Top-Level Takeaways

-

1st Financial earned CDFI status in 2014 and has since focused on creating a community impact through financial products and services.

-

The credit union recently produced its first impact report, which spotlights members who say their credit union helped them improve their financial security.

Five years ago, soon after being designated a community development financial institution, 1st Financial Federal Credit Union ($251.9M, Wentzville, MO) quitjust writing checks and dug in personally with the community it has long served.

Founded in 1968 by labor union members to serve McDonnell Douglas employees, the cooperative now works closely with non-profits in the St. Louis area to provide job training,financial education, and diverse products to its diverse membership.

We serve a wide range of members, with our two main targets being well-paid manufacturing employees and underserved families living below the average household income, says Laura Woods, 1st Financial’s vice president of marketing and community presence.We’ve turned what was traditional community engagement into targeted access to disenfranchised communities.

Here, the 10-year veteran of 1st Financial answers questions about the credit union’s approach to people helping people in and around St. Louis.

What does your title with community presence added to marketing say about 1st Financial’s commitments?

Laura Woods: Like most credit unions, community engagement was always lumped under marketing and widely ignored. And for many years we operated under a typical structure, meaning we visited cafeterias and hosted lunch andlearns.

We stopped cutting small checks and focused our community engagement efforts on nonprofits and government programming that deals with job training, education, and sustainable housing.

However, after receiving our CDFI designation in 2014, we began examining how we defined community development and how we could create a greater impact in the communities we serve.

After a lot of research, listening, and meeting with community leaders, we stopped cutting small checks and focused our community engagement efforts on nonprofits and government programming that deals with job training, education, and sustainable housing.We began donating funds, volunteer hours, financial literacy, and account access to the clients of nonprofits that are wholly focused on those areas throughout our field of membership.

We’ve donated significant time and money. We’ve opened more than 15,000 savings and checking accounts for households that were otherwise underserved by traditional banking institutions.

What is your service area? Why do you target it?

LW: 1st Financial uses 203 census tracts around St. Louis to effectively track and set goals for some of those most egregiously affected areas of poverty and traditional banking divestment.

Laura Woods, Vice President of Marketing and Community Presence, 1st Financial FCU

Following the 2009 recession and collapse of manufacturing in St. Louis, the jobs that once provided a ladder up for minorities disappeared. Being unbanked, unemployed, and without access to safe housing or financial services, it became difficult to buyor rent a house, buy insurance, and in some cases, find employment.

According to the FDIC’s 2013 survey, 50.8% of African American residents of the St. Louis area were either unbanked or underbanked nearly double the national average. The Urban Institute also recently reported a large disparity of creditscores in St. Louis, with predominantly black neighborhoods reporting an average credit score of 552 and mostly white areas of St. Louis averaging over 730.

Unbanked consumers in St. Louis spend approximately 5% to cash payroll checks, often turning to payday or installment lenders for access to small emergency loans with an average effective interest rate of 455% in Missouri.

By fully supporting job training, education, and sustainable housing projects, we’re able to provide safe, responsible banking and help our community find pathways to financial security.

What special account services and loans do you offer?

LW: 1st Financial has proactively designed checking accounts for every applicant, as well as fee-free, high-yield savings accounts and a credit builder loan that refunds 50% of the interest paid after 12 months and yields an average creditscore increase of more than 60 points.

For many years, we’ve served job training programs through account access and financial capabilities programming. We wanted to more holistically support men and women as they worked to join the workforce, often after an incarceration or extendedperiod of unemployment, so we created the Work1st Checking account. It requires only that the member meet with a financial counselor at least once and log in online to enroll in e-statements and online banking as they participate in a partnered jobtraining program. It does not require a ChexSystems pull or a monthly fee.

We also recognize the importance of car ownership as a means to meet the needs of a broad range of low-income families and have deployed programs to help families, even those with low or no credit, buy and maintain cars.

How do you price products in a way that helps members while also generating enough income to operate the credit union?

LW: How we underwrite makes all the difference. We use risked-based underwriting that allows us to fully understand whether the member’s score is on its way up or down, and we counsel or approve the loan accordingly. This has allowedus to greatly increase our loan income from the traditional model of only approving loans for perfect or near-perfect credit reports.

We also use account resolution as a way of keeping our delinquency under 1% while we deploy these higher-risk loans, which greatly aids in our ability to continue lending to lower credit tiers.

St. Louis Community Credit Union strives to be a positive force, and it has the impact report to prove it. Read about this St. Louis credit union in “How A Financial Cooperative Becomes A Voice For Social Justice” only on CreditUnions.com.

What has been the result of those loans?

LW: Our credit builder loan has shown an average 60-point increase for those who had an existing credit score at the start of the loan. This loan is for members who need to raise their score so they can qualify for low rate transportationloans, credit cards, or lower-cost insurance. Financial stability is built upon a better-than-average credit score. This is one tool to help them plan for the future and make a pathway toward security.

