As the chief financial officer at The Summit Federal Credit Union ($1.3B, Rochester, NY), Leanne McGuinness has an inside view of how the cooperative she joined as an accounting manager in 1991 plans its priorities.

So, when choosing what she deemed most important to discuss with CreditUnions.com from among 27 categories in a Callahan & Associates survey about 2023 strategic initiatives, it would seem natural for McGuinness to choose something around ROA, risk management, or fee structures.

Her first pick: board education. The second was increasing member engagement. And she wasn’t alone. Sixteen of the 43 respondents in the planning season survey also chose the former in the multiple-choice poll; 28 chose member engagement.

“Board education is something a lot of credit unions might not put a lot of thought into,” McGuinness says. “But we feel it’s imperative to our long-term success, and it’s also important to the movement.”

McGuinness uses that word — “movement” — very intentionally.

“’Industry’ doesn’t necessarily imply a social purpose,” the CFO says. “We serve a social purpose, and we want our volunteers to have a passion for what they’re doing on the board of a member-owned financial cooperative. For that, they have to understand both our business and our philosophy.”

According to McGuinness, collaborative efforts by the senior staff, long-time board members, and an active supervisory committee help the cooperative’s leadership stay aligned as they bring on new board members and move forward.

“The education they get and bring to the table makes a difference,” McGuinness adds. “It’s hard to quantify, but having a board looking at the right things and asking the right questions helps push us in the right direction on, for instance, creating new products and innovations.”

’Industry’ doesn’t necessarily imply a social purpose. We serve a social purpose, and we want our volunteers to have a passion for what they’re doing.

She points to a recent innovation at The Summit as an example of the member engagement category she also chose to highlight. The Summit’s virtual branch offers basic self-service functionalities, and more are on the way in 2023, including the ability to originate consumer and mortgage loans virtually. That’s fairly typical among tech-savvy cooperatives. But the operation also has four full-time staff using Zoom to provide real-time help.

“We want to meet the members where they want to be met,” she says. “That can’t always be just digitally. The Zoom function provides that extra benefit without the member having to leave the house. That’s another way we can stay relevant.”

Survey Says …

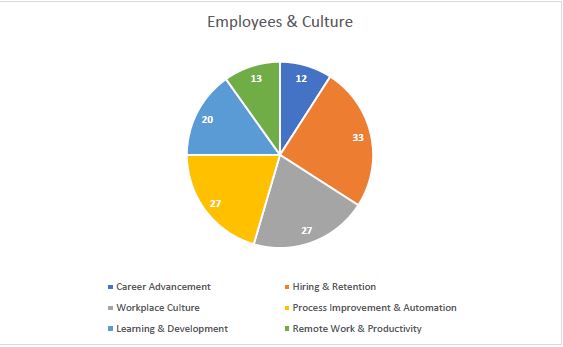

The Callahan survey of 43 credit union executives included 27 choices split into four categories: Board & Leadership, Employees & Culture, Product & Institution Growth, and Community & Members. Participants could choose as many of the areas as they wished, providing a peek at what these credit unions — which covered a wide asset and geographic range — would be taking on in 2023.

Hiring & Retention — which was under Employees & Culture — was selected by 33 of the 43 participants, the most of any single area. Next was 32 for Efficiency — which was under Product & Institution Growth. Meanwhile, 28 credit union executives each selected Deposit & Lending Strategies, Increasing Member Engagement, and Measuring Community Impact.

Increasing member engagement across channels is at the heart of 2023 plans for The Summit. Although COVID-19 proved that not everything can be done remotely, technology can better emulate the in-person experience than ever before.

“The member experience is at the heart of everything we do,” McGuinness says. “Our focus next year will be to continue to expand the way they can interact with us digitally and at the branch.”