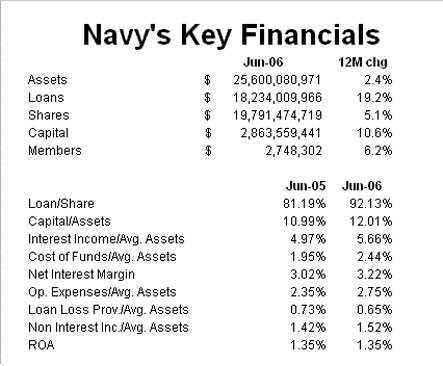

Led by real estate lending, strong loan growth pushed Navy’s assets to $25.6B at the end of the second quarter, according to Callahan’s First Look program. Membership at the world’s largest credit union rose 6.2% over the past 12 months to reach 2.7 million.

Although 12-month share growth of 5.1% exceeds the industry average, what has really driven the balance sheet growth is the 19.2% growth in loans. The $18.2B portfolio’s growth is led by a 27.3% growth in outstanding real estate loans. Real estateloan originations reached $4.0B in the first half of the year, up 13.6% versus the first half of 2005. Navy originated $9.3B in loans to members across all loan categories in the first six months of 2006.

Other key lending statistics include:

- Total auto loans have risen 13.6% since June 2005 to $4.8B

- All other loans are up 10.9% over the past 12 months

- Average member loan balance has increased from $9,460 to $11,002 since June 2005

- Total loans outstanding rose 5.7% during the second quarter

Money Market Growth Drives Share Increase

Navy’s share balances reached $19.7B as members moved into higher yielding money market accounts, which have posted nearly a billion dollar inflow since last June. Some of this inflow is likely due to members moving their funds out of regular savings,which declined $520M from June 2005. During the second quarter, total shares increased 1.2%.

Total Income Up 17.9%; Expenses Rise as Expansion Plans are Implemented

Solid lending growth coupled with the rising interest rates boosted interest income 22.2% versus the first half of 2005. Although fee income declined marginally from $73.7M to $71.7M, total income grew 17.9% to $902.2M.

In keeping with its announced plans to add 45 new branches and increase its workforce by 18% to 6,000 employees over the next five years, Navy has added five branches to its network and employee count has increased by 520 in 2006. The new hires have affectedoperating expenses as employee compensation is up 21.4%. Total operating expenses are up 22.5% with other increases posted in loan servicing, office occupancy and office operations.

Cost of Funds Rises but ROA Steady

Rising interest rates also affected Navy’s average cost of funds which jumped 57 basis points from June 2005 to 2.78%. This was offset by increases in the yield on investments and yield on loans, which reached 3.7% and 6.9%, respectively. Net incomefor the first half of 2006 rose 4.7% from previous year and ROA held steady at 1.35%.

Callahan & Associates First Look program is also a great way to preview trends in natural-person credit unions before call report data is released. Participating in Callahan’s First Look program allows you to see preliminary trends for year-end results. To participate in the First Look program, email your call report in XML format to 5300@callahan.com.