CU QUICK FACTS

Central Willamette Community Credit Union

Data as of 06.30.17

HQ: Albany, OR

ASSETS: $273.5M

MEMBERS: 27,336

BRANCHES: 6

12-MO SHARE GROWTH: 10.2%

12-MO LOAN GROWTH: 16.4%

ROA: 0.59%

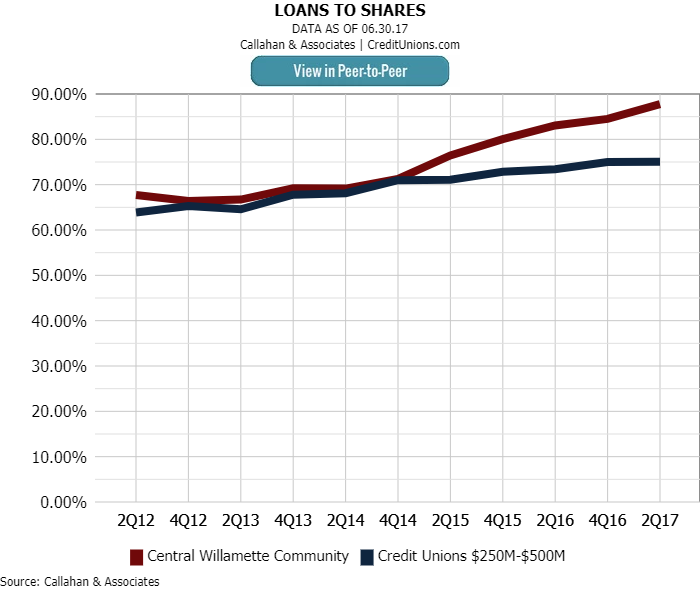

Over the past three years, the loan-to-share ratio at Central Willamette Community Credit Union ($273.5M, Albany, OR) has steadily eclipsed the average for credit unions with $250 million to $500 million in assets. In second quarter 2017, the Oregon-based credit union’s ratio was 87.8% versus 75.1% for its asset-based peers.

The credit union is well-capitalized, with a net worth ratio of 9.21%, but it needed to attract deposits to keep up with its eight consecutive quarters of double-digit loan growth.

That’s why in August, Central Willamette has run two campaigns designed to attract deposits and increase awareness of the institution.

The 36-Month CD Special

At Central Willamette, the portion of the share portfolio occupied by CDs has steadily declined during the past 10 years. According to data from Callahan Associates, share certificates comprised approximately 32% of Central Willamette’s total share portfolio in the second quarter of 2007. At second quarter 2017, that had fallen to 6.3%.

Much of this shift is the result of a post-recession economy, says the credit union’s chief marketing and sales officer, Amanda Lunger.

Compare your share portfolio to relevant peers quickly with Callahan’s Peer-to-Peer. Learn more.

I’ve been in the credit union industry for 11 years, Lunger says. I’ve run one CD promotion in that time because the market just hasn’t been right for that type of product.

But with the rise in interest rates this year, the credit union felt the time was right to test the savings appetite of its four-county market with a CD special. ContentMiddleAd

After reviewing its own balance sheet dynamics as well as the products offered by its competition, Central Williamette settled on a share certificate special with a 36-month term and two different rates depending on the deposit amount 1.6% for deposits lower than $100,000, and 1.75% for those greater.

Rates are going up, and we wanted to see if our membership had an appetite for this, Lunger says. We hadn’t promoted any kind of rate special in quite some time. There hadn’t been a market until recently.

The special will run throughout the month of August, but the results so far have been positive.

Month-to-date, the credit union has attracted nine new members and $1.2 million in deposits, including two large deposits of $200,000 and $60,000 from new members. And once these members join, the credit union immediately begins to onboard with phone calls, letters, and emails, trying to get them to adopt stickier products such as online banking, bill pay, or direct deposit.

That’s all good news. But the credit union also received feedback on how to improve the offer, especially regarding the long length of the term. When the special expires at the end of August, Central Williamette plans to run another special across September with an 18-month term.

We are trying to get people in here young and have them grow with us.

The Kid Kash Informational Campaign

To coincide with back-to-school season, the credit union is also running a Summer Savings Contest to encourage savings and inspire goodwill in its communities.

The August contest is meant to spur usage, specifically, of the Kid Kash savings account, which is open to members younger than 18 and is designed to entice young account holders to save early and build a relationship with the credit union.

People typically keep the first account they open with a financial institution, Lunger says. We are trying to get people in here young and have them grow with us.

The familial influence is strong, but credit unions can sway a switch. Learn more in How Do Millennials Choose Financial Institutions?

The Summer Savings Contest is a coloring contest that asks entrants a simple question: If you could create money, what would your dollar bill look like?’

The credit union provides a sheet of paper on which participants draw and submit to any branch location before August 31. To enter, artists must have a Kid Kash or Youth Savings account. The credit union will display entries across its six branches until it announces winners.

Central Willamette Community Credit Union’s back-to-school drawing contest promotes good financial habits as well as the institution’s youth account. So far, the credit union has received several dozen entries for new ideas for a dollar bill design.

One winner each from four age groups 0-3, 4-6, 7-11, and 12 and older will receive $75 split among a $25 deposit into their account, a $25 gift card, and a $25 donation to the charity of their choice.

We believe in the spend, save, share mentality, Lunger says. That’s why we broke the rewards down into a gift card for them to spend, a deposit into their account, and something for them to give to a cause they believe in.