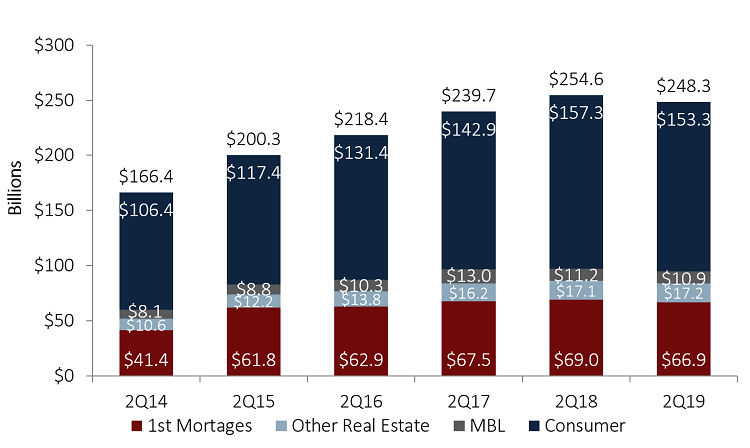

Loan originations in the first quarter of 2019 contracted for the first time in nearly five years. Loan production in the second quarter, however, picked up pace and was on par with year-ago originations.

Credit unions originated $136.8 billion during the second quarter of 2019. By comparison, they originated $136.7 billion during the second quarter of 2018. Despite the return to normal, the first quarter dip has had lasting effects on the portfolio. Originations for the first six months of 2019 dropped 2.5% year-over-year to $248.3 billion.

In the first quarter of 2019, credit unions reported a 15.5% year-over-year decline in first mortgage originations. As of June 30 thanks to a 6.9% YOY increase in mortgage production in the second quarter alone year-to-date originations fell by a more tempered 3.1%.

Analyze Your Lending Portfolio With Ease

As loan production has picked up the pace, discover the ways you can track your lending portfolio performance with Callahan Analytics. Build custom displays and go beyond regional averages to dive deeper into your data.

Learn More

Mortgage rates in 2019 have fallen in response to the change in tone at the Federal Reserve, and consumers have taken the opportunity to refinance and purchase homes. Through the first six months of the year, first mortgage originations accounted for 26.9% of total originations. Other real estate grew $162.8 million year-over-year and was the only area in which credit unions reported an increase in originations.

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Other real estate originations aside, loan originations fell across the board.

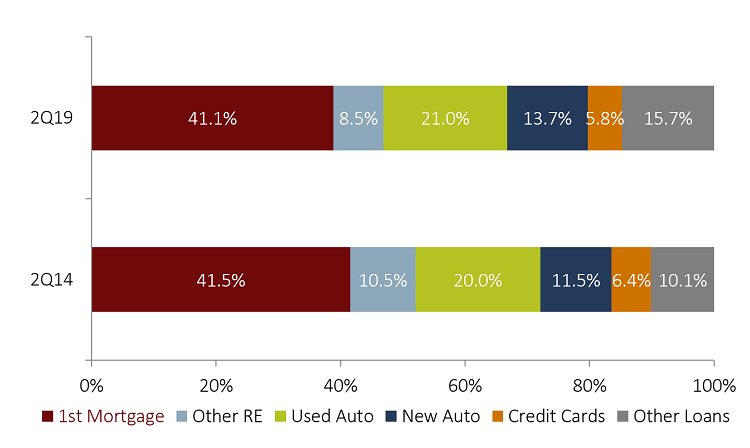

Real estate loans comprise a smaller portion of the lending portfolio than they did five years ago; however, they still accounted for nearly 50% of the pie in the second quarter of 2019 . At 41.1% of the total portfolio, first mortgage balances increased 10.6% year-over-year to $443.6 billion as of June 30, 2019. The share of the portfolio held by other real estate has fallen 2.0% since 2014. These loans accounted for 8.5% of the portfolio as of June 30, 2019; however, it is notable that this was the only major loan segment in which credit unions posted accelerated outstanding balance growth in the second quarter.

Vehicle loans made up 34.7% of the portfolio in the second quarter of 2019. That’s up slightly from 31.5% in 2014 . Used auto loans grew 5.4% year-over-year to $226.5 billion as of June 30. They made up 60.5% of the total auto portfolio. New auto loans, which increased 5.2% annually to $374.4 billion, accounted for the remaining 39.5% of the auto portfolio.

Credit card loan balances grew $4.5 billion, or 7.7%, year-over-year to nearly $63.0 billion at midyear. Credit card utilization, however, fell to 30.4% as credit unions extended credit at a faster clip than members spent it.

LOAN COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Auto loans make up a larger portion of the loan portfolio than they did five years ago 34.7% versus 31.5%, respectively.

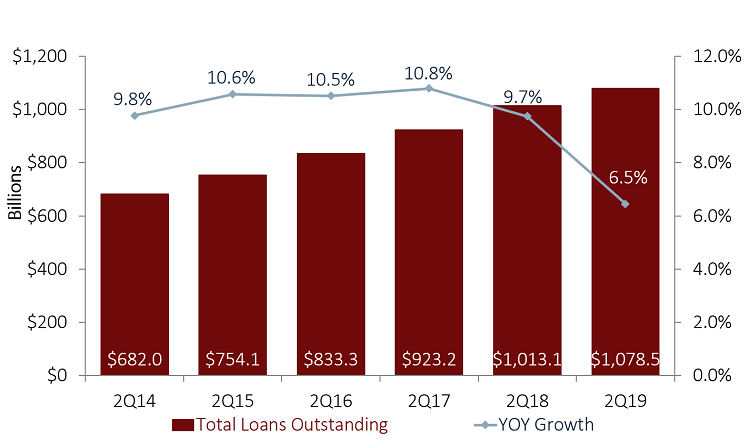

Like originations, growth in outstanding loan balances slowed in every major loan product save other real estate. Thanks, again, to the first quarter drop in originations, the annual growth in balances at midyear was slower than what credit unions reported in the same period last year.

Strong origination growth in the second quarter, however, helped stabilize the decline. Credit unions added $65.4 billion to total loans outstanding over the year. The biggest contributor to year-over-year growth was first mortgage loans, which accounted for 42.9% of total loan growth.

LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

A drop in originations in the first quarter contributed to a slowing annual growth rate in the second quarter.

It is important to note, the credit union industry has recorded robust loan growth during the past five years. In the second quarter of 2019, loan balances reached nearly $1.1 trillion that’s an increase of 6.5% from the year prior.