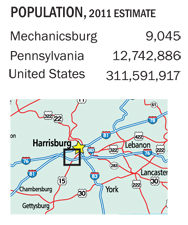

Located in the foothills of the Appalachian Mountains, just minutes from the Pennsylvania state capital of Harrisburg, sits Mechanicsburg, PA. The city is home to 9,000 year-round residents, the largest street fair on the East Coast (during which the town’s population swells to more than 60,000), and Members 1st Federal Credit Union.

The area enjoys low unemployment and steady housing values courtesy of the proximity of the state government. But according to Bob Marquette, president/CEO of the $2.2 billion Members 1st, the area’s diversity of businesses also goes a long way in creating an economically stable environment.

The state government is a huge driver, Marquette says. But you also have several major insurance companies located here. York is more manufacturing. Lancaster is a bit of a combination of agriculture and manufacturing as well as a bedroom community of Philly.

In addition to government, manufacturing, and agriculture, the city is located on a distribution crossroads of sorts. Access to a number of transportation routes puts Mechanicsburg on the backbone of the East Coast, says Fred Ryerse, senior vice president of lending at Members 1st. The city is located on east-west rail lines that run from coast to coast as well as on Interstate 95, the East Coast’s primary north-south roadway.

A lot of goods are dropped by rail, repackaged on to trucks, and distributed to points in the Northeast, Ryerse says. We are two hours from Philadelphia, an hour-and-a-half to Baltimore, two hours to Washington, DC, three hours to Pittsburgh, and three-and-a-half hours to New York City. That’s a huge swath of the American population you could reach by truck in less than four hours.

The city’s access to railways, interstates, and warehouses make Mechanicsburg a major inner-modal transportation hub for both the military and civilians. It’s this access that attracted one of the Navy’s two suply depots, which represents the roots of Members 1st.

Chartered in 1950 to serve the employees of Mechanicsburg’s Navy depot, Members 1st originally catered to the city’s defense industry, a stable employee group with a well-paid membership base. From serving the Navy Depot and the US Army War College in Carlisle, PA, the credit union expanded into a multi-SEG institution in the 1980s. It now serves more than 4,000 SEGs and is adding more than 80 a month ; and competes against some of the strongest bank brands in the country. Wells Fargo, Sovereign Bank, PNC, Bank of America, and Susquehanna Bank (a regional institution) all have a foothold within Members 1st’s market area. Harrisburg is also home to another major credit union, PSECU, which has $4.0 billion in assets. But in no way does the performance of area credit unions pale in comparison to their for-profit counterparts.

The awareness of credit unions, especially in Pennsylvania, has increased dramatically for a number of reasons, Marquette says. Our state credit union association has an I Belong’ awareness campaign

that we’ve strongly supported. On Bank Transfer Day we saw an increase in membership that continued into this year. And consumers are becoming more sensitive to fees.

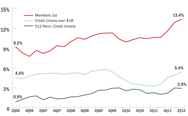

12-MONTH MEMBER GROWTH

VIEW LARGER IMAGE

To entice new members, the credit union has 51 branches spread across a seven county area. Its advertising outreach includes billboards and television commercials. And during an awareness survey the credit union conducted several years ago, nearly 97% of respondents recognized the Members 1st logo.

Our advertising has been effective in cutting through the clutter and differentiating ourselves, Marquette says.

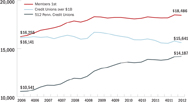

Not surprising, then, for the past six years Members 1st has posted member growth double that of its national asset-based peer group and at least three times that of its state peers. As the institution adds new members and diversifies its loan portfolio, the average member relationship ; total shares and loans per member, excluding business loans; has remained relatively stable.

AVERAGE MEMBER RELATIONSHIP

(EXCLUDING BUSINESS LOANS)

VIEW LARGER IMAGE

The credit union gains nearly 25% of its new members through its indirect lending channels. Although that might seem audacious, especially for credit unions skeptical of indirect lending, Marquette reminds leaders the core of the strategy is still basic lending.

It’s nothing more than approving loans, Marquette says. That’s your bread and butter. If you approve every loan a car dealer sends you, you’re going to lose your shirt. But if you’re lending and underwriting consistently, you’re going to be successful. I make more money on a loan than I make on my investments, so I’ll take that one service member, in the case of an indirect car member and get what I can out of them.

Instead of worrying about the indirect attrition rate, the credit union instead focuses on its conversion rate. According to a study conducted by the credit union, approximately 38% of members who join the credit union through an indirect channel have an additional product within three years. That’s not an insignificant amount of members that move from using a single- product to being an engaged, loyal member. To achieve this, the credit union educates new members about its products and services through a series of mailers and takes a consultative approach in its cross-selling techniques within branches.

MARKET QUICK FACTS

VIEW LARGER IMAGE

Of course, providing members with auto loans is just one way the credit union fulfills its community’s credit needs. The indirect lending philosophy of being there for the member when and where they need the credit union is prevalent in Members 1st’s real estate products, student lending, and even business services. The credit union doesn’t focus solely on one product in its loan portfolio. Instead, it relies on a diverse mix of home runs and solid singles, Ryerse says.

Components such as new auto and first mortgage comprise less of the credit union’s total portfolio ; 7.36% and 25.49%, respectively ; than Pennsylvania credit unions (8.44% and 30.99%) or credit unions of a similar asset size (10.35% and 45.95%). Conversely, components such as other real estate and member business loans comprise more of the credit union’s total portfolio ; 27.66% and 14.33 %, respectively ; than its state peers (24.05 and 3.86%) and credit unions with more than $1 billion in assets (12.75% and 5.96%).

The result is the credit union has no one component in which it is heavily vested; whereas, for example, first mortgages account for slightly more than 45% of the loan portfolio for credit unions with more than $1 billion in assets.

And although the credit union is proud to offer a mix of products, it knows it has limitations.

We don’t try to be everything to all people, Marquette says. With our membership growth, when consumers start borrowing anywhere near traditional volumes, our growth is going to explode. For now, it’s all about promotions. It’s all about tapping into what consumers want. You can’t create loan demand; what you can do is capture a larger share of what is out there.

Want to learn more? Watch the video series: Anatomy Of A Diversified Loan Portfolio.