Deep in the heart of Southeastern Texas, DuGood Federal Credit Union ($567.5M, Beaumont, TX) is opening a branch to help tomorrow’s tradespeople graduate on the right financial foot.

Oct. 20 marks the grand opening of the cooperative’s branch on the Lamar Institute of Technology (LIT) campus. The partnership, formally announced in July, has been in the works for more than a year. CEO Clint Wilson says it’s a long-term investment aimed at supporting the regional economy.

“Some of the world’s largest crude oil–to–gasoline refineries are located in Southeast Texas, between Houston and Baton Rouge, right where our credit union is,” he says. “Those refineries and industries rely on LIT to train the workforce here. That’s a vital part of this region, and we want to contribute to that success.”

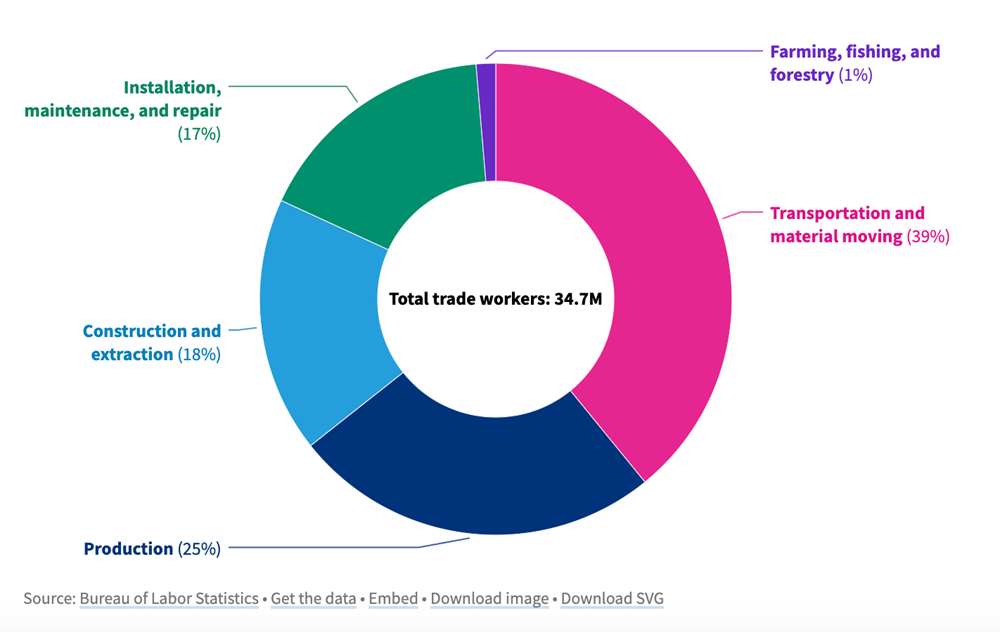

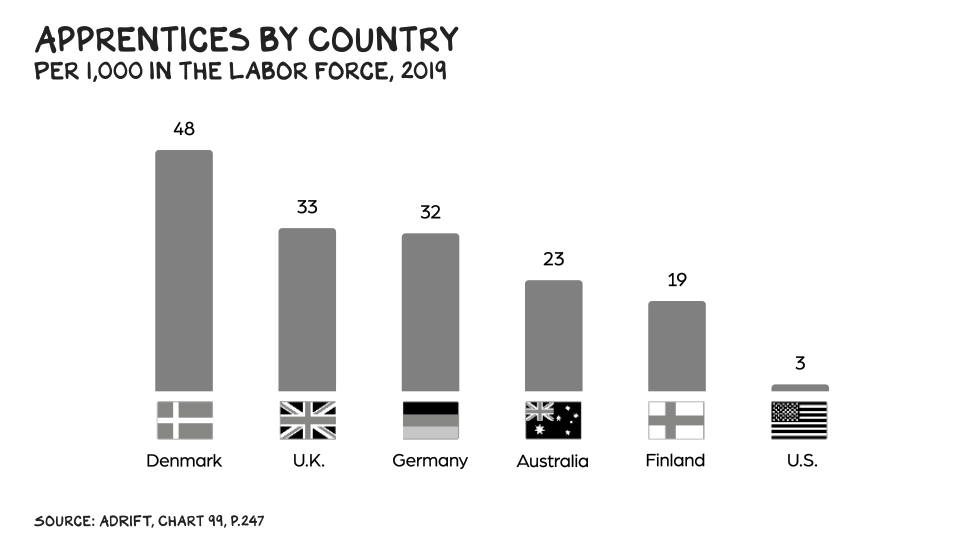

Indeed, as college enrollment declines and student debt rises, communities are rethinking what it means to prepare young people for success. Technical training offers a powerful alternative — one that equips students with in-demand skills and connects them to well-paying jobs in industries that are vital to local economies.

