United Nations Federal Credit Union ($5.1B, Long Island City, NY) has a field of membership that includes the United Nations, World Bank, International Monetary Fund, and affiliated agencies, all working to improve human rights and alleviate poverty across the globe. As of fourth quarter 2017, the 71-year-old financial cooperative had 126,459 members in more than 200 countries.

Many of UNFCU’s products and services align with its far-flung membership, including international home loans, currency exchange, and global banking with enhanced security. The credit union also invests more in its staff than the average credit union.

ContentMiddleAd

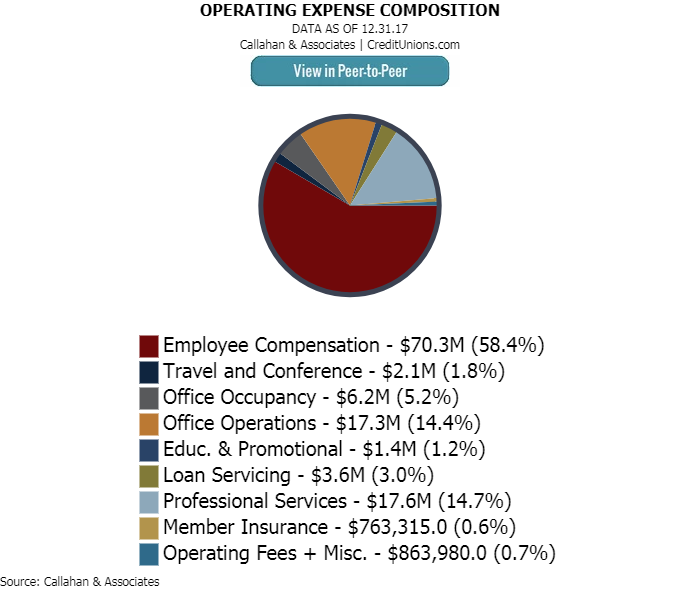

According to fourth quarter data available from Callahan & Associates, employee compensation made up 51.1% of operating expenses for all credit unions in the United States. At UNFCU, that figure was 58.4%, or 7.3 percentage points higher.

UNFCU was founded in 1947 by 13 UN staff members. The credit union&’s staff grew by 5.7% in 2017. At year-end, it had 538 employees, 23.9% more than the average credit union of $1 billion to $10 billion in assets.

In addition to employee growth, salary and benefits per full-time employee increased from $122,681 as of Dec. 31, 2016, to $130,841 as of Dec. 31, 2017. That’s a year-over-year jump of 6.7%. The credit union’s salary and benefits per full-time employee was 78.6% higher than the national average of $73,249. Headquartered in the heart of New York City, living expenses are much higher, necessitating greater pay and benefits than average.

Despite the high cost of employees, UNFCU has an operating expense ratio of 2.44%, compared with 2.87% for credit unions in its asset-based peer group. That efficiency is bolstered by a members-to-employee ratio of 235, far below the average of 385 for all U.S. credit unions regardless of size.