A Path To Prosperity And Financial Wellness

Some credit unions offer loans for trade schools and vocational programs that provide well-paying jobs without a four-year college degree.

Some credit unions offer loans for trade schools and vocational programs that provide well-paying jobs without a four-year college degree.

More U.S. states are mandating financial literacy courses. Credit unions are responding with tailored approaches to equip students with essential financial skills.

With a designated chief member experience officer and specialized roles for the member journey and product experience, PSECU is reshaping how it orchestrates member interactions.

As Callahan looks back on the year behind, inspiration emerges for the year ahead.

With all external-facing roles reporting to a central officer, teams are focusing less on function and more on members.

PSECU takes a realistic segmentation strategy to keep personalization manageable yet effective.

Credit Unions join to purchase their core data processor.

Some underwriting and belt-tightening, staffing and product changes are part of the response as swiftly rising rates roil the housing market.

Supply still lags demand but price hikes are slowing, and a lot has changed in the past 15 years.

Fueled by job mobility and retirement trends, credit unions are feeling the challenges of replacing C-level managers. Follow these tips for finding the right replacement, keeping projects moving, and easing the transition.

Fluctuating loan demand upset credit union lending pipelines and balance sheets in the first half of the year. How significant were these impacts?

Six data points showcase what’s happening in the U.S. economy that could direct credit union decision-making for the rest of the year.

Credit unions have made the choice to back away from indirect auto lending, but that has come with a substantial opportunity cost.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

Credit unions are reigniting investment strategies amid rate shifts and slowing loan demand.

The need for responsible higher education financing continues to grow, and your credit union has an opportunity to provide affordable, flexible funding for college and technical careers.

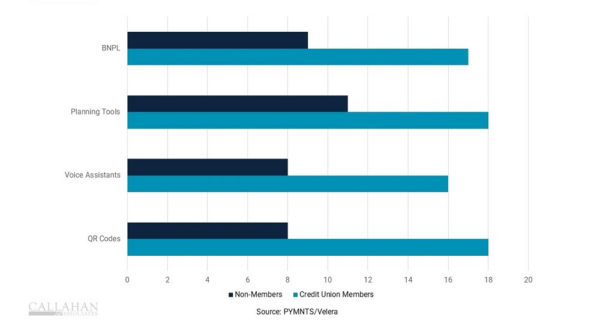

BNPL programs have become a key player in the financial landscape, with some credit unions adopting their own version for their members.

Market pressures and compliance challenges are just two variables pushing cooperatives to hand off their card operations.

How credit card reward programs drive business and loyalty at Alliant and Affinity credit unions.

A March 2024 study determined Buy Now, Pay Later tools are among the top features consumers want from their payments options.