The credit union industry hit a new high in the size of its workforce. The movement added more than 10,000 full-time employees from June 30, 2016, to June 30, 2017, an annual increase of 3.8% that pushed the employment rolls to 287,656 full-time equivalents.

The industry’s 3.8% growth in FTEs defined as all full-time employees and 50% of part-time employees trailed slightly behind its 4.3% membership growth. As a result, members per employee crept up slightly to 385, an increase from 383 one year ago. In the same period, assets reached nearly $1.4 trillion. This pushed assets per employee up from $4.6 million in second quarter 2016 to $4.8 million today, also a 4.3% annual increase.

Employee efficiency also rose. Loan originations per employee increased 5.7% to $1.7 million at the end of second quarter, the highest amount on record. Rising loan balances totaling $923.3 billion as of June 30, 2017 helped push interest income higher, and in turn increased operating revenue to $31.8 billion through the first six months of the year. In turn, revenue per $1 of salary and benefits, a productivity metric used to gauge how much income is generated for every dollar of employee compensation, increased to $3.02 at the end of June 2017, up from $2.97 one year earlier. ContentMiddleAd

Total income per employee has grown 4.9% over the past 12 months to $221,027. From an expense perspective, total non-interest expenses reached $20.5 billion at mid-year. That’s a 6.3% increase from 2016 and a 25.6% increase from five years ago.

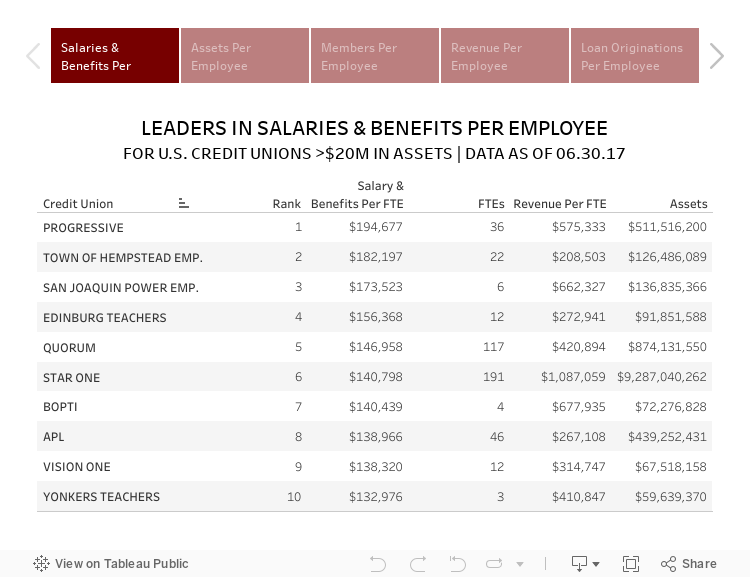

Employee compensation, the largest component of non-interest expenses, accounted for 51.5% of all operating expenses. To retain top talent, credit unions on average spent $73,286 per employee in salaries and benefits in second quarter 2017 that’s up 3.3% from second quarter last year.

Auto loan penetration expanded 1.06 percentage points annually to top 20.0%, showing that credit unions are increasingly extending auto credit. As more members turn to credit unions to finance their vehicles, however, maintaining sound asset quality is imperative for sustainable growth. The industry’s auto loan delinquency increased 1 basis point annually; auto loan net charge-offs increased 7 basis points year-over-year.

The credit union share of the auto finance market nationally increased 1.4 percentage points annually and hit 18.9% in the second quarter of 2017. Despite softening sales in the auto market, credit unions are not skipping a beat when it comes to meeting the vehicle financing needs of members.

Click through the tabs below to see the top 10 credit unions in each leader table.

var divElement=document.getElementById(‘viz1513709838747’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

var divElement=document.getElementById(‘viz1513709838747’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

See the rest of these tables and explore dozens more along with hundreds of pages of credit union performance data in the 2018 Callahan Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

CASE STUDY

Producing Innovative People And Products

Virginia Credit Union | Richmond, VA | Assets: $3.4B | Members: 262,178

Virginia Credit Union has undertaken a hiring surge to find top talent that will help lead the credit union into new areas of innovation.

Chris Saneda, executive vice president and chief information officer, says VACU budgeted 100 new positions in the past two years to support overall operations, particularly focusing on new levels of productivity in mortgage lending and digital engagement.

We have great confidence that the combination of three disciplines data, process, and innovation will lead us down a path of creating engaging experiences for our members, president and CEO Chris Shockley says. Ourstaff has already worked in harmony to produce a pilot mortgage app that has reduced errors and taken four full days off the mortgage process.

Indeed, shifting its focus to first mortgages has helped VACU double its mortgage business. And 77% of its checking account holders actively participate in online banking, 35% are active in the mobile channel.

The process component includes addressing specific business project needs ranging from a better understanding of operational capability to creating a smarter next-best-product model.

We’re using design theory and Lean Six Sigma with our current projects because they bring direct value to enhancing efficiency and removing barriers, Saneda says.

There’s also an innovation team that concentrates on ideation, creation, and evaluation.

We’ve asked them to focus on a small number of initiatives so they can quickly identify the right areas for investment, the EVP says. They’re guided by a crossfunctional team with leaders from technology, products,and marketing.

Importantly, the effort to create new products and processes includes giving some leeway.

Because the innovation team’s approach differs significantly from our traditional practices, they’re not subject to the rigor we customarily put forth, Saneda says. The intent is to try new ideas and assess what wecan integrate into mainstream practices to introduce leap-frog capabilities for our members that we might otherwise not consider.

Read The Whole Story

How Do You Compare?

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics. More insightful performance comparisons start here.