Top-Level Takeaways

- Using geofencing technology, some credit union marketers are setting virtual geographic perimeters around a physical location and targeting promotional offers to consumers who enter selected zones.

- Heritage FCU and Northern Credit Union are two credit unions that are using geofencing for home sales.

The credit union mortgage portfolio totaled $435.7 billion in the first quarter of 2019. That’s a 61% increase over five years ago and the industry’s highest total to date.

But as rates have risen in the past several years although this might soon change the market has shifted away from refinances and toward purchases. This change combined with advances in technology has ushered in a new era in mortgage marketing.

Today, credit unions using geofencing marketing strategies are able to set a virtual geographic perimeter around a physical location and target promotional offers to consumers who enter selected zones.

For example, a credit union might geofence a branch location, SEG sponsor, or auto dealership to determine who is going where. From that, the organization can infer what marketing might meet the needs of a particular group of members. Do these members need deposit products? Do they need consumer loans? Perhaps best of all, this degree of geofencing is easy and inexpensive.

Geofencing for mortgages has proven more problematic. But, as more credit unions search for a solution, strategies are emerging.

Geofencing With Targeted Ads

Heritage Federal Credit Union ($616.3M, Newburgh, IN) is a mid-sized credit union in a smaller market. The cooperative deployed geofencing in branches, SEGs, and home shows for two years before a conversation with a third-party digital vendor spurred the idea to try out mortgage-specific geofencing.

“We loved the idea,” says Holly Smith, the credit union’s vice president of marketing. “The hardest thing was determining how to get a list of addresses.”

After some internal deliberations, the credit union landed on a solution. Every two weeks, it imports the sale listings from the four largest realtors in its market. The credit union is able to download these lists for free, and armed with the data fence each address.

New home listings often mean open houses with attendees to target, and unlike for consumer loans, people tend not to shop for a house until they are ready to buy.

“If they are looking at a home, they are looking to move,” Smith says.

The Hoosier State cooperative also geofences its local VA clinic, Armory National Guard, and other military locations to identify potential borrowers for its VA loans. Once a potential buyer enters the fenced space, the credit union drops a cookie onto their device. Heritage then targets them via search, social media, and app ads.

Smith works with a vendor to administer Heritage’s geofencing strategy. The vendor handles the home listings. Smith, meanwhile, maintains her own schedule for updating marketing materials, which, in some apps, can change every two weeks. As for cost, the credit union pays at a cost-per-thousand, which keeps the overall cost low. In June 2019, the credit union hit 98% for its impression goal. Here’s how those numbers break down.

GEOFENCE IMPRESSIONS AND CLICKS

FOR HERITAGE FCU | DATA AS OF 06.01.19 06.30.19

| Open House | VA-Specific | |

|---|---|---|

| Impression Goal | 187,500 | 93,750 |

| Impression Actual | 167,767 | 108,637 |

| Clicks | 348 | 192 |

| CTR | 0.21% | 0.18% |

In June, Heritage received more than 280,000 impressions on its geofenced mortgage marketing messages and nearly 550 clicks.

What Heritage can’t do yet is tie clicks to corresponding closed mortgages. It’s working to devise a solution and in meantime plans to continue its current geofencing strategies until 2020. At that time, it will reassess its technical ability and possibly introduce additional targeted functionality.

Heritage: 3 Tips To Geofence

Geofencing is straightforward on the surface, but there are several variables to consider. Here, Holly Smith, vice president of marketing at Heritage FCU, offers three.

-

Consider The Audience: It’s easier to put together a marketing message for an auto dealer or an open house. You have to be more strategic when it’s an employer and market around additional criteria, such as do they get bonuses or stock options and what is their household income?

-

Consider The Message: Sometimes you need to remain general. We had a local competitor who was merging into another financial institution and closing branches. That’s a sensitive opportunity. We geofenced the closing branch locations and sent conservative messages to those potential members.

-

Build Trust: Our leadership trusts our marketing team to put the right tactics in place for the best return, despite the fact that there are challenges in tying impressions and clicks to outcomes.

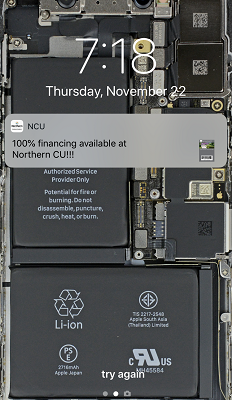

Geofencing With Coupons And Push Notifications

Like Heritage, Northern Credit Union ($257.9M, Watertown, NY) is a mid-sized credit union that operates in a smaller market. The credit unions also used geofencing in other ways before translating it to mortgages.

When it launched its Facebook page, Northern’s marketing team geofenced its own branches and parking lots to target display ads that encouraged visitors and passersby to follow the credit union on the social platform.

When it came to mortgages, however, the credit union tried something different.

Northern had an established history with coupons its loan officers handed out coupons that provided a $100 discount at closing. But as is the nature of paper, its effectiveness ebbed and flowed.

“People throw paper away, and they hardly returned the coupons,” says Daniel Estal, the credit union’s vice president of lending and market development. “Once we stumbled onto geofencing, we thought, let’s modernize this coupon for the digital age.”

Estal is a part of Apple’s Developer Program, which provides him a license to write and issue mobile coupons through Apple’s PassKit framework. Through this, he designed a mobile coupon that offers $100 off when a borrower closes their loan with Northern. All interested members need to do is add the coupon to their Apple or Android Wallet.

To generate downloads, loan officers talk with members about the offer at pre-approval, and the marketing team runs promotional material on the credit union’s website and social media channels. Additionally, members can text HOME’ to the credit union’s main number to request the coupon.

And better than paper, the credit union is able to update its coupon without asking members to download it again.

“We’re able to update the mobile coupon whenever we want and push out those updates to all phones instantly,” Estal says.

Once someone adds the coupon to their mobile wallet, the geofencing begins.

Northern has geofenced many of its competitor’s branches. When a coupon-holder pulls into one of those locations, Northern serves them with a push notification promoting the credit union’s interest rates or financing options.

The credit union knows who uses a coupon, but Estal uses the Call Back feature in PassKit as an additional source of data. He receives an email when a member downloads, activates, and subsequently deactivates the mobile coupon, which registers a city location. If there is no city location, he’ll determine where the borrower is located via an IP address lookup.

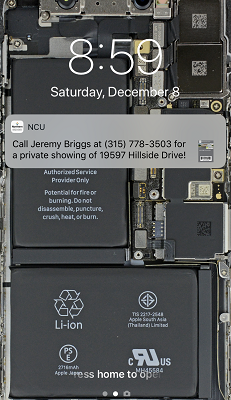

That’s not the only flavor of mortgage-related coupon the credit union offers, either. It offers a co-branded mobile coupon to its real estate partners as well, a similar coupon that specifically promotes area open houses. The coupon itself also includes loan officer information to spur pre-approvals.

Northern then geofences the homes. It serves those who download the coupon with a push notification inviting them to the open house or, once they’ve visited, more direct messaging enticing further contact or even an offer.

Geofencing With Northern

“After open houses, buyers often drive by the property multiple times to look at it again,” Estal says. “How does it look during the day? At night? On the way to work?”

Northern introduced its mobile coupon in summer 2018. It has received 272 downloads, 55 of which are still active. According to Rochelle Runge, the credit union’s marketing supervisor, the coupon has resulted in more than $500,000 in loan volume.

Northern’s geofencing expenses are low and mainly related to the coupon’s offers. In 2018, according to the credit union, ROI was nearly 3,000% with room to improve, especially as more members rely on their phones to manage their financial life.

“As more people become aware of the functionality and learn how to use it, we think its use will increase,” Runge says.

Northern: 3 Tips To Geofence

Geofencing is straightforward on the surface, but there are several variables to consider. Here, Daniel Estal, vice president of lending and market development at Northern credit union, offers three.

-

Track It: There are tracking tools in the program we use, but we had to refine the process ourselves. That would be helpful to have in the beginning.

-

Distribute It: At first, members could download the coupon with a loan officer or find it on the website or on social, but we were able to get it to the masses when we introduced our automated text option.

-

Do More: Our real estate partners don’t have to create anything our marketing team does all the co-branding. This has helped us drive referral business outside the coupons themselves just by strengthening these relationships.