Credit union income consists of interest income and non-interest income. Interest income comes mainly from loans and investments; non-interest income comes from outside of a credit unions core activities. This includes fee income and other operating income.

Based on early performance data released by the NCUA, and available in Callahan & Associates Peer-to-Peer, Callahan projects a large increase in overall income in the first quarter of 2018. Answer the questions in the quiz below to test your knowledge of income composition.

ContentMiddleAd

Click on the question to view the answer.

Question 1: (True or False) Total income is set to reach a record high for the first quarter?

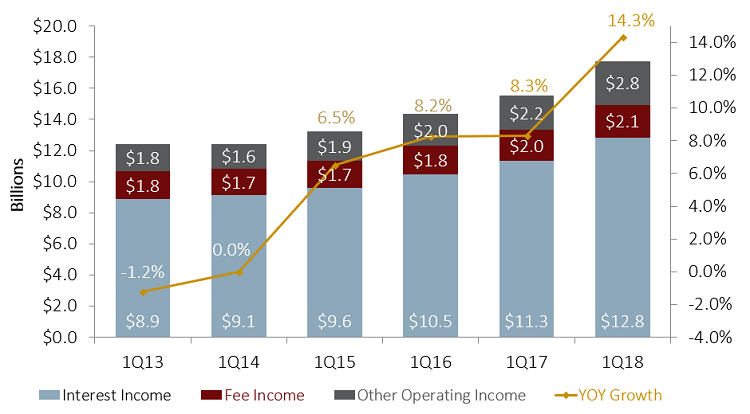

True. Callahan projects total income will grow 14.3% year-over-year in the first quarter of 2018, jumping to $17.6 billion from $15.5 billion in 2017.

Question 2: Which interest income or non-interest income post the largest year-over-year growth?

Non-interest income: Callahan expects non-interest income to grow 18.1% year-over-year, whereas interest income will grow 13.2% year-over-year. In each quarter of 2017, interest income growth outpaced non-interest income growth.

Question 3: What percentage of total income comes from fees? How does this composition compare to 2013?

Callahan projects fee income will total $2.1 billion 11.8% of total income in the first quarter of 2018.

In the first quarter of 2013, fee income totaled $1.8 billion and accounted for 14.5% of total income. This quarters performance demonstrates how credit unions continue to develop member-friendly ways to increase the bottom line.

TOTAL REVENUE AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.18

Interest income has increased 13.2%, or $1.5 billion, since first quarter 2017, but at 28.0%, other operating income has the larger growth.

Source: Callahan & Associates.

Callahan expects total income to increase 14.3% year-over-year. The bulk of this growth comes from other operating income, which Callahan projects will hit $2.8 billion in the first quarter, a 28.0% increase from 2017.

Save Time. Improve Performance.

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahans Peer-to-Peer analytics.