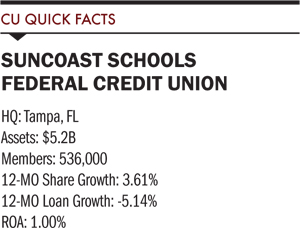

Suncoast Schools Federal Credit Union ($5.2B) is the largest credit union in Florida and the thirteenth largest in the nation. TheTampa-based credit union serves education communities as well as numerous SEGs and communities along the Gulf Coast of Florida. The real estate collapse in Florida, and specifically Fort Myers, hit Suncoast hard from 2008 to 2010. The credit union lost money for three straight years but has since returned to an ROA of more than 1%. Tom Dorety has been the CEO for 16 years.

Tom Dorety

You had a rough patch from 2008 to 2010. What is your strategy now?

Tom Dorety: We had a very hard patch, and we did a lot of things we did not like to do. We had to confront problems, but we never took our eye off the long term. We did not lay off employees; we did not close branches; and we did not drop core services. Because of that, we have a stronger base from which to launch ourselves into this strengthening economy.

What kinds of things are you doing now?

TD: We are working to improve our products. We are aggressively going after adjustable rate mortgages. We have improved our checking account along with our credit card rewards program and the companion program of donating to schools. In general, during the lean years of 2008-10 we could not be generous with our products and services, specifically with rates and fees. We are making up for that now. Our members suffered a lot through the recession and now we want to give back to them. We have returned to paying better-than-market rates and we are more aggressively promoting our products and services to connect with more members.

We are starting a credit card participation program for smaller credit unions. This has taken some time to set up because of regulatory clearance and so forth but we know the credit card business well and owing to the past few years are pretty well-versed on how to collect on them. So we think this is going to be a good long-term effort for us as well as a benefit to other credit unions who want to offer their members a quality credit card program with a trusted partner.

We have increased our efforts to support public education. Our core membership has always been public education: the children, the employers, the teachers, and the community. We are now putting nearly $2 million a year into public education and are the largest nongovernmental contributor to public education in our region. We feel this is not only the right thing to do but also Armed with the knowledge and experience gained from the past few years, credit unions have never had a greater opportunity to build business for the future. that it is the right thing for the long-term benefit of our credit union. We work with school administrators and education foundations and make sure the story of what we are doing with the schools gets out into the Gulf Coast communities.

But our work is not solely with schools. We also support children’s health initiatives. One of our biggest efforts has been to join with other local credit unions to raise $3 million to sponsor the Pediatric Intensive Care Unit and Autism Center at All Children’s Hospital.

Another area we’ve been focused on is employee development. Although we avoided layoffs during the recession, we reduced staff through attrition, trimmed employee benefits and salaries, and cut back on some training programs. We have done a pretty good job with employee compensation over the past 18 months, but when you’re not growing you create fewer advancement opportunities and ways to develop new leaders. Now we’re focused on training efforts at all levels of the organization. We are catching up with a more formal mentoring program and actively engaging younger managers in internal planning and external activities.

We also have launched a core conversion effort. Obviously, this is a massive project for us and is going to take another year or more to finish. But it is going to give us increased speed and flexibility. We’ll have more options than we have now and a greater ease of operation. We’ll be able to add products and code quicker than we can with our old system. No one can say what new sorts technology-based products we’ll want to embrace two and three years from now, but we are laying the foundation for a system that will be more adaptable to accommodating those products when they will be welcomed by our membership.

No one can say what new sorts of technology-based products we’ll want to embrace two and three years from now, but we are laying the foundation for a system that will be more … accommodating.

The younger generation is important t o any credit union’s long-term health. H ow is S uncoast Schools reaching out t o younger people?

TD:We want to be where they are, get their attention, and be transparent. We have more than 30 in-school branches, mostly in high schools, that are run by students. We actively support financial literacy programs and sponsor many student events. We are getting more comfortable with social media and have had success with several contests on Facebook.Mobile access is a priority, and we are in the process of completely redesigning our website [www.suncoastfcu.org]. We’reseeing results the number of new members younger than 18 has increased 28% over the past two years.

In addition to K-12, we are forging stronger relationships with our community colleges. They represent an incredible opportunity for future growth. Not only do they have a solid employee base, they also have students who are mostly young adults living in the community and are likely to stay here after earning their degree.

Any thoughts for credit unions moving forward?

TD: I’ve been in credit unions a long time and I’ve never seen a time with greater opportunities. It’s easy to get caught up in the issues of the day or even those of the past few years. Butwe have to look ahead. We have to be smarter on account of what we have been through over the past few years. But with the knowledge and experience we have gained plus some confidence, effort, and fortitude we can make tremendous strides. This is the perfect time to make the investments that are going to build business for the future.

This Q&A with Tom Dorety, CEO of Suncoast Schools Federal Credit Union ($$5.2B, Tampa, FL) appeared in the October 2012 issue of The Callahan Report. Click here to read the main feature, Look Forward To The Future.