A recent benefits addition at 7 17 Credit Union ($1.6B, Warren, OH) makes mental healthcare available via virtual as well as in-person care.

It’s not a minute too soon because U.S. workers have a lot on their minds.

Despite striking a better work-life balance, workers today still are more dissatisfied than they were during the pandemic. Add to that worries about health, the economy, inflation, and a “silent depression,” and it might not be surprising a full 45% of adults between the ages of 35 to 44 reported having a mental illness in a 2023 study by the American Psychological Association. That jumped to 50% for adults between the ages of 18 to 34. More worrisome is that these numbers represent a “significant increase” from levels reported in 2019, according to the APA.

On the employment side, the U.S. Chamber of Commerce reports companies across the country are facing “unprecedented challenges” in filling jobs. Given this environment, how can credit unions differentiate themselves in the market and establish themselves as employers of choice?

That was part of the goal at 7 17. Employees there have no limits on the number of mental health visits they can schedule, and the credit union covers 100% of the benefit. The new option addresses two major hurdles to mental healthcare: the shortage of local providers and the stigma of walking into a counseling center.

“A lot of people have access issues as it relates to services for mental behavioral health,” says Ryan Hough, senior vice president of human resources at 7 17. “Especially during the pandemic, it was difficult to get into any type of a doctor, and face-to-face was somewhat dangerous for people’s psyches and for their physical health.”

Now, in-person as well as virtual mental health counseling from licensed clinicians is available for all 7 17 employees and their eligible family members.

Healthy Employees Beget Happy Members

According to Hough, 7 17 embraces a nurturing philosophy. It takes care of employees and looks to them to take care of members in a manner that sets it apart in the market. When Hough joined 7 17 in late 2019, he knew he wanted to roll out a telehealth option that offered virtual mental health counseling.

“There’s such a stigma for mental health; it’s a woefully undermet need that begs for a solution,” Hough says. “We try to help our employees bring their best selves to work and give them tools to address things in their lives. If you’ve got something going on in your life, it doesn’t just turn off when you walk across the threshold at work.”

The new solution gives staff and their families an avenue to address their health concerns — both physical and mental — in a way that is convenient and accessible. Given the lingering effects of anxiety, grief, illness, and uncertainty posed by the pandemic, these services are just in time.

“We’re seeing mental health take a front seat for the first time in a long time,” Hough says. “Employees want to work for an organization that focuses on physical and mental health and wellbeing.”

Indeed, today’s hiring and recruitment environment necessitates a stable of services to address those needs, Hough says.

Assistance At The Tap Of A Button

7 17 uses the same vendor for virtual and in-person mental health assistance, and all practitioners are medical doctors eligible to practice in Ohio. The virtual option opens up a broader network of providers — which employees can access via app, online, or telephone — and goes a long way toward tackling issues of access.

“We have at least three, maybe even four generations who work for us,” Hough says. “Although many of us have smartphones and can access the benefit through the app, we still have a generation of employees who prefer to access it over the phone.”

CU QUICK FACTS

7 17 Credit Union

DATA AS OF 09.30.23

HQ: Warren, OH

ASSETS:$1.6B

MEMBERS:114,318

BRANCHES:14

EMPLOYEES:325

NET WORTH:13.8%

ROA:0.90%

The first time employees access the benefit, they have to address a few housekeeping items, such as date of birth, but once they start using the benefit and establish a rapport with a clinician, they can see that provider as often as they need.

“If you’re seeking counseling, especially regularly, you typically don’t want to talk to a different person every time,” Hough says. “You try to forge a relationship with your therapist, which could take a few times. If employees are engaged with a particular therapist, they can schedule virtual appointments for continuation of their therapy.”

That’s a major advantage for 7 17’s nearly 350 employees, two-thirds of which are represented by a union. And because the telemed services are supplemental, nothing changes for employees regarding their existing healthcare plan.

“We didn’t have to change our health plan,” Hough says. “We just bolted this right on top of it.”

According to Hough, the credit union’s healthcare plan is strong but had some gaps in coverage for certain preventive measures, therapists, and “things of that nature.” And like the larger plan, the credit union offers its telemed services benefit free of charge.

Knowing Is Half The Battle

The credit union was able to roll out its telemed benefit in a little less than a year — from identifying the provider to introducing the benefit to staff — but Hough says it could be done in as little as six months. To ensure employees are aware they now have virtual care available, the credit union relies on emails and text communications as well as flyers on its intranet. The provider, First Stop Health, customizes its own outreach to be more relevant to a person’s particular situation. For example, a staffer who has accessed care for their blood sugar levels might receive information about diabetes management.

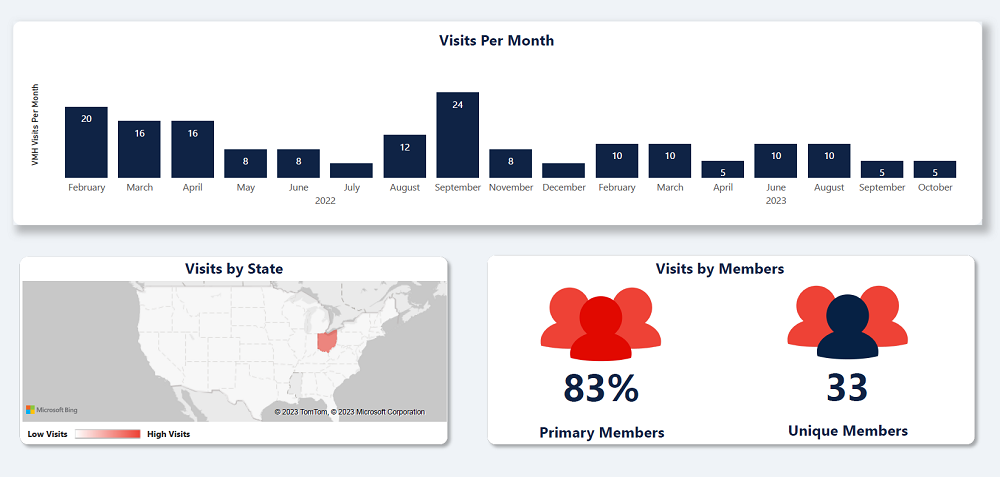

It is important to note employee care is private; however, 7 17 does receive utilization reports so it has a better understanding of how many people access the benefit during a month or quarter. These reports provide high-level insight into care, including total cases, visits per case, top reasons the benefit was accessed, and more. The vendor even provides an ROI breakdown, quantifying how much money the credit union saved by employees avoiding urgent care or the emergency room.

The telemed utilization report offers insight into how many employees are using mental health virtual services as well as the top reasons they are seeking assistance.

7 17 can track increases and decreases in utilization of its virtual mental health plan in the short term (i.e., month-to-month) as well as the long term.

Return on investment is always an important metric, and 717 can see at-a-glance how much money it has saved as employees take advantage of telemed services for physical as well as mental health.

Hough admits the utilization is stronger on the virtual medical care side than on the virtual mental health side, but that reflects most people’s proclivity to address needs that are more acute. Still, at 37%, usage is not insignificant.

“I’ve had people tell me it was so easy and so much better than having to go to a clinic,” Hough says.

Lessons And Looking Ahead

Like any benefit, a credit union must be willing to put in the work and resources required to make mental health services a success. 7 17’s relationship with First Stop Health is deemed high-risk because of the private health and personally identifiable information at play. That’s why the credit union’s risk committee has a process for approving vendors and ensuring information is safeguarded.

Once the program is available, a credit union must work to ensure utilization, which in itself is a “blessing and a curse,” Hough says.

Utilization is great because it means the service resonates with employees and helps save time and money. However, when it comes time to renew the contract, if employees have used the benefit more than the vendor estimated, someone will eventually foot that bill — and prices rarely go down.

Finally, offering a service like this creates an expectation of availability among employees, which can make rolling back the benefit difficult.

Still, 7 17 is pleased with the results so far and has no plans to change anything.

“We intend to continue with it,” Hough says. “Utilization is still very high.”

Explore New Strategies For Keeping Your Employees Happy

Do you want to outperform the market, attract and retain top talent, and improve your organization’s impact? You can do this and more — and Callahan can help. Join other leading credit unions that have transformed their organization and learned how to do well while doing good. Register today for 2024 sessions.

REGISTER TODAY