We launched it in May 2017, and as of September 2019, we had 140 loans for $65,000 outstanding. The loans range from $300 to $600 each, and we repay 50% of the interest at the end. This is highly effective and attractive to members; the loan is the third-mostvisited page on our website.

We’ll be performing more detailed credit migration analysis for each of our accessible loans in the coming year and hope then to show the impact of a car loan for a credit-challenged household.

Describe some of 1st Financial’s non-financial product efforts?

LW: Our Helping People 1st grant supports local nonprofits that serve families seeking job training, education, and sustainable housing. We’ve given more than $50,000 in these small grants. We also give every 1st Financial employeeeight hours of paid volunteer time off each month to serve at these nonprofits.

Strategic partnerships include our College Kids program, which has given us the opportunity to open 13,000 free, deposit-only savings accounts to incoming kindergartners in the St. Louis Public School District. These students have saved more than $80,000so far and earned more than $700,000 in incentives in the form of a savings account from the St. Louis City Treasurer’s Office for pursuing higher education after high school .

We also created the STL Youth Jobs program, which has allowed us to provide nearly 3,000 free checking and saving accounts to youth between the ages of 16 and 24 who are participating in an STL Youth Jobs, MERS Goodwill, or St. Louis Agency on Trainingand Employment (SLATE) youth job training program.

See It In Action

Community development manager Tracy Verner introduces financial empowerment coordinator Kiara Jefferson at a press conference announcing 1st Financial’s partnership in the Save Our Sons program with the St. Louis Urban League.Urban League president Michael McMillen is at the far left.

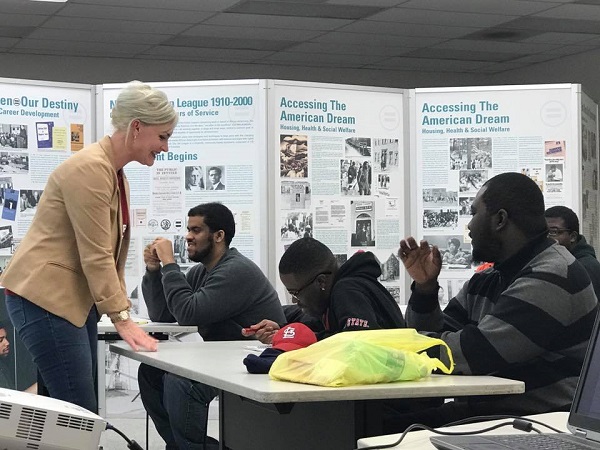

Community development manager Tracy Verner teaches a financial literacy session as part of a job training program in St Louis.

SLATE hired a full-time youth financial empowerment specialist specifically to support our financial literacy curriculum and open accounts for the credit union. We also recently deployed a full-time employee, funded through a St. Louis County CommunityDevelopment Block Grant, at the Urban League Ferguson Empowerment Center to provide financial capabilities to the participants of its Save Our Sons job training program.

We also are about to launch our third off-site full-time employee to support the efforts of a partner CDFI in St. Louis that serves people seeking credit repair and financial counseling.

We’re hopeful we will be able to continue expanding this model of off-site full-time employees in partnership with mission-aligned non-profits and government-sponsored programming.

How do you decide which programs to get involved in?

LW: With one community development manager and three full-time financial empowerment specialists, our time and resources are limited, and we say no a lot. If it doesn’t land in job training, education, or sustainablehousing, it’s not something we can support.

If it does make it through that first filter, we examine the time and money it would require to take on and whether we’re best suited to carry out the work. If we feel strongly we should do it, but don’t have the financial resources, we mightexamine fundraising opportunities.

How do you measure 1st Financial’s impact on your community?

LW: We measure impact in many different ways, including products deployed, loan dollars to C-tier credit and lower, credit score migration, dollars donated to strategic nonprofit partners, volunteer hours donated, assets saved, and increasesin products per member.

We also have assembled a CDFI Advisory Board made up of men and women that work and live in our CDFI target market. They are aware of living with many of the hurdles facing our members, and each quarter we present them with an impact report and discussour efforts to make a greater impact.

We also produced our first impact report for the community this year, covering 2014 to 2018.

Our goal is to continue measuring and providing opportunities for all members to participate in the impact they are creating by being a member of 1st Financial.

Creating And Measuring Impact

1st Financial has more than a few best practices for how to lend and engage in the cause of community service. Here are four from Laura Woods, the St. Louis credit union’s vice president of marketing and community presence:

- Listen to community leaders about what’s needed in your community. Don’t assume to know. You’ll likely be wrong.

- Draft a three- to five-year community development plan with realistic, specific goals for how you’d like to create impact. Say one goal is to increase credit scores. How will you do that? With credit counselors? New products? Both?

- Measure your impact. For example, purchase the credit scores of your members and measure that success periodically.

- Keep your compliance and finance department up to date with your community development efforts. They won’t love it all, but it’s better to have them understand the risk and not fight you on it.

This interview has been edited and condensed.