Top-Level Takeaways

-

A growing staff at the SECU Foundation relies on resources provide by the large credit union.

-

Grant review often starts at local branches with advisory boards that have a personal connection with the community.

-

The foundation’s work underscores SECU’s commitment to corporate responsibility.

As the charitable arm of the nation’s largest state-chartered credit union, the SECU Foundation has funded high-impact projects that improve the quality of life in every one of North Carolina’s 100 counties.

The 501(c)3 receives more than 100 funding inquiries every year and relies on local advisory boards to help vet applications. Final approval for projects comes from the foundation board, which itself is appointed by the corporate board of the foundation’s parent organization, State Employees’ Credit Union ($40.1B, Raleigh, NC). The approval process reflects the deep level of integration that exists between the foundation and SECU, whose membership claims approximately one-fourth of the state’s population of 10 million people.

One of the most important things about our foundation is that it’s supported by the entire organization, says Jama Campbell, who four years ago became the foundation’s first full-time employee and its executive director.

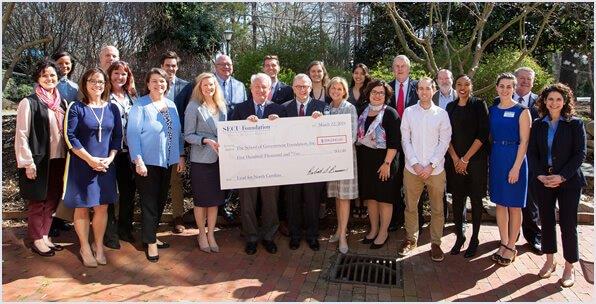

The SECU Foundation awarded a $500,000 grant to Lead for North Carolina, a program sponsored by the University of North Carolina at Chapel Hill that will provide two-year paid local government fellowships for 20 college graduates across the state.

That support comes in myriad forms. The foundation’s primary source of funding is a $1 monthly contribution from 1.4 million checking account holders at SECU. Members can opt out of the contribution and instead pay a $1 monthly maintenance fee, but few do. Consequently, the foundation has access to approximately $16 million a year in income that underpins the $169 million in grants it has awarded since its founding in 2004.

From Board To Board

Jama Campbell, Executive Director, SECU Foundation

The board of the SECU Foundation — which includes the 11 corporate board members of SECU plus up to five additional outside directors — has the final say on grant approval. The panel acts on recommendations from several layers of review, often beginning with the local branch advisory boards.

Every SECU branch has an advisory board that consists of 12 seats — meaning there are more than 3,000 advisory board seats available to members across the credit union’s 272-branch network. The boards each provide a close-up view of their local community and engage with the foundation whose work also includes the efforts of many of the credit union’s 7,100 employees.

We’re supported by operations, accounting, lending administration, internet services, marketing, and administration, says Campbell, who worked for SECU for two decades, most recently as vice president of branches, before becoming executive director of the foundation.

Her experience at SECU made her an ideal fit for a job that involves marshaling the skill sets of every department at SECU and juggling the input of the member advisory boards at every branch.

We have the power of the entire SECU organization behind us, which enables us to do what we’re able to do, Campbell says.

SECU Foundation funding has helped ABC of NC build a 26,000-square-foot facility in Winston-Salem for diagnoses, treatment, and support for autistic children and their families.

In her years of branch management, Campbell herself worked with grant applicants, the advisory boards, and other stakeholders and gained firsthand knowledge of the challenges and opportunities the money helps address. That inside view made her the right person to step up when the foundation needed someone’s undivided attention.

Things were split up among people who had other jobs, Campbell says. That worked, but the time came for the foundation to have its own dedicated staff. We needed that to grow our visibility and impact.

Building Staff And A Career Path

Campbell now manages a staff of three plus herself, a team that helps the foundation build its own capacity while providing avenues of opportunity like those available at the big credit union.

We now have a vice president, project coordinator, and administrator that work with scholarship and internship programs, the executive director says. Our career path for program officers is similar to that available to a loan officer within SECU’s branch network.

Establishing a charitable foundation offers several benefits for credit unions. For those interested in standing up their own foundation, check out the Guide To Foundations from Callahan & Associates. It’s got credit union insights on what it takes to launch, lead, and fund a credit union foundation.

In fact, the foundation’s work includes a lending element — including loans to developers of affordable housing for teachers and Habitat for Humanity projects — that’s a good example of how the foundation relies on the credit union’s internal resources to administer key elements of philanthropic work.

Campbell expects to add a few more people in the next couple of years as the foundation increases both its capacity and visibility. That visibility is another critical component to the foundation’s success.

Growing Exposure And Engagement

The foundation’s current employees are all previous SECU staff members. They have a lot of visibility into SECU, and they want credit union employees to have visibility into the foundation.

We constantly remind the whole staff about our processes and how we want them to be an integrated part of what the foundation does, Campbell says.

Leverage Your Purpose For Greater Impact

Organizations that are purpose-driven out-perform the market, have an easier time attracting and retaining employees and are changing the way business think about their roles and responsibilities to communities and society as a whole.

Sustainable Business Strategy with Rebecca Henderson teaches credit union leaders that being purpose-driven is more than being a community-forward organization and helps them rethink their roles and responsibilities to members, employees, communities, and the environment.

The foundation executive director does her part by speaking at senior vice president meetings, manager and supervisory seminars, and gatherings with an educational bent.

Visibility is important externally, too. Along with the foundation staff, the advisory board members act as representatives of both the credit union and the foundation, helping to identify needs and grow awareness of what SECU is and does as a financial institution and a philanthropy.

We want the citizens of North Carolina, along with other organizations and financial institutions, to understand how serious we are about corporate responsibility and giving back to the community, Campbell says. We always have, of course, but the foundation allows us to take that to a whole new level.

This is the second of a two-part series about the SECU Foundation. InPart 1 learn more about the foundation’s origins, funding, and grant-making.