Member business lending at credit unions is growing, and offerings such as business credit cards give credit unions the opportunity to deepen business relationships and better compete with banks.

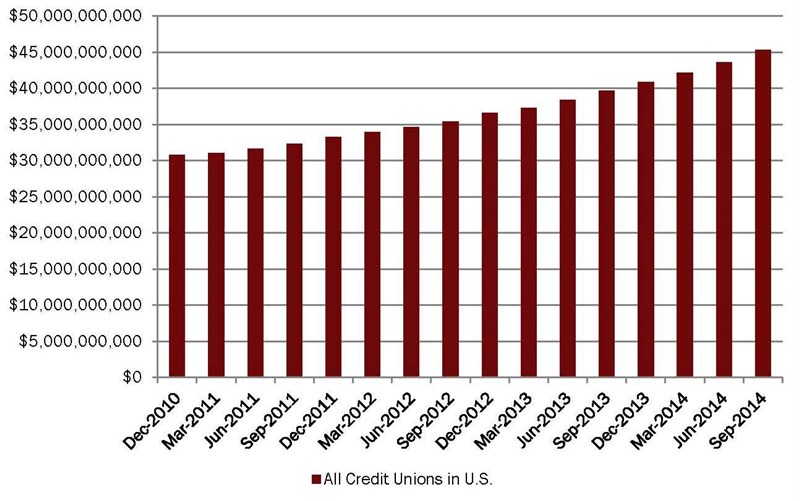

TOTAL MEMBER BUSINESS LOAN BALANCES

For all U.S. credit unions | Data as of Sept. 30

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

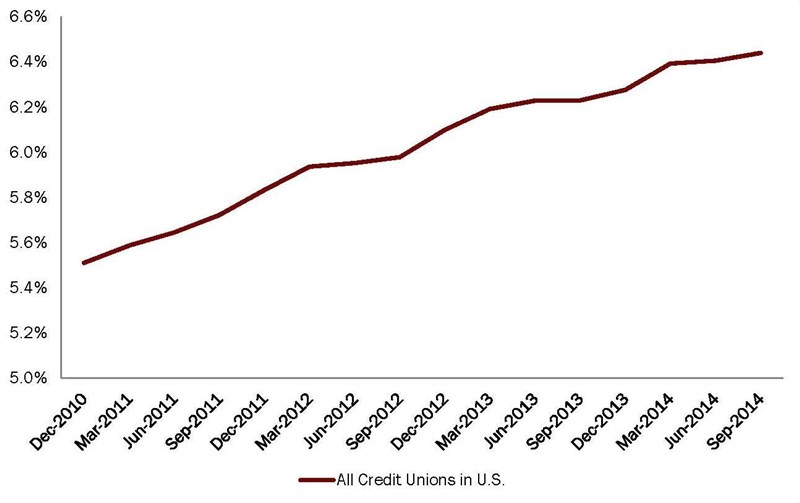

MEMBER BUSINESS LOANS AS A PERCENTAGE OF TOTAL LOANS

For all U.S. credit unions | Data as of Sept. 30

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

Credit unions have myriad best business practices to offer one another. Here are four about credit cards from Ent Federal Credit Union ($4.0B, Colorado Springs, CO) and Numerica Credit Union ($1.4B, Spokane, WA).

Focus On Underwriting

Numerica launched both its business lending and business credit card in the mid-2000s, says Greg Hansen, vice president of business services. The card has a credit limit of $25,000 and carries a rate of prime plus 1.5%, with a floor of 8.9% and a ceiling of 17.9%.

Financial flexibility is critical for the small businesses the Washington state credit union wants to attract, so Numerica strives to underwrite applications within a few hours of their submission. The credit union looks at a variety of factors, such as the organization’s credit report, length of operation, and previous relationship with Numerica. If applicable, the credit union requests a tax return to analyze cash flows and looks for a Debt-Service Coverage Ratio of 1.25. Based on these, the credit union will determine how much credit to advance.

We’re not just handing out credit cards, says Jill Carlsson, SBA and small business underwriter at Numerica. We don’t want to end up with a portfolio we have to charge-off in two months.

The credit union tries to attain a wide view of the applicant’s financial needs so it understands members and can tailor products and offers to deepen relationships.

We don’t look at business credit cards as just transactions where members get their card and we never see them again, Hansen says. We want them to know we are looking at this as an entire relationship.

There Are Benefits Of Keeping Your Portfolio With A Partner Vendor

Colorado-based Ent doesn’t hold credit card loans in its portfolio a fact evident in its Search Analyze reports on CreditUnions.com. Instead, its vendor partner, Elan, manages and underwrites the credit union’s entire portfolio, including its fleet of business credit cards. It’s an advantageous relationship for the credit union, which has approximately 5,500 active business credit cards and $10 million in outstanding balances, as of December 2014.

The partnership reduces the regulatory burden on the credit union and allows it to outsource its marketing efforts, although Ent also sends its own direct mail and uses its own electronic marketing channels.

It’s very cost efficient, says Victoria Selfridge, vice president of corporate communications at Ent.

This relationship works, in part, because Ent is part of Elan’s advisory board. Several times each year, Ent representatives attend meetings to discuss what’s working and what’s not. If performance data is any indication the credit union’s outstanding balances in its business credit card has increased 22% year-over-year there’s more right than wrong.

Elan is open to feedback because they know this is a partnership, says Chris Chippindale, the credit union’s vice president of enterprise initiatives. [Ent’s] name is on the plastic, and we’re standing behind the product.

Market Aggressively Against The Competition

Unfortunately, too few businesses see credit unions as a place to get a commercial loan, a fact acknowledged by Numerica:

If you want any commercial lending product, you go to a bank, Hansen says.

Numerica takes a two-pronged approach to combat this notion and boost its own performance. First, it shows the business community the competitive commercial products it offers. Numerica targets advertisements to a professional services group that lends primarily to those in the dental, medical, legal, and accounting professions and also advertises in local business journals and trade magazines.

Second, Numerica talks to business owners, attorneys, and accountants. Loan officers and other branch staff attend events such as those put on by the Greater Spokane Incorporated, the local Chamber of Commerce.

In its marketing efforts, the credit union promotes several facets of its product and business processes and underscores how competitively priced and responsive it is.

If you are the first to respond, you generally get the loan, Hansen says. So we want to be fast.

Make Cards Part Of A Larger Small Business Lending Suite

Within Numerica’s Business Services department, the credit union offers a suite of products. Business credit cards are a part of a larger portfolio that includes investor real estate and traditional commercial and industrial loans, cash management products, and merchant services, among others. Carlsson estimates that 40-50% of business credit card holders also have another product with the organization.

As of third quarter 2014, member business loans make up 19.23% of Numerica’s total loan portfolio, well above the 6.62% of its asset-based peers. The credit union’s goal in 2015 is to gain an additional $42 million in business loan originations.

We want to offer the full suite of products so we can properly promote business lending and have the entire business lending relationship with the borrower, Hansen says.

The business credit card comprises a small part of the overall portfolio. Outstanding member business loans at Numerica total $229 million. Outstanding credit card balances from the 421 cards in circulation as of January 2015 represent $933,573 of the portfolio But the product contributes to deeper relationships Carlsson estimates 40-50% of those with a business credit card have another business product with the organization and the return is strong, says Hansen.

We don’t lead with it necessarily but it’s a big part of our product suite, he says. We’re able to finance small businesses through [this] product because they don’t need much. They don’t need a big term loan or line of credit. They need $15,000-$25,000 to run their business.