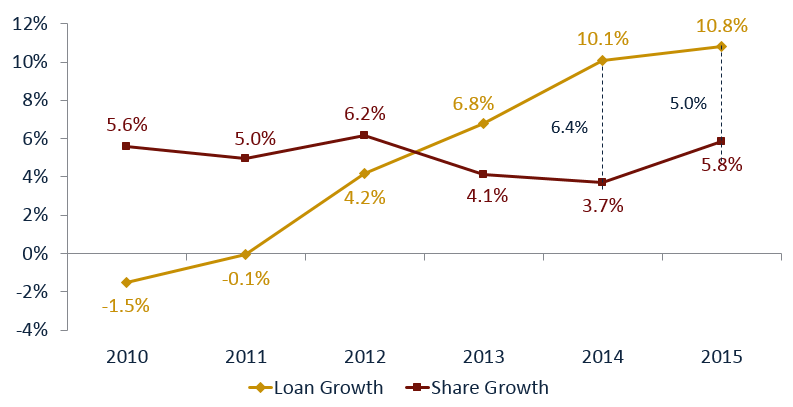

Amid an improving economy and accelerating loan demand, liquidity is becoming a topic of interest for many credit union executives. Loan growth has outpaced share growth for the past nine consecutive quarters, and net liquidity flow from shares into investments has been negative. In other words, credit unions have been increasingly funding new loans with investments instead of new shares. With the rising importance of shares, there are many reasons for credit unions to celebrate in the third quarter.

1. Share growth is increasing.

In the third quarter of 2015, credit unions reported year-over-year share growth of 5.8%, up 2.2 percentage points from one year ago. This is the first time in three years credit unions have posted a year-over-year increase in the third quarter share growth. Consequently, the spread between loan growth and share growth tightened as of September 2015.

LOAN GROWTH VERSUS SHARE GROWTH

For all U.S. credit unions | Data as of 09.30.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

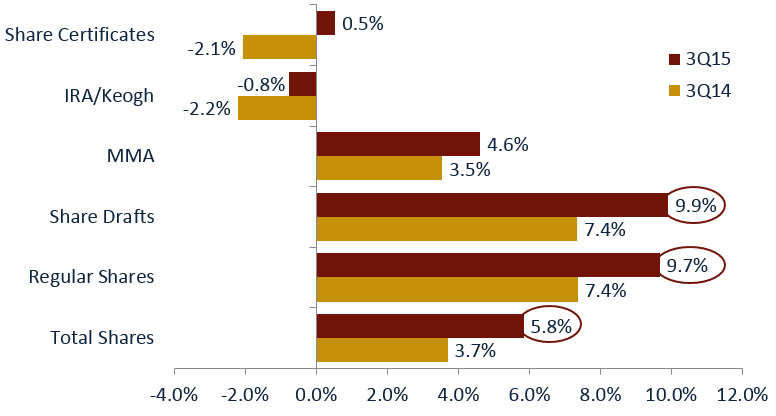

2. Core deposits are the stars of the share portfolio.

Core deposits share drafts and regular shares underpinned the share growth at credit unions. Both share drafts and regular shares increased at a nearly double-digit pace over September 2014. That’s stronger than the growth reported 12 months ago.

But its not solely in core deposits where credit unions are turning out a strong performance. Money market shares are also growing at a faster rate versus one year ago. Moreover, share certificate balances posted positive annual growth and IRA/Keogh accounts reported a smaller year-over-year decline as of September 2015.

12-MONTH GROWTH BY SHARE COMPONENT

For all U.S. credit unions | Data as of 09.30.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

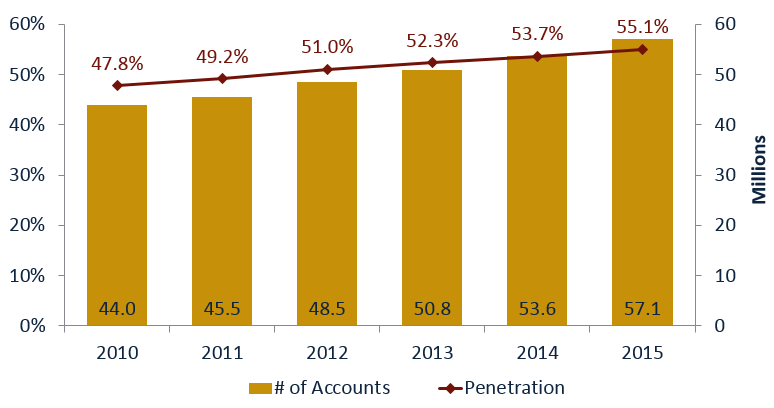

3. More members are using credit union checking accounts.

Balances in share draft accounts are increasing; so, too, are the number of share draft accounts. The number of share draft accounts increased 6.5% year-over-year and topped 57 million at the end of third quarter. The percentage of members holding a credit union share draft account also expanded 1.4 percentage points year-over-year to reach the industry’s all-time high of 55.1% as of September 2015. This shows credit unions are strengthening their relationships with members.

SHARE DRAFT ACCOUNTS AND PENETRATION

For all U.S. credit unions | Data as of 09.30.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates