Top-Level Takeaways

-

TwinStar Credit Union has set a new course for its future, adding new roles and tiers to its leadership team.

-

In the 10 months since the change, the credit union has strived to eliminate inefficiencies in its governance structure.

CU QUICK FACTS

TwinStar Credit Union

Data as of 12.31.19

HQ: Olympia, WA

ASSETS: $1.5B

MEMBERS: 132,143

BRANCHES:21

12-MO SHARE GROWTH: 9.5%

12-MO LOAN GROWTH: 4.0%

ROA: 1.32%

In the past 10 years, TwinStar Credit Union ($1.5B, Olympia, WA) has more than doubled in asset size. It also has added 55,000 members and crossed the state line into Oregon.

But as the credit union changed in ways both big and small, its senior leadership structure stayed the same.

We basically had the same organization structure in place since we were half our size, says Scott Daukas, the credit union’s chief strategy officer. As we started to evaluate where the world was going and where the credit union needed to be, we realized our structure had holes in it.

TwinStar first considered a reorganization in November 2018 and spent the next four months strategizing different concepts. The Evergreen State cooperative wanted to modernize its structure to create a nimbler decision-making process; however, it didn’t want a streamlined leadership structure to come at the cost of development opportunities.

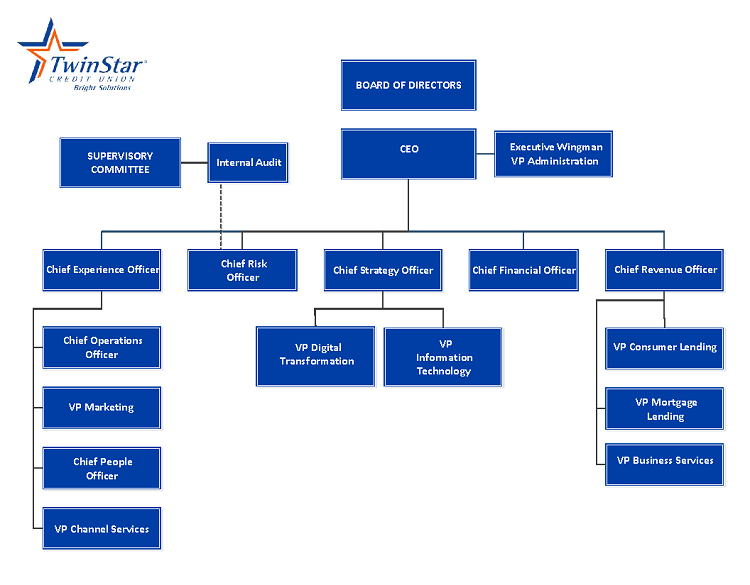

The leadership team agreed on a new framework in February 2019 and implemented it on May 1. Out was a flat leadership team that consisted of 10 senior managers; in was a three-tiered team of 16.

3 Tiers For The Leadership Team

TwinStar started the reorg by thinking big. It identified three pillars under which to group similar operational areas. It then created leadership positions to lead the broader divisions and filled in department-level gaps below.

Those three pillars are:

- Corporate Strategy: Corporate partnerships, project management, IT infrastructure, and large-scale programs such as digital banking.

- Experience: Member-facing and brand-building departments, including marketing, human resources, training, branching, and the contact center.

- Safety and soundness: Support departments, including compliance, risk, finance, lending, deposits, and e-services.

We organized around those three pillars and then filled the gaps that existed underneath, Daukas says.

Scott Daukas, Chief Strategy Officer, TwinStar Credit Union

The credit union took its existing team of 10 and expanded it to 16; from there, TwinStar settled on a six-person executive team. The roles of CEO, CFO, and chief risk officer remained part of the executive team. To those, the credit union added a chief strategy officer, a chief experience officer, and a chief revenue officer. TwinStar filled those new positions internally, which required it to reassign some leaders and move up others. For example, Daukas moved from chief risk officer to chief strategy officer while the assistant vice president of risk, Daniela Parker, moved into the chief risk officer role.

We realized that many of the functions of a chief strategy officer were being performed unofficially, and it’s an area we wanted to see developed further officer, Daukas says. And she was an obvious candidate to move up.

The scope of the executive team changed, too. Before, it strived try to reach a consensus in its decision making, which created inefficiencies and workarounds that only served to add governance and bureaucracy to the process. So, TwinStar provided the smaller executive team with a clear directive.

We’re focused on the direction and development of the credit union’s three-year, on out, strategy, Daukas says.

The tier of senior managers that sits directly under the executive team focuses on the one- to three-year strategy as well but also is responsible for operations and culture. The rest of the leadership team focuses on the current year and executing the current plan.

This is a more streamlined governance structure, Daukas says.

With its new leadership structure, TwinStar sought to create more efficient governance.

A Simple Question

Big change like this does not occur simply at a conceptual or structural level, it occurs at a human level, too. And, it can cause disturbances across the organization if it’s not communicated properly.

We approached it with a great deal of caution knowing that jobs were going to change, bosses were going to change, and team makeup was going to change, Daukas says. It’s less about the names changing in the directory and more about people being OK with that change. You just don’t know how people are going to react.

The credit union ensured all members of the original 16-person leadership team understood the changes and could answer questions anyone in the organization might have. Although Daukas believes the credit union could have been more prepared to answer detailed questions, he believes the communication strategy was a success.

TwinStar did not layoff any employees; however, it did shuffle the structure in a way it had never been before. So, the credit union began incorporating key organizational change management concepts to help staff adjust to the new normal.

Their world was stable and safe and now they’re questioning things, Daukas says. For some, their current bosses have different expectations and standards from their previous bosses.

The credit union had to consider more than its internal communications, however. TwinStar had already set corporate goals for 2019 and knew disrupting the working order of the shop created the potential to lose focus in the shuffle. So, it put a few things on hold ultimately pausing some 40 mostly minor projects to focus on change management and culture, Daukas says.

We gave ourselves permission to be nimbler and more proactive in planning for what where want to be rather than responding to how the world changes around us.

In midyear 2019, the credit union completed a culture-building exercise to re-articulate the credit union’s purpose. And for the six months after the May 1 effective date, it logged questions, concerns, and ideas, although at the end it found it needed to make only a few changes.

We gave ourselves permission to talk about what wasn’t working, Daukas says. When you’re putting something together, you don’t exactly know how it’ll work in the real word. But by and large we got it right, and that’s made life easier.

For Daukas, the biggest benefit of the reorganization has been the credit union’s willingness to ask one simple question: Why are we doing what we are doing?

The strategy officer says it can be easy to accept things as they are or to blame others when things don’t go to plan. That didn’t happen during TwinStar’s reorg.

We approached it by trying to understand why things weren’t happening, Daukas says. When we created a plan to ensure things do happen, we quickly solved long-term challenges in communication and governance.

The credit union also managed to reach all but one of its corporate goals for 2019, a reflection of the reorganization’s acceptance within the institution. Now, the credit union has its sights set on the future, and not a moment too soon.

We gave ourselves permission to be nimbler and more proactive in planning for where we want to be rather than responding to how the world is changing around us, Daukas says.