and credit unions with more than $1 billion in assets (86.5%) was 28.7 percentage points.

Fueled by 14 consecutive quarters of double-digit loan growth that outpaces share growth, the industry’s loan-to-share ratio continued its ascent in the fourth quarter of 2017. This is not surprising, as loan demand increases during times of economic expansion, whereas members look to credit unions as a savings safe-haven during times of economic contractions.

How does your loan growth stack up to peers? Peer-to-Peer makes it easy to find out. Request a demo today.