COVID-19 has made life more difficult, for credit union executives and football stars alike. But life finds a way. That’s why this Sunday, perhaps the most difficult season in NFL history will culminate in Super Bowl LV between the Tampa Bay Buccaneers and defending champion Kansas City Chiefs.

With apologies to Packers fans, this is the matchup most football fans wanted to see: the current greatest quarterback in the league, Patrick Mahomes, against the greatest of all time, Tom Brady.

As we like to do here at Callahan, we leave the football analysis for the experts. Instead, to determine our winner we turn to Callahan data; by creating custom peer groups in our Peer-to-Peer software, we can compare the credit unions in each metro area across seven different metrics.

Here’s what we found.

Are You Ready For Some Football?

Kansas City 0, Tampa Bay 0

LOAN GROWTH

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Tampa credit unions hold a commanding lead in loan growth, as Kansas City cooperatives saw a steep decline in this metric across 2020.

Kansas City 0, Tampa Bay 1

LOAN-TO-SHARE RATIO

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Historically, Tampa credit unions are more loaned out than their midwestern brethren. And that’s no different at third quarter, as the loan-to-share ratio at Tampa-area credit unions sits 22 percentage points higher than at Kansas City shops.

Kansas City 0, Tampa Bay 2

AVERAGE MEMBER RELATIONSHIP

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Another metric, another Tampa win. In the past five years, Tampa credit unions have grown their average member relationship by approximately $5,000, compared to $2,000 for Kansas City credit unions.

Kansas City 0, Tampa Bay 3

SHARE DRAFT PENETRATION

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

For the past five years, approximately 70% of Tampa credit union members have a checking account; at Kansas City cooperatives, it’s less than half.

Kansas City 0, Tampa Bay 4

TOTAL DELINQUENCY

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Across 2020, loan quality has improved for credit unions in both metro areas, though Tampa’s remains lower.

Kansas City 0, Tampa Bay 5

NET INTEREST MARGIN

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

On the board! At third quarter, the net interest margin at Kansas City credit unions sits 13 basis points higher than at Tampa credit unions 2.94% to 2.81%.

Kansas City 1, Tampa Bay 5

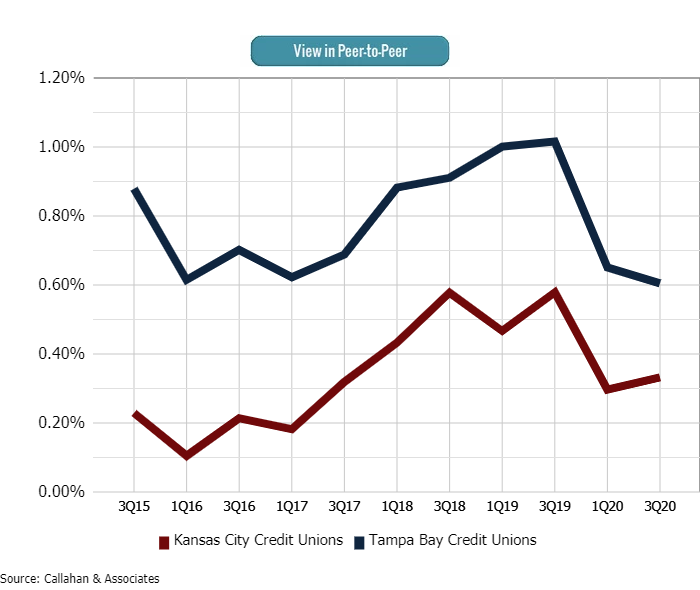

RETURN ON ASSETS

FOR KANSAS CITY AND TAMPA BAY CREDIT UNIONS | DATA AS OF 09.30.20

Callahan & Associates | CreditUnions.com

Tampa finishes strong. Though ROA declined for credit unions in both metro areas across 2020, Tampa holds a 27-basis point advantage at third quarter.

Kansas City 1, Tampa Bay 6

The Bottom Line

Well, that does it. The Tampa Bay Buccaneers, led by Tom Brady, will win the Super Bowl this weekend. The old guy has still got it!

There’s plenty of reason for Kansas City fans to feel optimistic, however. The Chiefs posted the best record in the NFL this season, at 14-2, and employ some of the league’s best offensive players. In addition, Kansas City has two more things going for it: Callahan’s can’t-miss datamatic analysis has missed two in a row and lost some of its legendary (to us) reliability, and Callahan dog Charlie (pet to our very own Victoria Taylor, Callahan’s director of marketing and engagement) has picked the Chiefs to win. And, even though Victoria is from Kansas City, we have to respect the power of the puppy.

But what do you, the CreditUnion.com reader, think? Leave us a comment below telling us who’s going to win and why.

And don’t forget to check out some of our past predictions:

- Callahan Bowl XIV: Kansas City Chiefs VS San Francisco 49ers

- Callahan Bowl XIV: Los Angeles Rams VS New England Patriots

- Callahan Bowl XIII: Philadelphia Eagles VS New England Patriots

- Callahan Bowl XII: Atlanta Falcons VS New England Patriots

- Callahan Bowl XI: Seattle Seahawks VS New England Patriots

- Callahan Bowl X: Seattle Seahawks VS Denver Broncos

- Callahan Bowl IX: San Francisco 49ers VS Baltimore Ravens

- Callahan Bowl VIII: New York Giants VS New England Patriots

- Callahan Bowl VII: Pittsburgh Steelers VS Green Bay Packers

- Callahan Bowl VI: Indianapolis Colts VS New Orleans Saints

- Callahan Bowl V: Chicago Bears VS Indianapolis Colts

- Callahan Bowl IV: Seattle Seahawks VS Pittsburgh Steelers

- Callahan Bowl III: Philadelphia Eagles VS New England Patriots

- Callahan Bowl II: Carolina Panthers VS New England Patriots

- Callahan Bowl I: Tampa Bay Buccaneers VS Oakland Raiders