A credit union’s core processor is integral to its success. Evaluating core processors can be difficult for credit union executives who are trying to boost offerings, speed, and ease while keeping operating expenses in check.

With a total of 41 core providers, there are many options and considerations at play when assessing fit for a specific financial institution. A major factor to consider is size. There are 36 core processors that serve credit unions with more than $20 million in assets; that number drops to 14 when looking at credit unions with more than $500 million in assets.

Thinking About A Core Conversion?

It’s important to know which core processors are making a difference for credit unions in your market and asset range or with similar business models. Callahan offers this, conversion best practices, and more to help you make yourbig decision.

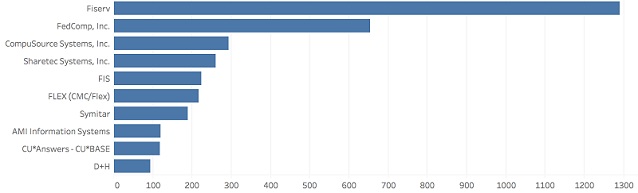

Smaller credit unions might want to consider the chart below, which shows the 10 most popular providers for credit unions with less than $100 million in assets. Fiserv leads that group with 1,289 credit union clients. FedComp comes in second with 654clients, and CompuSource Systems is in third with 293 clients. The average asset size for a credit union client of FedComp is $4.8 million, and the core provider has no clients with more than $100 million in assets.

TOP 10 PROVIDERS BY NUMBER OF CREDIT UNION CLIENTS $100M IN ASSETS

FOR U.S. CREDIT UNIONS $100M IN ASSETS | DATA AS OF 06.30.16

Source:Peer-to-Peer Analytics by Callahan & Associates.

The chart below, which breaks down providers for credit unions with more than $1 billion in assets, offers a contrasting viewpoint. Symitar and Fiserv lead this group with more than 100 clients each that have more than $1 billion in assets. FIS and D+H rank third and fourth with 19 and 18 clients, respectively. This list along with distribution considerations are helpful for credit unions that have $1 billion or more in assets, as these institutions have different operational and transactional considerations from their smaller cooperative counterparts.

TOP 10 PROVIDERS BY NUMBER OF CREDIT UNION CLIENTS > $1B IN ASSETS

FOR U.S. CREDIT UNIONS > $1B IN ASSETS | DATA AS OF 06.30.16

Source: Peer-to-Peer Analytics by Callahan & Associates.

More Members Served

Although consolidation within the industry is resulting in fewer credit union numbers, the industry is posting strong growth rates in assets, loans, shares, and members. The number of credit unions shrank by 4.3% year-over-year, but assets grew 7.4% andmembers expanded 3.8%. Core processors might see fewer potential clients each year, but credit unions are attracting more people to the cooperative financial model and, accordingly, need more data processing power.

Read more about the necessity for core platforms to evolve in The De-Commodization Of The Core Processing Platform.

Consider the chart below, which shows the top 10 core processors by number of members served. Fiserv leads with 39.3 million members and Symitar is in a close second with 31.7 million members. Together, these two core processors serve a combined 66.9%,or roughly two-thirds, of the industry’s more than 106 million members. Corelation, a relatively new core processor, is increasing its reach and now serves 1.4 million members. This chart is helpful for those looking to ensure their core processor is equipped to handle the data from a large or increasing amount of members.

TOP 10 PROVIDERS BY CREDIT UNION MEMBERS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.16

Source: Peer-to-Peer Analytics by Callahan & Associates.

It’s important to address data processing relationships, especially when a credit union’s strategy involves increasing assets or members. Occasionally, switching core processors might be necessary, but it’s worth noting that core processors often offer ancillary services that can scale with a credit union’s growth. Every credit union has different needs and requirements for data processing, but a high-level understanding of the market place dynamic is key to a successful evaluation.

You Might Also Enjoy

-

A Leap Of Faith In Branchless Banking

-

How To Outsource Credit Union Core Processing

-

How 4 Credit Unions Seed Their Future With Cloud Core Processing