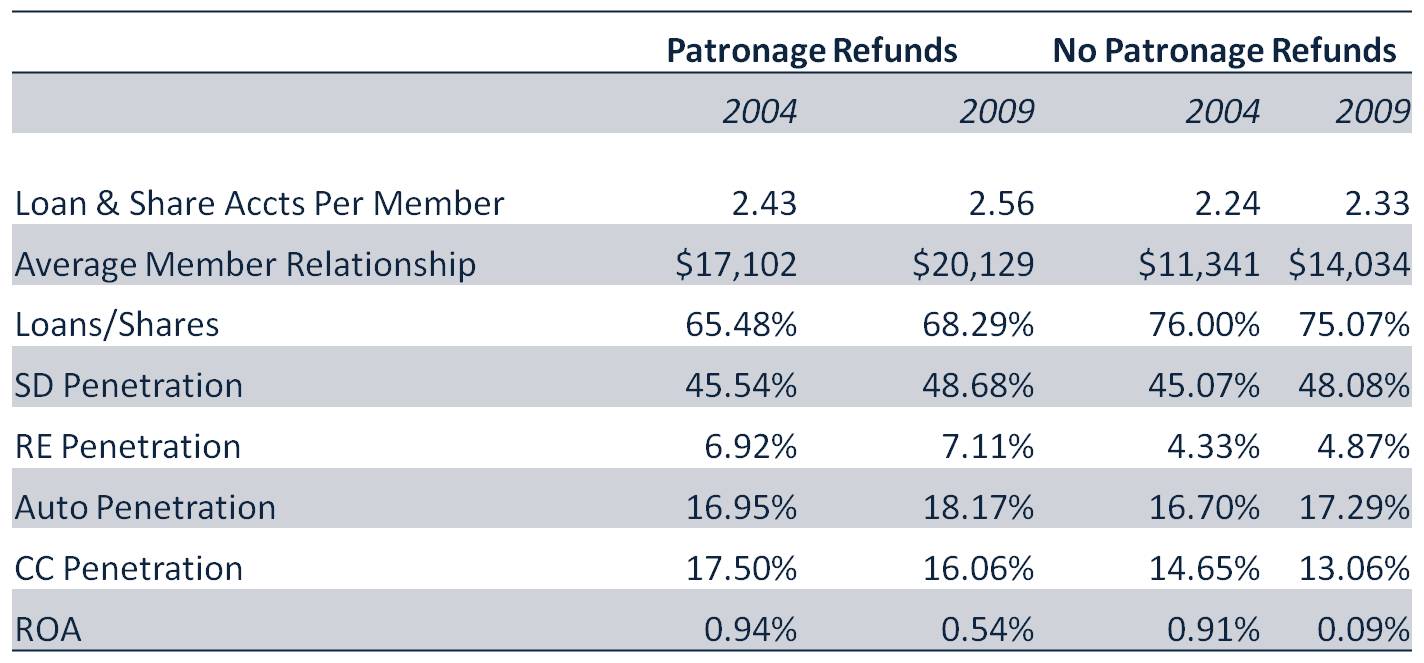

To understand the pros and cons of patronage dividends, it can be helpful to take a quick look at the data. So, our analysts provided one quick scan of the industry. To do so, they split credit unions into two categories: Patronage Refunds and No Patronage Refunds. Here are the definitions of the two categories.

Patronage Refunds Credit Unions are defined as:

- Credit unions that reported at least $50,000 paid out each year in interest refunds for the past five years.

- Twenty-seven credit unions (out of 7,556) fit this profile.

- The cut-off of $50,000 was used to weed out credit unions who reported an interest refund due to account errors and small credit unions whose quick growth would influence the analysis.

No Patronage Refunds Credit Unions are defined as:

- Credit unions that reported a $0 value of interest refunds each year for the past five years with an asset size of $100M to $1B.

- 1,118 credit unions fit this profile.

- An asset range was used to approximate the average asset size of the patronage refunds group to avoid any discrepancies due to asset size (which has the impression of influencing financial performance metrics and product penetration rates).

Now that the categories have been defined, here’s a quick look at the balance sheet health of the two groups.

Source: Callahan’s Peer-to-Peer software.

We can also take a look at how member relationships have progressed for the two groups over time.

Source: Callahan’s Peer-to-Peer software.

Although not all-encompassing, this comparison should give you an idea of the differences in performance between these two groups of credit unions.

Note: Watch for an upcoming report from Filene on patronage dividends.