A long-term focus on boosting community prosperity combined with visits to cooperatives around the world has inspired University Federal Credit Union ($2.7B, Austin,TX) to redefine and expand how it can improve the quality of life for members and more.

In April 2018, UFCU’s board of directors approved a carefully crafted motion that formally pivoted the credit unions focus and codified the cooperative as a social purpose credit union. UFCU is not only committed to staying true to its roots and mission but also is doubling down on the seventh cooperative principle concern for community as a part of its commitment to community financial health.

“All credit unions serve a social purpose. At UFCU, we’re reaching well beyond financial services to influence secondary education, middle skills employment, and housing affordability,” says UFCU CEO Tony Budet, who spearheaded this new vision that puts community impact at the forefront of everything the credit union does. “Under the umbrella of community financial health are challenging and meaningful objectives that have ignited the imaginations of our board, executive team, and staff.”

UFCUs board and executive team includes many local leaders who actively work to improve the Austin community. The credit unions new focus resonated with these stakeholders, who were eager to leverage UFCUs brand and scale to accomplish more than they could individually.

Being a social purpose credit union means Budet has focused as much as 70% of his time on community issues while the executive team at UFCU handled most day-to-day matters. Currently, the CEO spends approximately 30% of his time outside of the credit union. The credit union is shifting strategy so, over time, everything it does will be in service to three high-impact areas: education, employment, housing affordability.

High-Impact Areas

UFCU has been the No. 1 mortgage lender in the Austin area for the past three years. Not bad for a credit union that opened with 30 members and $855 in deposits.

UFCU was founded in 1936 to serve the University of Texas. Today, it serves more than 200 universities, associations, and employers in Central Texas and Galveston County. Many of its select employee groups are connected to institutions of higher education, and the credit union recognizes that mid-skill employment industries such as plumbing and HVAC that require training that falls between a high school diploma and four-year degree is vital to the Texas economy.

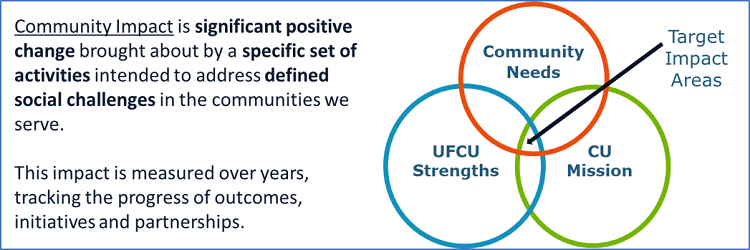

With the end goal of creating a financially healthy community, UFCU identified the top social and developmental issues in its service area. It then compared these issues against the strengths and mission of the cooperative to select three areas in which it could make the biggest impact.

A community truly prospers when its people are financially healthy and have ample opportunities for quality education, employment, and housing, says Heather McKissick, senior vice president, community impact for UFCU.

Programs For Education

To improve area education, UFCU worked with the president of each university it serves to learn about the strategic goals of the institutions. This enabled the credit union to identify common priorities, which include:

- Increase first generation college student graduation rates.

- Increase two-year certification completion rates.

- Reduce time to first employment.

- Improve socioeconomic mobility.

Armed with this information, the credit union has started creating programs to support the goals of the universities. UFCU Scholars, for example, provides college scholarships and paid internships along with financial health training, savings incentives, and mentoring and networking opportunities. It benefits the students who participate, but it also benefits the credit union. Through their firsthand experiences, scholars naturally become ambassadors for UFCU and share the credit union difference with their classmates.

UFCU Scholars

The UFCU Scholars Program has provided college scholarships, paid internships, financial health

UFCU Plan U

Plan U helps skilled employees at UFCU’s SEG partners reduce debt, build better credit, and increase savings.

To date, the credit union has given $300,000 to more than 150 scholars, provided 18 internships, and funded 78 high school equivalency fee waivers through the program.

Programs For Employment

Because of the link between education and employment, some of UFCUs programs benefit more than one high-impact area. For example, the UFCU Scholars Program promotes both education and employment. However, the credit union also is tailoring specific assistance for mid-skill employment.

Plan U offers online and in-person financial health counseling, education, and special product offerings for the mid-skill employees of UFCUs partner groups. Although still in the pilot stage, the program has helped more than 50 participants reduce debt, build better credit, and increase savings.

Programs For Affordable Housing

In the area of affordable housing, UFCU is partnering with Foundation Communities on a facility called the Prosper Center. Foundation Communities is a local nonprofit that offers attractive, affordable apartments with on-site support services for education, financial stability and health. Credit union volunteers, sponsorships, and programs, ensure the community has access to such essential services as:

- Tax preparation.

- Financial health counseling and education.

- Down payment savings programs.

- Mentoring, tutoring, and after-school care.

This partnership currently provides support services and affordable housing to more than 2,800 families.

Lessons Learned And Looking Ahead

UFCU has learned that measuring the real impact of its efforts is a long-term proposition.

“How to measure the big-picture impact is not an easy or quick thing,” McKissick says. “It’s not just a credit union challenge, all social purpose businesses are grappling with the same thing.”

At this stage, the credit union is measuring participation, process, and outcomes. And, it’s learning a lot along the way.

“Partnering with organizations that already have a good handle on those long-term measurements is key,” McKissick says. “We don’t have to reinvent a way to measure impact just expand the thinking to include how we’re working on these areas together.”

She encourages other cooperatives to take their time throughout the process from identifying the areas where they can make the most impact to measuring the end results.

“Don’t be in a hurry,” she advises. “This is not just another marketing angle.”

Purpose=Impact

Purpose-driven organizations outperform the market, have an easier time attracting and retaining employees, and are changing the way businesses think about their roles and responsibilities to society.

Sustainable Business Strategy with Rebecca Henderson teaches credit union leaders that being purpose-driven is more than being a community-forward organization and helps them re-examine their part in ensuring the long-term prosperity of members, employees, communities, and the environment.

Credit unions need to deeply and clearly understand the needs of their communities to ensure they design the right programs to make a lasting difference. Involving the entire organization, from the board level to front-line staff, is key in doing this. For its part, UFCU embeds its employees in its social purpose mission.

“It’s not just something you can slap a logo on and expect people to get behind” McKissick says. “This is about who we are as an organization. The staff has to make it come to life.”

That means a credit union must dedicate a great deal of time to educating staff members about community needs and connecting the dots so it is clear how their day-to-day jobs and volunteer support have a significant lasting impact.

For UFCU, taking the time to fully onboard employees resulted in 53% of employees volunteering more than 3,000 hours in 2019.That’s a total contribution of $76,200 worth of volunteer time plus more than $160,000 in monetary donations through the employee matching program alone.

And, this is just the beginning.