Top-Level Takeaways

-

Pen Air marketers developed a dashboard using nothing more than PowerPoint.

-

The dashboard gives a quick, easy look at marketing ROI and community impact.

Measuring the impact of marketing dollars is an age-old dilemma credit unions around the industry face.

Six months ago, marketers at Pen Air Federal Credit Union ($1.9B, Pensacola, FL) introduced a digital dashboard to demonstrate the value the team brings to the credit union and the credit union brings to the community.

Pam Hatt, Director of Marketing, Pen Air Credit Union

The idea is to better communicate to the board of directors the impact we have on our members, staff, and community,says Pamela Hatt, Pen Air’s director of marketing.

Created in PowerPoint, the Marketing Impact Board is a part of the quarterly board packet and, along with laying out exactly what that department is doing and accomplishing, shows senior leadership how the organization as a whole is reinforcing the credit union’s mission statement Enhancing Lives Through Exceptional Service, Strength, and Financial Solutions.

The marketing team has presented the dashboard twice so far, for fourth quarter 2016 and first quarter 2017, and keeps the format high-level and easy to understand. In addition to being a communication tool for the upper levels of management, Hatt saysthe dashboard also gives staff and volunteers tangible reasons why people should join the credit union.

Click the tabs below to view the slides from Pen Air’s Marketing Impact Report.

MARKETING IMPACT REPORT: SLIDE ONE

Pen Air Credit Union marketers use a PowerPoint template to build the cooperative’s quarterly Marketing Impact Board Report. This slide includes the credit unions communerosity initiatives.

MARKETING IMPACT REPORT: SLIDE TWO

Pen Air Credit Union marketers use a PowerPoint template to build the cooperative’s quarterly Marketing Impact Board Report. This slide addresses the hard dollars the credit union has spent.

Hatt compiles the information provided by her team members and then reviews the dashboard with senior vice president of member experience Angie Betts, who then reviews it with CEO Stu Ramsey.

Currently, the dashboard includes the results of marketing support for business initiatives, such as a credit card campaign reaching 119% of goal with the help of a new commercial.

Public relations reporting captures engagement via Facebook, Twitter, and Instagram as well as appearances in traditional media articles and segments.

Future projects, such as branch remodels and upcoming marketing initiatives, fall under the Communerosity tracking.

Hatt says Pen Air colleague Mark Decker coined that term during a brainstorming session.

Communerosity is where generosity and community come together, Hatt says.Those are two qualities we value highly at Pen Air. We’re humbly generous with our time, talents, and sponsorships. It’s a lifestyle each employee embodies.Communerosity is now one of our core values at Pen Air.

Communerosity breaks down participation in community events, which this past quarter included a golf tournament, school district engagements, and an affinity credit card initiative with the local minor league baseball team and an early childhood developmentgroup.

The dashboard tracks employee volunteer hours 687 in the first quarter of 2017 alone and calls out the top three volunteers by name, position, and hours volunteered.

The dashboard also lists marketing dollars spent per member, which the marketing team has pegged at $3.61 per member, counting charitable giving, sponsorship dollars, and total marketing dollars so far this year.

The credit unions 5300 Call Report lists $11 for that measurement, but Hatt says that includes other special projects that fall into her overall marketing budget.

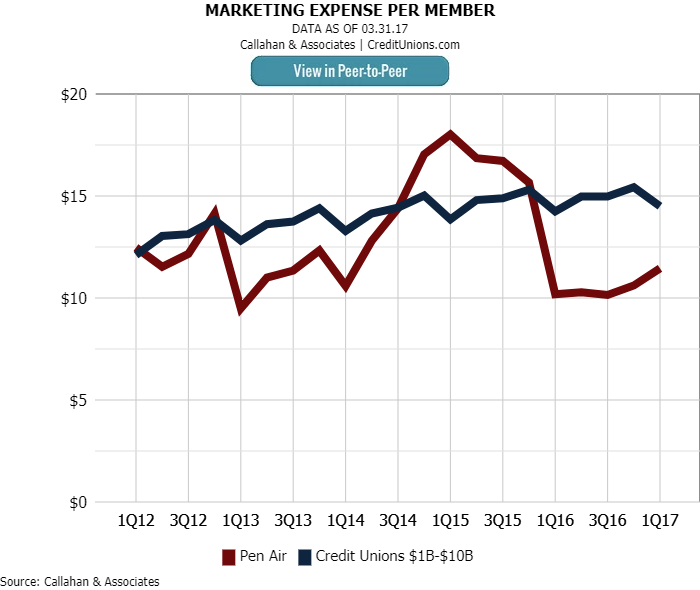

Pen Air spent $11 per member on marketing in the first quarter of 2017, according to the credit unions 5300 Call Report filing. That’s $3 less than the $14 average spent by the 275 credit unions with $1 billion to $10 billion in assets.

That discrepancy in numbers goes to show the different ways credit unions can collect, interpret, and present data to make educated decisions about strategy.

Our financials and the 5300 Call Report tell us if we are spending our dollars in alignment with our budget,Hatt says. Peer-to-Peer reports tell us how we are doing compared with our peers. The Marketing Impact Board communicates how we’re enhancing lives.

Now two quarters in, the Marketing Impact Board has been well received, Hatt says.

The board and C-level appreciate the simplicity and clarity of the information being reported, the Pen Air marketing director says.And, it helps my team better quantify and understand the why behind what we do everyday.

Although the dashboard is easily replicated, it does require work to gather all the data. If a credit unions values arent completely aligned or it lacks focus in its values, deciding what to report on can easily spin out of control.

CU QUICK FACTS

PEN AIR FEDERAL CREDIT UNION

Data as of 03.31.17

HQ:Pensacola, FL

ASSETS: $1.4B

MEMBERS:98,387

BRANCHES:19

12-MO SHARE GROWTH:5.67%

12-MO LOAN GROWTH:21.32%

ROA:0.80%

Hatt makes sure Pen Airs version focuses on two objectives ? showing what her team does in terms of marketing and advertising, specifically, and then on the credit unions community impact.

With these parameters in place, the dashboard helps keep the credit union focused and consistent in its activities and behaviors.

Make sure your culture, core values, mission, vision, and brand are clearly outlined, says Hatt, a 28-year banking veteran who has been with the Panhandle credit union for the past five years.Make sure your staff is developing thesethings so they’re fully engaged. Once you have that in place, creating a dashboard is easy.

Don’t re-invent the wheel.Visit Callahans Executive Resource Center to check out member-donated andCallahan-created examples of tactical documents, policies, and templates. New additions include Pen Airs Marketing Impact Board.