DuGood Gets “LIT”

Conversations between the credit union and college began when a DuGood member involved with the LIT Foundation introduced Wilson to LIT’s president, Sid Valentine.

“We immediately clicked and began discussing ways a credit union like DuGood and university like LIT could work together,” Wilson says.

Lamar Institute of Technology solicited competitive bids and evaluated multiple proposals for an on-campus branch. The school ultimately did select DuGood, and the RFP process helped the credit union hone its plan and determine the best way to serve LIT.

“I’d always had some ideas on how the credit union could serve LIT students, but I wasn’t sure what the actual needs or gaps were in the students’ finances,” Wilson says.

For now, the branch staff will include two to three full-time employees in addition to an interactive teller machine to handle all cash transactions.

“We’ll have tellers available to accept checks, open accounts, and print debit cards, but there won’t be a traditional cash vault or drawers,” Wilson says.

Products Designed With Students In Mind

DuGood did not want to simply establish a campus presence. It wanted to offer products and services that would make an impact, too.

For example, the credit union designed a 0% interest loan to help LIT graduates or soon-to-be graduates purchase essential career-related items such as tools, uniforms, or technology. “Power On” provides up to $1,500 to eligible borrowers, requires no minimum credit score, and offers a 12-month repayment term.

“The Power On loan is to make sure students have everything required to be as successful as possible on day one of their career,” Wilson says. “It’s a service we are well-positioned to offer, and we’re happy to do it.”

According to the CEO, anyone can take out the loan, but the credit union envisions it as an add-on for students who have already joined the credit union and are taking advantage of other services, including student checking and an LIT-branded debit card.

When it comes to checking and debit, the student account features fee-free services, no minimum balance requirement, and Scholarship Reward Points, a cash back-style perk that account holders earn with every purchase and redeem for college expenses.

“There aren’t any strict controls on exactly what they can use it for,” Wilson explains. “As long as they’re an active student and can show proof of enrollment, they can redeem those points for scholarship rewards.”

Financial Education As A Long-Term Investment

Student members can also earn Scholarship Reward Points for engaging in DuGood’s financial wellness resources either in person or through the online platform Enrich, which tracks each student’s use. For example, if a student completes a certain number of courses, they’ll earn bonus points on their debit card.

“That’s one way we can incentivize and reward them for completing financial education courses,” Wilson says. “If they attend an in-person seminar, we can give them bonus points for that, too.”

When students create a log in through Enrich, the system prompts them to complete an assessment to create a customized plan for their needs. Topics include budgeting, managing credit, and student loan repayment. The tool also includes gamification, which makes for a better user experience.

Maximum Impact With Scholarships

DuGood FCU is launching a $10,000 annual scholarship fund for LIT students. Every fall and spring semester, it will award five students $1,000 each.

For now, DuGood will offer on-campus workshops once a semester and also plans to host an annual reality fair. That’s important because, according to Wilson, financial wellness is at the center of the credit union’s mission on LIT’s campus.

“There’s a lack financial education in our society in general,” the CEO says. “The students going into LIT aren’t any different.”

What is different is that LIT offers mostly two-year and trade-oriented programs.

“A lot of these careers pay six figures or more in the first year out of school, and we want students to be as financially educated as possible so they can make smart decisions early in their careers,” Wilson says. “This means being ready to buy a home sooner, understand credit, and avoid common pitfalls that come with a sudden increase in income.”

Although scholarship points go toward debit card users, the resources are available to all students, whether they are members are not. That means smarter students across the board and higher impact for the credit union.

“Hopefully, a lot of students do join,” Wilson says. “Our role is to do good and to help people. The best way we can do that is by providing high-quality financial education coupled with high-quality, low-cost financial services. That’s what we’re there to do.”

DuGood’s investment in LIT is more than a branch opening; it’s a blueprint for how credit unions can support workforce development and economic inclusion. For cooperatives serving regions with large populations of non-degree holders, this model offers a compelling opportunity to meet members where they are and help them go further.