Whether fintech caters to consumers or enterprises, collaborates with traditional financial service institutions, or competes with them, we should all be cognizant of their growing prominence in the financial sector.

I recently attended a keynote address by Al Dominick, CEO of DirectorCorps, an information resource to the financial community, at a finance event hosted by University of Maryland’s Robert H. Smith School of Business, where I’m currently pursuing my MBA. The theme of the address was Why You Need to Know about Fintech.

Al Dominick, CEO, DirectorCorps

Financial technology, commonly known as fintech, is an industry consisting of companies that utilize new technologies and innovations while operating in the same realm as traditional financial institutions, such as banks and credit unions. Fintech is shifting the paradigm of traditional intermediary roles by making them obselete, also known as disintermediation.

Dominick says, Leadership teams at financial institutions and fintech companies alike are in a race to align services and product mixes to suit core customers’ current interests and prospective customers’ expectations.

Let’s Talk Payments, a content and research company reporting on the fintech industry, summarizes fintech as a one-stop shop segmented by different service types such as bank account, personal finance management, insurance, compliance, HR and payroll solutions, investing, lending, peer-to-peer payments, cybersecurity, and cryptocurrency. Fintech is revolutionizing more than 30 areas of banking and new trends are emerging in the financial sector as shown below:

Arguably, one of the most prominent controversies in the financial world currently is how fintech companies should be regulated. Dominick says that recent remarks from the head of the OCC, Thomas Curry, strike a more positive tone toward fintech than his previous statement mentioning although leniency will not be shown, the OCC will consider the benefits of fintech when implementing regulations. Dominick went on to say Curry previously made it clear that fintech companies would be held to the same standard and regulations written for incumbent financial institutions. Along the same vein is current discussions regarding granting national bank charters to fintech companies.

Just a few weeks ago, Curry described his proposal for a fintech charter saying, We will beissuing charters to fintech companies engaged in the business of banking because it is good for consumers, businesses, and the federal banking system. When fintech charters come to fruition, fintech will be granted greater flexibility and the ability to avoid state-by-state registration, which can be worrisome for banks and credit unions.

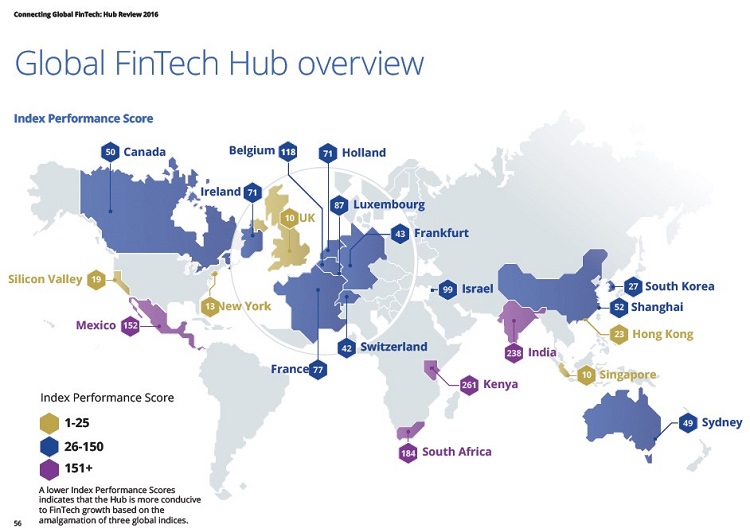

Regardless of the regulation and charter controversy, the fintech industry is growing exponentially. Some of the most technologically advanced regions of the world like Silicon Valley, New York, the UK, Singapore, and Hong Kong show the lowest index performance scores, meaning that those regions are more conducive to fintech output than the others.

According KPMG and CB Insights, from 2010 to 2015, investments in fintech have risen from $1.8 billion to $19.1 billion. Some of the top VC-funded deals in 3Q16 included Qufenqi, an installment plan e-commerce platform, with a total equity funding of $874 million to date. Ripple, a banking direct transacting system, raised $55 million in the third quarter and One97 Communications,a digital goods marketplace and mobile marketing platform, raised $60 million, also in the third quarter last year.

Fintech companies are in no shortage of capital and the wind is at their back. I’m hoping this blog shed some light on the advancement and repositioning of fintech firms since the financial crisis. Whether your credit union is in negotiations to partner with these firms or are competing head-to-head, knowledge is power.