Digital banking has long been promised as the future of banking. Each year, annual predictions and outlooks all echo the same sentiment — the decline of the branch, the year of digital dominance, and the top digital features that will be sure to change banking forever.

However, an interesting thing happened in 2022. Financial institutions shifted focus from providing more digital banking tools to increasing adoption of those tools among their member base, particularly among those resistant to digital banking.

In Engageware’s ENGAGE 2023: Customer Engagement in Banking, Annual Trends Report, more than 100 banking leaders were surveyed to better understand their challenges and priorities for 2023. Fifty-three percent ranked digital adoption as their top institutional priority for 2023. Why? The industry is facing a staffing shortage — 50% of banking leaders ranked staffing as the top challenge heading into 2023, a 66% increase from 2022. Digital adoption is no longer a nice to have, it’s a necessity for credit unions to overcome staffing challenges.

The Digital Adoption Challenge: As Told By Your Peers

The survey, conducted in August of 2022, included both quantitative and qualitative questions. Although the quantitative results were profound, the qualitative insights illuminate the impact of members resistant to digital for common banking questions and needs.

Here are just a few of the comments shared by your professional credit union peers:

“We need a better solution for the 3,000+ phone calls a month we get asking what the balance in their account is — currently being answered by a live person.” — $500M asset credit union

“How do we get more members to realize everything they can do digitally?” — $300M asset credit union

“Member resistance to change and adoption of technology moving away from how services were traditionally previously delivered.” — $275M asset credit union

“Members continued reliance on physical branches vs. digital banking.” — $600M asset credit union

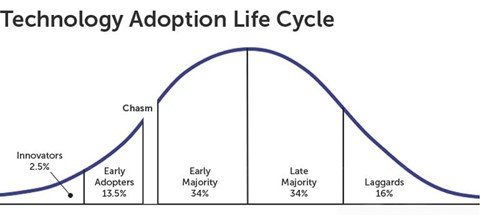

Crossing The Digital Banking Chasm

Geoffrey Moore’s 1991 book Crossing the Chasm highlights the dynamics faced by innovative new products with a particular focus on the chasm, or adoption gap, that lies between early adopters and the late majority and technology laggards. Moore introduces the Technology Adoption Life Cycle — which begins with innovators and moves to early adopters, early majority, late majority, and technology laggards.

The key takeaway for credit union leaders focused on driving greater digital adoption is this: How you promote new technology to early adopters is fundamentally different from how you promote new technology to the early majority and especially to the late majority and laggards.

For credit union leaders looking to increase digital adoption, the tactics that worked for the Innovators and Early Adopters will not work for the Late Majority and Laggards. The answer isn’t more digital solutions, the answer is adjusting how you promote your digital offering.

Driving Adoption With Late Majority And Laggards

The answer for many has been to introduce more and more technology — virtual banking, virtual assistants, personalization, and online account opening. But if the late majority and laggards haven’t adopted basic digital banking features like online banking and mobile banking, the solution isn’t more technology. The solution is adjusting how you introduce these members to your digital offerings.

For the late majority and laggards who rely solely on branch or contact center staff, the opportunity to drive adoption rests with your employees. Your staff must become technology advocates that inform members that self-service technology solutions exist and teach members how to use the technology. Given the current staffing challenges, this might seem like more work for your already overburdened staff. However, the adage of “Give a man a fish and feed him for a day. Teach him to fish and feed him for life.” applies here.

A contact center leader at an $850 million asset credit union recently shared their approach and the results it has had:

“When a member does get into our call center and asks us very general questions, we will redirect them. You know, Mr. Jones, I am glad that you called in today. Were you aware that we have this tool on our website on our mobile app, where you can ask this question, you can get some self-help if you need to, especially because we are not here 24/7. Right now, this is a great resource for you to be able to get the answers you need when you need them.”

Investing In More Digital Or Employee Empowerment Solutions

A contact center leader at a $1 billion asset credit union shared the challenges they face with staff being digital advocates:

“Member-facing staff are resistant to digital options — they are unable and often unwilling to assist members who are having trouble because they do not understand and pass the member off to marketing for help.”

As credit union leaders consider their 2023 digital strategy and budgets, the question is this: If digital adoption is a key priority — do you invest in more digital solutions that the late majority and laggards won’t use, or do you invest in resources for your employees to become digital advocates?

To cross the chasm of digital banking adoption, credit union leaders must provide their employees with the resources and job aids to become digital advocates. Although you might never get 100% digital adoption, reducing the number of calls and interactions asking for account balance by even 50% will have a profound impact on your staffing efficiency and overall member experience goals.

Engageware is the leading provider of customer engagement solutions for the credit union and banking industries. Trusted by hundreds of financial institutions, Engageware’s Appointment Scheduling, Employee Knowledge Management, and Customer Self Service solutions help credit unions and banks improve customer experience, operate more efficiently, and drive greater growth by enabling customer engagement at every touchpoint.