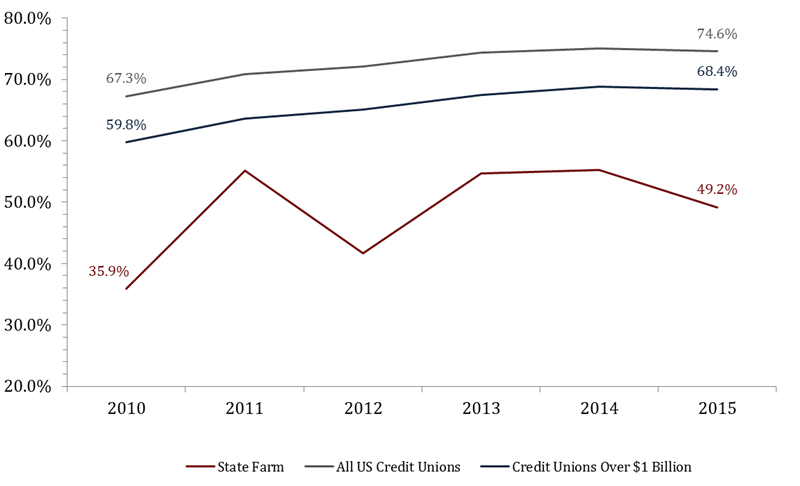

Efficiency ratios at America’s credit unions have improved since June 2014. The industrywide ratio, which measures how much money it takes credit unions collectively to earn $1 of revenue, has declined 64 basis points to 74.56%.

A lower efficiency ratio indicates a credit union is smartly using its assets and liabilities, and few credit unions are as efficient as State Farm Federal Credit Union ($3.9B, Bloomington, IL). The SEG-based credit union posted a second quarter efficiency ratio of 49.18%. That’s a 6.08% year-over-year improvement.

EFFICIENCY RATIO

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

The credit union’s branching model is a major contributor to its efficient operations. Instead of relying on stand-alone branches, State Farm FCU establishes branches inside State Farm Insurance locations. This strategy has allowed the credit union to reduce many of the costs associated with opening and operating a branch.

How Do You Compare?

Check out State Farm FCU’s Search & Analyze scorecard on CreditUnions.com; then build a peer group to compare your own performance.

Click Here

At midyear, State Farm FCU was among the most efficient credit unions in both asset-based and national peer groups. Compared to credit unions with $1 billion or more in assets, State Farm FCU ranked 9th out of 238. Out of the top 10 performing credit unions with $1 billion or more in assets, State Farm FCU showed the most improvement year-over-year followed by Self Reliance New York ($1.1B, New York, NY), which reduced its ratio by 3.01%.

EFFIEICNCY RATIO LEADER TABLE

For credit unions $1B+ | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

| State | Name | Efficiency Ratio (before Provision for Loan Losses) June 2015 |

Efficiency Ratio (before Provision for Loan Losses) June 2014 |

Year-Over-Year Change |

|---|---|---|---|---|

| AL | APCO Employees | 35.40% | 36.40% | 1.00% |

| NJ | Merck Employees | 39.25% | 33.28% | -5.97% |

| CA | Star One | 41.37% | 41.30% | -0.07% |

| NY | SelfReliance New York | 45.13% | 48.14% | 3.01% |

| NY | Melrose | 45.69% | 47.37% | 1.68% |

| CA | F & A | 47.49% | 45.35% | -2.14% |

| IA | University Of Iowa Community | 47.76% | 48.07% | 0.31% |

| GA | Robins | 49.10% | 48.69% | -0.41% |

| IL | State Farm | 49.18% | 55.26% | 6.08% |

| TX | Navy Army Community | 50.90% | 48.34% | -2.56% |

Source: Peer-to-Peer Analytics by Callahan & Associates